For the descendents of Richard Dearie and his son John Russell

Malayan Collieries Reports Accounts and A.G.M.s. 1920

MALAYAN COLLIERIES, LIMITED.

DIRECTORS' REPORT AND STATEMENT OF ACCOUNTS

For the Year ended 30th June, 1920.

TO BE PRESENTED AT THE

SEVENTH ANNUAL GENERAL MEETING OF SHAREHOLDERS,

TO BE HELD AT THE

Registered Offices of the Company, Hongkong and Shanghai Bank Buildings, Kuala Lumpur, ON

Friday, the 15th day of October, 1920,

AT 2.30 p.m.

FRASER & NEAVE, LTD., PRINTERS, SINGAPORE.

Malayan Collieries, Limited.

Directors.

JOHN ARCHIBALD RUSSELL (Chairman). |

The Hon. MR. ROBERT PEEBLES BRASH. CHEW KAM CHUAN.

ADOLF ALOIS HENGGELER. ALEXANDER GRANT MACKIE.

Managing Agents and Secretaries.

J. A. RUSSELL & Co., Kuala Lumpur.

Registered Offices.

HONGKONG & SHANGHAI BANK BUILDINGS, KUALA LUMPUR.

NOTICE IS HEREBY GIVEN THAT THE SEVENTH ANNUAL GENERAL MEETING of the Members

of the Company will be held at the Registered Offices of the Company, Hongkong and

Shanghai Bank Buildings, Kuala Lumpur, on Friday, the 15th Day of October, 1920 at 2-30 p. m.

for the following purposes, viz.: -—

To receive and consider the Annual Statement of Accounts and Balance Sheet, and the reports of the Directors and Auditors;

To declare a Dividend;

To declare the Directors’ remuneration;

To elect Directors in place of those retiring, who offer themselves for re-election;

To elect Auditors for the ensuing year;

To transact any other business that may arise.

By Order of the Board,

J. A. RUSSELL. & CO.,

Managing Agents & Secretaries.

Dated 30th September, 1920. Hongkong & Shanghai BANK BUILDINGS, KUALA Lumpur

Malayan Collieries, Limited.

Report of the Directors for the year ended 30th June, 1920.

The Directors have pleasure in submitting their Seventh Annual Report and Statement of Accounts for the year ended 30th June, 1920.

TITLES. —The Company has now duly signed but not yet received delivery of titles to all its property. The total area is 8,961 acres, 2 roods, 26 poles, against an approximate area claimed by the Company of 9,23-5 acres. The difference of over 200 acres is land excised by the Government from the Company's property for a Railway Reserve and Village Site.

MINES AND PLANT. -—An account of these will be found in the Acting Mine-Manager's sub-joined report. Some photographs of the Mine will be found at the end of this Report.

COAL SALES. —These totalled 200,707 tons as against 179,834 for the last financial year, and 161,272 for the previous year.

STAFF. —Mr. T. L. McCall, Mine-Manager, went home on long-overdue leave of absence, Mr. E. England acting for him from the 15th April, 1920. Mr. F. J. Porteous, Chief Mechanical Engineer, who, like Mr. McCall, has been with the Company from its inception, left on leave of absence at the same time, Mr. J. G. Swanstone acting in his stead.

LONDON AGENTS. —Messrs W. R. Loxley & Co., 34 Lime Street, E.C.3, were appointed the Company's financial and forwarding agents in Great Britain.

CONSULTING ENGINEERS. — Messrs Forster Brown & Rees of Cardiff and London continued as the Company's consulting engineers. '

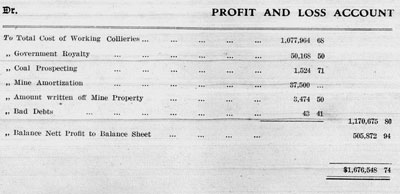

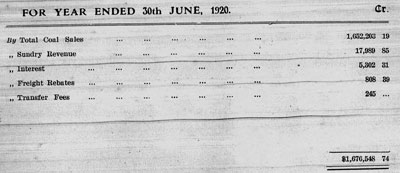

PROFITS—

The Profits for the year, subject to Directors' fees, amount to ... ... $505,872.94

