For the descendents of Richard Dearie and his son John Russell

The Straits Times, 15 August 1916, Page 7 and MALAYAN COLLIERIES REPORT. [Articles] The Singapore Free Press and Mercantile Advertiser (1884-1942), 16 August 1916, Page 7 Malayan Collieries.

INITIAL INTEREST-DIVIDEND DECLARED. . Report of Directors for Past Year. The following is the report of the directors of Malayan Collieries, Limited, for the year ended June 30 last. It is signed by Messrs. J. A. Russell and Co., the managing agents and secretaries. The directors have pleasure in submitting their third annual report and statement of accounts for the year ended June 30, 1916. On October 1 a third call of $1 per share was made on ordinary shares thus making these $9.25 paid up. During the year application was made for the conversion of a further 200 acres to mining lease (making a total area under lease of approximately 1.747 acres) whilst the prospecting license was renewed over the balance of the concession. Coal sales (Chart) from July 1915 to June 1916 totalling 50,042 tons 19cwt. Extra roads for the company'’ diamond drill having arrived, some deeper prospecting was done with satisfactory results. The Government line to Bukit Arang Station, situated upon the Company’ s property, was opened on Sept 1, 1915. The Company’s siding was completed and opened during November and duly paid for, and the charge over the company’s property in favour of the Government (being security for the payment of the same) was discharged. 0. The want of telephonic connection between Kuala Lumpur and the Colliery continues to be felt a great drawback. It is hoped that the Government will shortly see its way to proceed with the proposed extension of the Kuala Lumpur telephone system to Rawang. At one time during the year considerable trouble was experienced with the mine labour, and Mr. McCall made a visit to Bengal to investigate the possibility of employing Indian coal miners. The chairman whilst in Japan also made inquiries regarding Japanese labour. Nothing definite has yet come of these various investigations, matters being still in train, but the knowledge that they were and are being made has had an excellent effect upon the present labour which towards the end of the company’s year showed marked improvement. 0. Professor W. A. Bone, D. Sc. F.R.S. professor of Chemical technology (Fuel) Imperial college of Science and Technology, London, was engaged throughout the year on experimental research work into the nature and properties of the coal, especially with a view to its possibilities for long temperature distillation and briquetting. 0. 0. Payment and Dividend. Interest payable on ordinary shares.- 0. In accordance with the terms of an agreement dated June 13, 1913, and made between the vendor of the one part and the company of the other part, no dividend shall be payable on vendors’ shares until those issued to the public have first received interest, upon the amount for the time being paid up, at the rate of 6 per cent per annum for those years described as “ the period of development”. The “period of development” is defined as commencing from the date of formation of the company and terminating with that account day on which the total profits of the company shall first have amounted to a sum sufficient to pay a dividend of 12 per cent on the amount paid up upon the ordinary shares. With the account day of June 30, 1916, the specified “period of development” therefore ends, and after payment of interest on the ordinary shares both classes of shares will rank equally for dividends in proportion to the amount credited as paid up upon them. It is now proposed to begin wiping off the arrears of interest due, by declaring an initial interest dividend of 6 per cent. for the company’s first year, 1913-14, to be calculated upon the amount paid up upon these ordinary shares during the above mentioned first year. As there is still the sum of 75 per cent per share due to the company from the holders of ordinary shares, except in those cases where shareholders have paid up the whole of their calls in advance, it is proposed that this interest-dividend shall not be paid in cash but be credited to the account of such ordinary shareholders in reduction of the call- liability attached to their partly –paid shares. The profits for the year amount to $99,941.14. 0. Which the directors recommend should be dealt with as follows:- In payment of a dividend of 6 per cent upon 88,150 ordinary shares credited as $6 paid (being interest at 6 per cent per annum for the company’s year 1913/14 as provided for by agreement dated June 13, 1913)… $31,734.00 0. To be written off mine development..$25,000.00 0. To be written off formation expenses…$8,235,00 0. Balance to be carried forward to the next year’s accounts…$34,972.14 The directors to retire are Towkay Loke Yew, C.M.G., and Mr. Robert Peebles Brash, who being eligible, offer themselves re-election. Auditors, - Messrs. Barker and Co. retire and offer themselves for re-appointment.