Less interim dividend 5 per cent, paid 15th February, 1920 ... ... 75,000.00

$430,872.94

to which must be added the balance brought forward from last year's account of 39,797.50

$470,670.44

Which the Directors recommend should be dealt with as follows: —

Payment of a final dividend of 20 per cent, on 150,000 shares, making

25 per cent, for the year .................................................................................... $300,000.00

Transfer to General Reserve ................................................... 150,000.00

Balance to be carried forward to next year's account ... ... 20,670.44

$470,670 44

DIRECTORS. —The retiring Directors are Mr. Adolf Alois Henggeler and Mr. John Archibald Russell, who, being eligible, offer themselves for re-election.

AUDITORS. —Messrs. Evatt & Co. retire, but being eligible offer themselves for re-election.

By Order of the Board

J. A. RUSSELL & CO., Managing Agents and Secretaries

Kuala Lumpur, 30th September, 1920.

MALAYAN COLLIERIES, LIMITED.

Acting Mine-Manager's Report to the Directors for the year ended

30th June. 1920.

Sirs,

I have the honour to submit herewith my annual report of the, work done on your property for the financial year ending 30th June, 1920.

COAL SALES. —The sales of coal for the year under review amount to 200,707 tons.

SOUTH MINE—MAIN SEAM. —The main incline was advanced some 300 feet during the year and has now reached a distance of 1,850 feet measuring along the slope from the surface.

As predicted in the report for 1916-17: —

No. 1 Bench level has been abandoned, all the coal that it was possible to extract having been worked.

No. 2 Bench level has been extended beyond the area worked by No. 1 Bench level.

No. 3 New Bench level at the bottom of the mine has opened up an excellent face of clean coal, and so far no faulted ground has been encountered.

During the year 1,070 feet of arching have been completed, and the total length of roadways now arched is 1,740 feet.

There have been numerous cases of spontaneous combustion in this mine, but all have been successfully dealt with.

NORTH MINE—MAIN SEAM. —The main incline has not been, advanced during the year. No. 1 and 2 'Bench levels have made good progress, and there is a large tonnage of coal in sight ready to be worked by means of coal cutters and hydraulic stowage.

A serious fire broke out on the No. 1 Bench level, 150 feet away from the main line, but was successfully sealed off. This entailed withdrawing one pump which had been installed and sealing off a portion of the road-way. The fire produced a large fall of roof in its vicinity.

New Jig levels have.now been opened up from No. 2 Bench level to No. 1 Bench level, and the Coal from No. 1 Bench is now lowered down to No. 2 Bench level.

Two electric storage-battery locomotives arrived, and have been at work ever since in this mine. They are admirably suited to the work, are capable of handling a large output and so far have given every satisfaction.

Later on in the year-delivery was taken (?of a) long-wall coal cutter and this has been at work for several months with most.... ? long-wall coal conveyor has also been received, and this is being installed

It is intended to install…

PUMPING. —All motors, pumps, and pipes on order were taken delivery of during the year. The new pump room in the South Mine is now completed, and the large turbine pumps are being installed. When completed, these will adequately deal with all excess water from hydraulic stowage operations and the extra water entering the mine during rainy seasons.

VENTILATION. —The new Sirocco Fan was started up during the year and the increased

quantity of air; circulating in the mines has greatly ameliorated the conditions underground. It

may also be stated that the increased ventilation has undoubtedly reduced the number of cases

of spontaneous combustion.

HYDEAULIC STOWAGE. —This is now installed in the North Mine No. 1 Section, on the coal cutting face. The advantages expected from this method of operation have been fully obtained—the full thickness of coal seam can be won, and fires reduced to a minimum. A good supply of sand is now available from the Kundang Mine and makes an ideal stowage material.

COLLIERY RAILWAY, AND SIDING EXTENSIONS. —Several new sidings have been completed during the year. The length of track owned by the Colliery which is in actual use now totals 3 ¾ miles.