The Malay Mail, Monday August 21, 1916 and Malayan Collieries. [Articles] The Straits Times, 23 August 1916, Page 10 and MALAYAN COLLIERIES. [Articles] The Singapore Free Press and Mercantile Advertiser (1884-1942), 23 August 1916, Page 12 (edited)

Malayan Collieries Annual General Meeting. Future Prospects. The third annual general meeting of shareholders in Malayan Collieries, Ltd., was held at the registered offices of the Company, 8 10, Loke Yew Buildings, Kuala Lumpur, on Saturday at 11 a.m. Mr. J. A. Russell (Chairman of Directors) presided. Mr. P.P. Spradbery for the secretaries read the notice convening the meeting, and also the minutes of the last meeting which were confirmed. The annual statement of accounts and balance sheet and the report of the directors and auditors were submitted to the meeting. Chairman’s Speech. The Chairman, in moving their adoption, said: - Gentlemen,- 0. The report and accounts have been in your hands for the specified period, and I presume you will take them as read. Following my former practice I shall before moving their adoption first make a few comments on some of the more important items contained in the balance sheet. Taking the debit side first, you will see that the issued and subscribed capital now stands at $1,424,647.50 as against $1,341,480 in the last balance sheet. The difference is principally due to a call of $1 a share having been made during the year on the partly paid capital. The calls in arrears are due from shareholders at the Front. The item “ sundry creditors” consists of wages, royalty and freight still due on the June output. The profit I shall discuss when we come to the profit and loss account. Turning to the credit side you will see that the expenditure on mine development to the end of the financial year amounted to $183,711.97: but this amount is greater by a sum of $25,000 than it would have been had your directors been able to charge all development work to revenue. A detailed statement of the development account for last year will be found on the end page, and to this I shall presently refer. You will observe that our railway siding cost us $40,780.39 as against the official estimate of $77,000, the difference being due to our having taken up a contract under the Railway Construction Department and by doing the work ourselves effecting a considerable saving. As contractors under the Railway Construction Department we drew from this Department advances for the work, repaying the Government in installments upon the conclusion of the contract for the total cost of construction. Interest on the loan was paid by the Company to the Government at the rate of 6 per cent. The charge for $77,000 which the Government had taken upon our property was discharged with the payment of the final installment. The Government aid so granted was of the greatest assistance to the Company, for it was given at a time when owing to the railway not being completed the mine could produce no revenue, and yet when the financial crisis prevailing would have considerably embarrassed shareholders in meeting any further call. Your Directors were and still are of the opinion that the Government had promised the original concessionaires to build them or their successors a line to the pit head, but his Excellency the High Commissioner having decided that this was a wrong construction to put upon the promise, although your board may not agree with His Excellency’s views, nevertheless those views being what they are your Board can only be exceedingly grateful to him and the F.M.S. Government for the financial accommodation that the Government compensatorily rendered the Company. On reading the item “motor cars” you may strongly think that the Company posses more than one. This is not so; it only owns the one the mine- manager uses; but during the year it being found possible to sell the old one at a profit and buy a new one this was accordingly done. Our stock of mine stores in hand may seem somewhat large, but mining requisites are at present so difficult to obtain that not only do we think it wise to carry a good stock of them, but we are, as opportunities occur, always increasing our stock. The item, “coal sales” under the heading “sundry debtors” consists almost entirely of June sales, our custom being to render bills monthly. The second subsidiary item headed “sundry” is for rents, freight and commission, an account I shall explain later. From the item “cash at bank and in hand” it will be seen that there is a sum of $25,000 on fixed deposit. It is the practice of the Company to put on fixed deposit any available funds not immediately required, it being always of course, permissible for the deposit to be broken. The cash in London is for plant on order. 