OPEN CAST MINES. —Additional boilers and winches have been installed at 1, 2 and 5 Open cast mines. This will produce an increased output. Gantrys, Boilers and Winches are now under erection at No. 3, 4 and 6 Open cast mines. Coal will be produced at No. 4 and 6 Open cast mines in a very short period. These two mines will then give a large output.

MACHINERY. —During the year two additional Babcock & Wilcox boilers were started up. These boilers are fitted with automatic chain-grate stokers. The results are most satisfactory. Chain-grate stokers have now arrived for No. 1 and 2 B. & W. boilers, to replace the hand-fired step-grate furnace. No. 5 and 6 B. and W. boilers have now arrived.

Three new electrical generators of 300 killowatts capacity each were received during the year, and are now erected and in use. The necessary extensions to the switch board were received and have been erected.

Plant at present on order comprises: —New Smoke Stack, Railway Locomotive, Boiler-feed pump, Cables and Briquetting Machinery.

BRIQUETTING. —The railway sidings are completed and foundations for the machinery house are now under construction. Part of the plant has arrived.

BUILDINGS. —Two new Bungalows were erected during the year. Two more are under

construction. The Police Station and Quarters are now erected and occupied by the Police.

. '

BRICK YARD. —288 Laksas of bricks were made and burnt during the year for use in and about the mines. The site for the new Brick Yard is being cleared.

LABOUR. —There are now some 2,500 coolies on the mines. Wages have risen steadily during the year owing to increased cost of living. There are 140 acres under foodstuffs.

KUNDANG WORKINGS (HYDRAULIC STOWAGE). —This mine is now opened up and the permanent sluice boxes erected and ready for use. The mine now produces a good supply of sand for the stowage operations.

STAFF. —The mine staff at Batu Arang now comprises 11 Europeans, the increase being two Assistant Engineers, two Surveyors, and one Assistant Manager Mr. McCall, Mine-Manager, and Mr. Porteous, Chief Engineer, went on leave from the 15th April, 1920, since when the writer has

acted as Mine-Manager.

In conclusion I wish to express my hearty thanks to the staff who have given me during Mr. McCall's absence every possible assistance.

YOUR Obedient Servant. E. ENGLAND,

Acting Mine-Manager

Batu Arang, 15th August. 1920 '

The Malay Mail October 19th 1920.