0. I now turn to the profit and loss account, which is for the latter six months only, the balance of expenditure for the first half of the year being all debited against capital. On the debit side of the profit and loss account the largest item is for contractors’ wages, as much of the mining as possible being done on contract rates. The Government royalty is a royalty of 25 cents a ton payable to the Government on all coal, whether lump coal or screenings, passing the Company’s boundaries. The Company has protested against having to pay the full rate royalty on screenings, but without obtaining relief. If you will now glance at the debit side, you will notice that besides the main item of coal sales the Company has sold its surplus production of bricks and a small quantity of firewood. The firewood was obtained from timber felled in the course of clearing sites, timber which the mine could not immediately use and which would have rotted if allowed to lie. You will also see an item” rents, freights and commission” to which I have previously referred and which is the aggregate of various odd earnings of the Company, some of which amount in themselves to sums of but a few cents. The item includes a profit we have made on purchasing provisions wholesale, on shop rents, on our locomotive hauling for others, on repairs for others done in our workshop. You will see that we waste no opportunity for economy here or a small profit there; it is the secret of successful organisation. 0. Last Years Development. 0. I will now for a moment refer you to the detailed statement of last year’s development account of which I have already made mention. You will find it printed on the last page and from it you will observe that the gross total expenditure for the year under review on this account was $122,648.36 but that against this has to be placed a sum of $56.921.64 being the Company’s receipts during the period of development. Your Directors, recognising the value of sound finance, would have preferred to have reduced development account by charging all development expenditure after the 1st January to revenue, thus reducing the profit, which, if you now refer back to the profit and loss accounts, you will see is put at the sum of $99,941.14. The amount of extra expenditure which they would have liked to have charged to revenue is about $25,000. As development work will always be in progress, it is only proper that it should in future, be charged against revenue and not to capital, for it is in practice, whatever it may be in theory, a legitimate recurrent working expense. In this case, however your Directors were legally advised that they had no option but to debit it to capital, the Company being bound by an agreement with the vendors regarding the payment of dividends on vendor shares, which dividends may not be paid until such date ad the net profits have reached a certain specified total. If this $25,000 had been charged to capital the date when that total was reached would have been deferred for another 6 months, with the consequent diversion from profits in which the vendor shares may participate of an additional sum equal to the payment of a further 6 months’ interest on ordinary shares. This would have been a legal infringement of vendor shareholders’ rights, and as such have laid the Company open to being sued by the original holders, or any subsequent purchasers, of vendors shares. Development account is now closeable, so that this predicament will not again arise, and all future deadwork incidental to mining may, if thought advisable, be charged to revenue. In the meantime your Directors propose to adjust the present position by appropriating from profits the sum of $25,000 in reduction of development account. This of course will not affect the holders of vendor shares, who are only concerned in the date when the total undivided profits have reached the sum specified by the Agreement, that is to say a sum equal to the payment of a dividend of 12 per cent. on the amount paid up on the ordinary shares, because at that date interest on ordinary shares ceases, and vendor shares rank for the future, in the matter of dividends, equally with the ordinary shares, subject of course to the first charge upon profits of an amount sufficient to pay the arrears of interest due upon the ordinary shares to the date in question. By looking at the Director’s report you will see that besides writing off $25,000 from mine development, your Directors also recommend that a sum of $8,235 be appropriated in writing off formation expenses, leaving $66,706.14, and that this balance $31, 743 be absorbed in the payment of a first installment of the arrears of interest- dividend due on the ordinary shares, and the remainder amounting to $34,972.14 be carried forward to the current year’s accounts. The agreed upon period of development has taken three years to complete, so that after paying for the first year of development there is still another two years’ interest to be paid before regular dividends may be declared. It would not be financially safe for the Company at this juncture to wipe off any greater sum than the first year’s arrears of interest, for the Company cannot carry on with a smaller sum of working capital in the finance of its coal sales than the amount it is now proposed to carry forward. The Company is still faced with a certain amount of capital expenditure for new plant, and it will be necessary to call up the balance of 75 