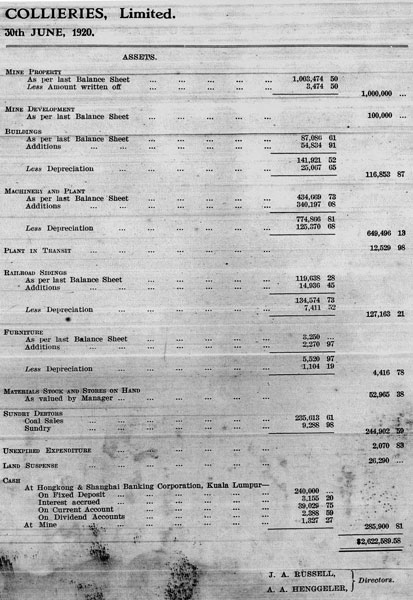

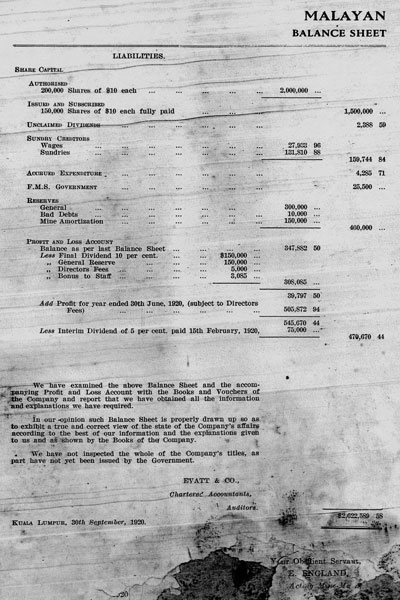

The seventh annual general meeting of the shareholders in Malayan Collieries, Limited, was held at the registered offices of the Company, Hongkong and Shanghai buildings, Kuala Lumpur, on October 15th, at 2.30pm Mr. J. A. Russell presiding. Mr. W. S. Coutts for the secretaries read the notice convening the meeting. The annual statement of accounts and balance sheet and the report of the directors and auditors were submitted to the meeting. The Chairman in moving their adoption said: Gentlemen: - the reports and accounts having been in your hands for the specified period, I shall, with your mission, take them as read. Before moving their adoption however, I will, as has been my yearly custom, make a few comments upon some of the items in the balance sheet before you. Taking the debit side first, Sundry Creditors totaling to $159,744.84 consists of wages, freight Government Royalty and traders’ accounts due by the Company for June account. Since the closing of the Company’s accounts, the whole of the above liability has been met. Under the caption F.M.S. Government” is the sum $25,000. This represents the Company’s liability for land premium to the F.M.S. Government for the area which the Company has hitherto held under Prospecting License but is now taking up under Mining Lease. In the Directors’ Report you will see that in converting our title to the land from Prospecting License to Mining Lease, the Government has excised some 200 acres. This action we consider to be a somewhat arbitrary one, for in our opinion whatever the Government may do with the surface of the land, it cannot fairly deprive us of the right held under our Prospecting License to the issue of a title to mine any coal that may be beneath that surface. These 200 odd acres, were without consulting us and without compensation, excised from our title. We naturally would not do anything by mining or other action to injure the railway line, as it would certainly not be I our interest to do so; but underground mining could be conducted without causing any harm. The Government in a brief communication has further asked us to hand back to them the already issued title to our first selected block, the one which we are now actively mining, for what is termed “ emendation”. From Government survey plans we see that this Portion 1285 with an area of 1282 acres has vanished and in its place is now Portion 1364 with an area of only 1266 acres. We know nothing officially about either this Portion 1364 or another new portion, No. 1365, which now appears for the first time on the Government survey plans. I do not think that this Company has been unreasonable nor is it now going to commence being so; but it cannot consent to its rights being thus whittled away, without compensation and without even being consulted. In the past we have suffered much in this direction. When we took an option from the original Rawang Syndicate, we took one over land held by a prospecting Licence issued under the old Mining Enactment. A preliminary selection under this Prospecting License had already been made and this Company was formed primarily to work that selection. The time, 1913, was one of growing financial depression. When the title was issued it was found that Mr. Broadrick, the then British Resident, had endorsed upon it some fresh clauses, the most inimical of which was that the lease was not subject to renewal at the expiration of its term of 21 years. Messrs Drew and Napier took up the point vigorously with the Resident and succeed in getting the right on our title to one extension of a further period of 21 years. Under our Prospecting Licence we had a definite legal right to a title conveying continuous renewals for as long as we continued to mine the land. Had we taken the matter to Court we must I think have won; but we could not afford to delay the floatation any longer so had perforce to accept a serious diminution of the rights to which we were entitled under our Prospecting Licence. This is perhaps along excursion into the past, but I mention it to show you that we have not always received very sympathetic treatment from the Government, and must be excused if we are now somewhat suspicious of any “emendations”. The Government cancelling of tin mining titles which is being now indulged in and the refusal of renewals is rightly or wrongly causing doubt in many as to the security of tenure in these States. I will conclude this digression by repeating that this Company has no intention of being unreasonable nor of obstructing for the mere sake of obstruction. There is no body more open to argument and negotiation than your Board. To return to the Balance Sheet, Accrued Expenditure is the proportion applicable to the period under review of the Company’s Consulting Engineers’ fees. Reserves total to $460,000 an increase of $187,500 over that for the previous financial year. We are recommending that a further $150,000 to placed to Reserve which will then make $610,000 in all. This sum includes $150,000 for mine amortization which is standing charge. Your Directors are considering investing this sum in some form of enterprise not directly connected with winning coal at Batu Arang. Turning now to the credit side, $3,474.50 has been written off Mine Property making this a round sum of $1,000,000 which is a most conservative value to place on coal bearing land. Mine Development remains the same at $100,000 which is also a low figure, all development work now being charged to revenue. Extra buildings during the year have cost $54,834,91. Further building additions are still being made. Machinery and Plant was increased by $340,197.08 giving a total of $774, 866.81. Against this amount $125,370,68 has been written off in depreciation. We had also at the end of the financial year another $12,529.98 worth of plant on the water. We furthermore have orders placed for still additional plant which will be arriving during the current year. Our extra locomotive forms part of this ordered plant, while the balance of the briquetting machinery constitutes yet another portion. The cost of the plant on order will be met out of the current year’s profits. Owing to the kindness of the Railway Administration we have been able to hire from them an extra locomotive. Without this aid we should have been in a serious position. An extra $14,936.45 was spent on our sidings bringing that account to $134,574.73 from which sum depreciation of $7411,52 has been written off for the year. Our unused stock of stores has been valued at $52,965.38. Sundry Debtors amounting to $244,902.59 is practically all due on coal sales and has since been collected. Unexpired Expenditure represents quit rent and insurance paid during the last year but applicable to the current year’s working. Land Suspense is on account of the conversion of part of our land from a Prospecting Licence tenure to Mining Lease. The details of this I have already explained. Our cash balance at the end of the financial year amounted to $285,900,81 of which the sum of $240,000 was on fixed deposit with our Bankers. Since the closing of our year the cash balance has materially increased. Turning now to the Profit and Loss Account, you will notice that the cost of mining the years’ output was $1,170,675. including mine amortization of $37, 500 and royalty paid to Government of $50,168.50. Bad debts only amounted to $43.41. The coal sales for the year yielded $1,652,203.19 while sundry other revenues produced a further $24,345.55 After deducting all charges, the Company made a net profit for the year of $505,872.94. To this profit has to be added the balance of $39,797.50 brought forward from the previous year’s account making a total of $545,670.44 Your Directors declared an interim dividend of 5 per cent on the 15th February last absorbing $75,000 and leaving $470,670.44 now available for distribution. They recommend the payment of a final dividend of 20 per cent making a total distribution for the year of 25 per cent, the placing of a further $150,000 to Reserve, and subject to the payment of Directors’ fees and a bonus to the staff, the carrying forward to next year account of the balance of $20,670.44. A new feature of our Seventh Yearly Report is the photographs of the mine which we hope shareholders may find interesting. The mine is becoming what is for this country quite a fair-sized concern and one of considerable importance to the economic life of both the Federated Malay States and the Straits Settlements. It has been the endeavour of your Board to make the Company as sound a one as possible, placing it rather in the class of good industrial undertakings than of mining ventures. With this end in view as much work as possible has been charged to revenue, our depreciation has always been on the safe side, amounting to $162,428,54 for the year under review, while we have from the beginning been consistently conservative in the matter of dividend declarations. Our plant is of the best make, no expense having been spared in obtaining the highest class of machinery and equipment. But we confidently plan to make the mine yet bigger and still safer. For this current year our output will be considerably greater than that for the one now under review. We hope that for this month it will touch 30,000 to.ns and that by the end of our present financial year this monthly output figure will be almost doubled. In normal times there should be no difficulty in disposing locally of the annual production of 6,000 tons which such a monthly output would give, and should we anticipate the demand continue in excess of this quantity, we propose increasing our production during the following year to an outturn of a million tons. As our coal is not a good bunkering one, we have not formulated plans for a greater annual production than this amount but should there be a ready market for the coal even beyond 1,000,000 tons a year, with further development it would not be difficult for us in the course of another two or three years to double or even treble that annual output. In fact we have coal in quantity, and possessing now the means to increase production, in say, another two years’ time the amount of our Colliery output will be governed solely by demand existing for the coal. In the Federated Malay States we do think we have much reason to fear any really effective competition: the coal answers admirably for land purposes, and with an annual output of 1,000,000 tons could if necessary be sold at a price with which no imported coal could possibly compete. It is not as though the price of our coal was considerably higher than the price of coal in other producing centres. If we first admit that for bunkering purposes without being briquetted it is by itself of small use, for ordinary land purposes it would, nevertheless, be worth in Europe to-day quite 100 per cent more at pit head than we are at present charging local consumers. Compared with the greater part of the rest of the world, fuel in the Federated Malay States is cheap. I