cents a share still due on ordinary or partly- paid shares. As it will cause shareholders a certain amount of inconvenience first to receive an interest dividend and then to have to pay it back again in the form of a call, it was proposed in the Directors’ report that this interest dividend should not be paid in cash, but be credited to the holders of ordinary shares in reduction of the liability attached to some of those shares. Upon going into the matter more closely, however, it seems a moot point whether the Company quite has the right to do so, while the London Stock Exchange, for a reason that is not very clear, do not recommend the practice. At the risk, therefore, of causing ordinary shareholders some little extra trouble, and of disappointing those few of them who had expressed a decided wish that the Company would be able to place dividends against calls, your directors have decided not to go on with the suggestion, but recommend instead that the payment of the dividend be in cash. Instead of the former arrangement, I have now therefore to announce that a final call of 75 cents per share upon the ordinary shares will be made, which call will probably be payable sometime in October. The usual notices of call giving the exact date when due will be posted to shareholders in due course. 0. Labour Investigations. 0. Glancing now at the Director’s report you will see that reference is made to certain labour investigations the Company made in India and Japan, and I wish to take this opportunity of thanking with your permission and on behalf of the Government for the assistance they kindly rendered to the Company in connection with inquiries our mine manager made in the former country. Despite however, this aid from the local Government, we were unable to achieve any successful results in India, and I can hold out but little hope of our being more successful in the same country within at least the near future. All the mining labour that India can at present spare is being sent to Tavoy, and the Indian Government is not inclined to allow mine labour to be recruited for the F.M.S. You will also note in the Directors’ report that throughout the year we have had the best Home man obtainable engaged upon research work in connection with the suitabilities of our coal for distillation and briquetting purposes. We have sustained disappointments and encountered many difficulties over this research work, our coal being rather unique in many of its properties, and it is this that has caused the work of the investigation to be so protracted and still not finished; but we believe that we are now within measurable distance of success. Professor Bone will not commit himself to any definite report until the conclusion of his investigations, but in a response to an enquiry from this end for information to place before you at this meeting, I have just received a cable from London Agent, Mr. F. J. B. Dykes, which reads as follows: “Bone states as the result of laboratory investigations Rawang coal during past year he is of the opinion prospects briquetting commercially sufficiently favourable justify large scale test now being arranged also large scale test low temperature distillation coal likely to yield important data from point of view of determining best conditions obtain valuable by- products from coal and he anticipates good results.” 0. A description of the work done at the mine during the year under review will be found in the mine manager’s report, and to it there is very little that I can add. The intrusion of shale in the North Mine has taken us a whole year to get through. This “want” has been an unseen calamity seriously adding to the cost of development and reducing our coal output, but we are once again in good coal, which is all the more fortunate as the earthquake which was experienced about a fortnight ago started the roof “working” over a short distance of the main level of the South Mine, and has thus temporarily interrupted communications with the inside workings. This weighting of the roof is a common occurrence in mining and will only curtail the output for about 3 weeks, by which time communications should be re-established. The arrival of the extra rods for our diamond boring set has enable us to do a considerable amount of prospecting work during the whole year. The results on the whole have been satisfactory. We are opening up an area on the North Seam outcrop with the object of practically testing this second seam of ours and the quality of its coal. We may congratulate ourselves on having been able to purchase from the Railway Department a locomotive for use on our siding, which has resulted in greatly increased efficiency and economy. We have to thank the Railway Administration for letting us have this locomotive at a reasonable figure. It would have been impossible to have obtained one from Home during the war. You may be interested to learn that we run the locomotive on what we call ‘smalls”, that is to say on our screenings. We have now a service between Kuala Lumpur and the Colliery of three up trains and three down trains daily. From the first of next month we have contracted to supply the coal requirements of the F.M.S. Railways. 0. A question shareholders may wish to ask is what is our mining cost per ton of coal; but this is a query that I shall not be able to answer, for development work and the actually winning of the coal have been hitherto too interlocked for us to be able to work out ay reliable figures. Future Prospects. Another point on which I am sure shareholders are anxious for information is that regarding our future prospects. First as to tonnage. Our output was in the neighbourhood of 500 tons a day when the earthquake already referred to occurred, temporarily diminishing production. Difficulties such as the “want” in the North Mine, and now this trouble in the South Mine, are always liable to occur, and in fact difficulties of some sort or another always will be occurring, but as the mine gets more developed and the number of working places increase, the effect of such troubles will not be so felt, for they will not make so serious a difference to our total output. You will remember that our plant and workings are designed for an output of 500 tons a day, but I am now able to tell you that it will deal with an output of almost a thousand tons a day, and, providing we have the sale, we shall be turning out this amount early in 1917. By no very great additions to our plant and workings we shall be able to output a much greater tonnage than 1,000 tons a day; but it is at present extremely doubtful whether we shall be able to find a local sale for even 1,000 tons a day let alone any greater amount, the local fuel requirements being limited. This is a pity, for after the war competition from Indian and Japanese coals will be most keen. The price of firewood too, will always be a serious factor for us having a competitive influence absent in most other coal producing countries. Since our coal entered into the market the price of mining firewood in Selangor has as a consequence already been markedly reduced, and it has even on some mines we have formerly captured cut us out again. We shall have, therefore, to rely upon a large output with resultant low working costs per ton, and a corresponding cheap price to the public, in order to be able to compete with firewood and these foreign more highly calorific fuels. The really wretched smallness of the total local fuel consumption is the unhappiest feature of an otherwise fairly favourable future, and it is to obtain an output comparable with coal mines in other parts of the world, and therefore of working coals that can compete, that your Directors are devoting so much time and money to research work at Home in connection with briquetting and distillation. It is recognized that for a large production we must look to developing an export trade. I myself am leaving within ten days’ time on flying visit to London principally in connection with the distillation experiments to which I have referred, and of finding a market for disposing of the by products to be obtained. To show you how thoroughly your Directors have gone into the matter of increasing the coal demand, they have had experiments made at Home on suction-gas producers, pressure- gas producers and cooking ranges. It has been proved that the coal will do admirably for the two latter, while it is only a question of perfecting means for dealing with the tar that is withholding equally successful results being obtained in suction-gas plants. Should any enterprising group wish to light Ipoh electrically and to supply power to the neighbourhood, or do the same for any other F.M.S. centre, they could not do better than to erect a Mond or other producer gas plant and to burn Rawang “smalls”. Their tar and ammonium sulphate recovery would pay to a great extent for the cost of the “smalls”, which for a large and long contract the Company would probably be in a position to offer to sell on especially attractive terms. I feel confident that no water or oil power scheme could compete with the one I have above suggested both for cheapness per unit and reliability. With regard to our requirements for the current year, we have still a good deal of expenditure ahead of us. We shall want extra boilers, a large and more powerful fan installation, punching machines and probably a screening plant. The punching machines will be run by compressed air, and it is hoped by their use to increase and cheapen production, and to decrease the percentage of smalls. After full consideration your management have decided not to install coal cutters yet awhile, our seams and the nature of our coal not being quite suitable to their employment, but we shall later on require to use some form of underground locomotives for haulage in the main levels. In installing more plant than is usual in Indian coal mines, your management’s idea is not only to have an efficiently run modern and economic mine, but also render the Company less dependent upon a capricious labour. We shall have to erect during the current year still another bungalow, while we are also considering building a police station and quarters. We have still and shall always have a lot of development work to do, and we wish never to have less than from eighteen months to two years work in view. Towards the end of the financial year we shall probably require more European assistance at the mine. 0. Reducing Price of Product. 