suppose that the Federated Malay States Railways is the only railway in the whole world that can claim to have effected a reduction in its fuel costs per train mile last year over that of the previous twelve months. Now as a matter of making the mine safer, our greatest difficulty has been with internal fires, some of which have been extremely serious and have caused us grave anxiety and loss. To cope with these spontaneous fires the whole system of mining at the Colliery is being altered. By the new method no coal will be left behind in pillars to grind and spontaneously ignite, but will be totally removed and its place filled with sand introduced by means of hydraulic stowage. In order not to close down the workings, the conversion to the new system has to be a gradual one and it will thus still be another year or more before the new method is in full operation throughout the mine. But even at this stage in the conversion, the danger from fires has already been greatly minimized, and were another bad one to beak out, it would not have that disastrous effect upon our output that such an occurrence would have caused so late as six months ago. On the whole, therefore, I think you can feel reasonably assured that you posses a safe investment with a promising future. That future, of course, is bound up with the future of the Federated Malay States, and particularly with the general prosperity of its tin mining industry. A severe and prolonged fall in the price of this metal would adversely effect our coal sales and consequently our profits. But such a fall should it occur could only be for a comparatively temporary period, for I do not suppose that anyone in this country, even during a time of general depression like the present, has any real doubts as to the actuality of the prosperous future before these States. It is probably the intention of your Board shortly to ask you to sanction an increase of the Company’s authorized capital from $2,000,000 to $4,000,000. It is not proposed immediately to issue any of this further capital, but your Board has under consideration the strengthening of the Company by the possible acquisitions of other properties. The Company’s representatives have inspected coal deposits in China, Siam and the Dutch East Indies but hitherto with negative results. Two properties are now under examination which may prove as unsuitable as the ones previously visited but to be ready with the power to raise more capital in case a good property be obtained, we propose asking for the sanction I have mentioned. I should explain that although we feel confident that the product of no outside field would compete with our present coal for railway, mining and other land boiler purposes in the F.M.S. where our geographical position, our rail communication and the great thickness of our seams and quantity of our coal all combine to place us in an unassailable position for the production of a big out put salable at a low local price, yet for certain uses where bunkering and storing are essential and for the large trade adjacent but outside the F.M.S., an additional coal field possessing some of the qualities which our present fuel lacks might conceivably strengthen our position and widen our market. Wit our present staff, our experience, and our plant we consider that we might possibly be able to work efficiently and profitably fields that others could not operate so successfully. But we should acquire no further property unless we were first fully convinced of its value and had no doubt that it would add to our strength and profits. Not fearing competition in our own particular market, we can afford to be discriminately fastidious regarding any outside property offered us. I have again to thank the Colliery staff for their loyal services during the year and especially Mr. England, our acting Mine-Manager, who has had an exceedingly trying time in carrying out the conversion from one mining system to another, in dealing with spontaneous fires and in increasing the output. No one could have the interests of the Company more loyally at heart than Mr. England, and his long and varied colliery experience has been of great value to your Directors when considering future development. Mr. McCall and Mr. Porteous are still on leave and are I trust enjoying the holiday so long delayed. I have also to thank one of our shareholders Mr. Ho Man, for the valuable advice and services he has rendered the Company during the past year. Messrs. Chan Thye Lee, whom Mr. Ho Man manages so progressively, operate more tin mines in Selangor than any other firm. They were among the first people to use our coal and today after the F.M.S. Railways they are our biggest customer. We have recently concluded with the General Manager of Railways an additional contract for an extra 5,000 tons of coal a month, and I should like to take this opportunity of saying that despite little differences which occasionally may arise between ourselves and the Railway Administration, we have to thank it for a great deal of real assistance afforded us and for the invariable courtesy and accessibility of its General Manager who is always ready to discuss with understanding and a refreshing broadness of vision the difficulties and points between us. Finally, to the Government Electrical Adviser, Mr. Bolton, we are indebted for several interesting conversations upon the power requirements of the country with special reference to our coal. I now beg formally to move that the report of the Directors produced, together with the statement of