0. Taking it all round, our prospects are bright, and I think our future is assured- our ample supply of good mining timber at pit mouth is a great asset – but I would ask shareholders to be patient in the matter of dividends, for we have many difficulties yet to negotiate. The worst, that of consumption, I have already touched upon; and in this connection shareholders must, as I have said, remember that with each reduction in working costs it will be the Company’s policy to reduce the price of coal to the public, hoping by giving the country a cheap fuel to stimulate the growth of industries consuming it. The average price the Company is obtaining for its coal today is cheaper than it was for the year I am reviewing, and that average price will, your Directors anticipate, be still further decreased before the end of the current financial year. Another difficulty we have to face and overcome is the matter of filling. This question will become more pressingly urgent as time goes on, and in preparation for the day when it has to be solved we must accumulate a substantial reserve fund. So far, through the exercise of the utmost vigilance, we have had no bad debts, but as our sales increase it is impossible that we shall escape a certain proportion of these unfortunate concomitants of wholesale trade. 0. The Pioneering Shareholders 0. So you will see from all these points I have mentioned that if we wish to put our enterprise on a sure foundation we shall still have some lean times ahead of us before that desirable goal be reached. But, however distant it still may be, it is now above the horizon; which is indeed everything. So I wish to congratulate those shareholders who were original subscribers; that is to say, the great majority of the present shareholders, for very few except Home holders of vendor shares have sold. If any body of shareholders deserves a handsome reward for their enterprise, it is the original shareholders in this Company. Malayan Collieries, as you know, met with the greatest opposition at its floatation. There were letters in the public press denying the existence of coal, denying its value as fuel if it did exist, and denying, if it not only existed but was valuable that any but a fool would take shares in a company that would be years before it could pay a dividend. None of the big users of coal, whether smelters, miners or ship owners subscribed a cent to the floatation. Their arguments were always the same; the arguments that had appeared in anonymous letters in Singapore papers’ especially the one “why subscribe for shares and have to pay in full for them, when they are certain to be obtainable at a big discount before the Company is dividend paying?” It was useless for the present speaker to urge that if everyone took this view the Company would not be floated, and that it was the duty of the particularly rich smelting or shipping or mining company with whom the speaker happened at the time to be pleading to support an enterprise having its object the development of the local coal resources; they presented a deaf ear and buttoned- up pockets to his entreaties. The Company was subscribed for almost entirely by one group, mainly Chinese in Kuala Lumpur, and a smaller group, also mainly Chinese in Penang, most of whom were the speaker’s personal acquaintances. Only one British mercantile house of any standing subscribed for shares, a Singapore firm, while no big consumer of coal did likewise. I am sure that all those who did subscribe thought they were embarking upon a perilous gamble, which reflects so much more credit on them for having supported it. Personally I myself, knew it was no gamble. Like Mr. Dykes, I have always after its very thorough two years prospecting had faith in the field, and I think that this is proved by the fact that such profit as I made from the floatation I took entirely in shares, while I at the same time subscribed in cash for close on $100,000 worth of those issued to the public, and have ever since been a steady buyer both of these ordinary and the vendor shares. The Company’s first and most staunch subscriber was Towkay Loke Yew, C.M.G., and he, and he alone, I think, adopted the attitude that it was the duty of those who had made money in this country to take hazards in support of an enterprise likely to be of benefit to Malaya; a view which might I think have reasonably been expected to be held amongst the big and wealthy smelting, shipping and mining companies who have done so well out of the F.M.S. I have little doubt that the shareholders of this Company, having borne all imagined risks, and having proved that coal in this country can be successfully worked at a profit, were a new coal- field now discovered and a company formed to exploit it, those same big interests who turned our own pioneer babeling from their doors would subscribe to such a new floatation with protestations about benefits to the country at large and to the mining industry in particular deserving every encouragement and support. In this connection I would point out that had we liked to opencast our mine we could have produced coal much quicker and at a much cheaper rate per ton, and, moreover with the sinking of considerably less capital than we have done. In fact we could easily have floated a small company with a small working capital, the vendors retaining the same or bigger proportions of the whole than they did. The shareholders would have made money quite gaily for some years, and then have had to close their open cast mine down, having in their unconscious greed succeeded in ruining one of the most valuable assets the F.M.S. possesses I would warn you that it is still possible for another company working any newly discovered coal field on the opencast method to cut us out of the market. I shall not weary you further or ever again upon these points, but they are matters on which I have always promised myself to speak as soon as the Company entered the dividend paying stage, and I think that the rumoured scramble of one and everybody for permission to exploit a recently reported and still unproven coal find in Perak makes them all the more apposite at this present juncture. When one remembers the apathy with which many of the people who now wish for rights to work Enggor treated the thoroughly prospected but to their minds risky, Rawang field, this scramble must have for the cynical a flavour delightfully humourous. 0. Mine Manager’s work. Before concluding I should like to say how much this company is indebted to our mine manager Mr. McCall, and to his staff for their devoted, skillful and unremitting work and care during the year. This Company has been singularly fortunate in its mine staff, than whom a more loyal and, moreover a more intelligent, does not exist in this country. I shall presently have great pleasure in asking shareholders to pass a vote of thanks to Mr. McCall and to those under him 0. I will now formerly move that the report of the Directors produced, together with the statement of the Company’s accounts as of June 30th, 1916, duly audited, be now received, approved and adopted, which motion I shall ask Mr. Henggeler to second, but before putting it to the meeting I shall first endeavor to answer to the best of my ability any question that shareholders present may like to put. 0. Mr. Mawson said that the Chairman had referred to the possibility of finding other coal deposits in the F.M.S. Would it be possible to work any such newly discovered field, supposing that it was not out of the way, in the same manner and for approximately the same cost per ton as their own property was being worked? 0. The Chairman replied that this would he thought depend largely on the field and the nature of the seam or seams. He was told from geological evidence it was most improbably that a better quality coal would ever be found in the country, while it was also improbable that there would be discovered a bigger field than theirs. He would ask Mr. McCall to give them the benefit of his more technical knowledge. Mr. McCall the mine- manager said: “ I regret that Mr. Mawson’s question is almost impossible to answer as so many factors enter into the case. Chief amongst these I would place (1) the quantity of water to be pumped, (2) the liability of the seam to spontaneous combustion, (3) the absence or presence of gas, (4) the nature of the roof, (5) the inclination of the seam, (6) the available supplies of mine timber, and many other minor items all bearing directly on the question too numerous to mention without further knowledge of local circumstances.” Mr. Henggeler seconded the Chairman’s motion to adopt the report and accounts, which was unanimously carried. The Chairman then moved the payment of a dividend of 6 per cent upon the ordinary shares credited as $6 paid up, which was seconded by Mr. A Grant Mackie and carried. 0. The sum of $3,000 was voted to the five directors in remuneration of their services for the past year, to be divided amongst them as they themselves thought fit. Towkay Loke Yew C.M.G. and Mr. R.P. Brash were re-elected to seats on the Board. Messrs. Barker and Co. were re- elected auditors for the ensuing year at a fee of $750. 0. A vote of thanks was passed to Mr. McCall and his staff at the mine for their very valuable services during the past year. 0. The meeting concluded with a vote of thanks to the Chairman and the directors, for which the Chairman on behalf of himself and his co-directors briefly returned thanks.

Malayan Collieries Report, Accounts and A.G.M. 1916

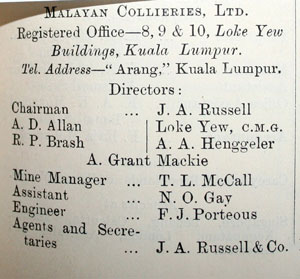

MALAYAN COLLIERIES, LTD.

Registered Office-8, 9 & 10 Loke Yew Buildings, Kuala Lumpur.

Tel. Address-"Arang," Kuala Limpur.

Directors:

Chairman J. A. Russell

A. D. Allan Loke Yew, C. M. G.

R. P. Brash A. A. Henggeler

A. Grant Mackie

Mine Manager T. L. McCall

Assistant N. O. Gay

Engineer F. J. Porteous

Agents and

Secretaries J. A. Russell & Co.