the Company’s accounts as at June 30th, 1920, duly audited, be now received, approved, and adopted, which motion I will ask Mr. Grant Mackie to second; but before putting it to the meeting I shall first endeavor to answer to the best of ability any questions that shareholders present may care to put. Mr. Hopson Walker asked for the details of the contract with the F.M.S. Railways to which the Chairman had referred in his speech. It was a matter about which many shareholders held strong views, believing that they were being taken an unfair advantage of by the Government. The Chairman in reply stated that that the first contract with the Government was for a period of five years. It was entered into at the time that the Company began producing coal. There was at the time prejudice against the Company’s coal, and it did not command a ready sale. It was most important to secure the Railway contract as to do so was to establish the value of Rawang coal as a fuel. The Railway Department knew this, and, as was only business, practically dictated its own terms. The Company agreed to supply 5,000 tons of coal a month at the rate of $5.50 per ton, that is, the Railway had the right to be supplied with 5,000 tons and the option to take either 10 per cent less or 10 per cent more than the contracted amount. Whenever it could, of course, it took ten per cent more. It must be admitted that at this time the Company did not foresee the great rise in the cost of its coal production which has in sympathy with everything else since taken place. He would further admit that these rates to the F.M.S.R. were not remunerative ones to the Company. In that original contract, the Railway had also a clause by which it had the right to buy, at the same rate of $5.50 per ton a quarter of any output there might be above a monthly production of 17,000 tons. Shareholders might remember that two years ago there was an agitation against the Company when certain consumers accused it of profiteering. The Government appointed a commission consisting of Mr. Eyre Kenny and Mr. F.A.S. McClelland to investigate these charges. This Commission went through the Company’s books and came to the conclusion that there was no profiteering. The Commission recommended, he believed, that if the Company were to reduce the price of coal to the ordinary consumer, it be allowed to raise the price to the Railway which was far too low. The Company heard no more of the charge of profiteering nor of the Commission’s recommendations. The F.M.S.R. wanted still more coal a month, but the difficulties of increasing the output during the war were great. When the means of production improved, Mr. Anthony, the General Manager of the Railways, was exceedingly reasonable and admitted that the clause giving the Railways the right to a quarter of any increase over 17,000 tons a month was extremely hard on the Company. He said he was prepared to cancel that clause if the Company gave the Railways another 5,000 tons of coal a month on a long contract, the two contracts to run simultaneously, if the Company also did not charge the Railways too high a price for this additional coal. The Company was not prepared to tie itself down to another long contract, but said it was willing to give an extra 5,000 tons per month to the Railways at $10.50 per ton for a year in return for the Railways canceling the excess production clause. The contract for this additional amount had been duly entered into. There was over another year of the first contract still to go. At the end of that period, no one could expect to get the Company’s coal at $5.50 per ton, unless there were a revolutionary reduction in the cost of production. Mr. Grant Mackie said that imported coals were still fetching $48/- and more a ton in Singapore. Chairman said that Rawang coal was, as they knew, a semi-bitumous coal, and without being briquetted or mixed with other coals was unsuitable for bunkering. They could not expect to realize such prices as $48/- a ton for it. Mr. Grant Mackie said that, anyway, it was a most valuable asset to the whole Peninsula, and that a man in the leading firm of Mining Engineers in the country had remarked to him only the other day- “God knows what we should have done during the war without this coal” If the Company wanted to profiteer it could force some people to pay $35 a ton for Rawang coal. A small output at high prices would pay the Company, if not the country, better than its present policy of a large output at low prices. Of course this state of affairs might not always be so, but it was true at the present moment. No Company had ever been further than theirs from indulging in profiteering. Mr. Hopson Walker said that he was fully satisfied with the Chairman’s explanation as to how it was that the Company sold coal at such low prices to the F.M.S. Government Railways. The additional contract would to some extent rectify the matter, and he thought that the company had done wisely into entering into this additional contract with the General Manager of the Railways. He trusted that a report of the meeting and this discussion would appear in the local press, as he knew that many shareholders thought that the Board unduly and unnecessarily favoured the Government in letting it have cheap coal. The Railways, these shareholders said, paid at least from $20,000 to $30,000 a month less than it should do for its coal: $300,000 a year was a big item: it represented 20 per cent of the Company’s capital. The explanation given by the Chairman would show these shareholders how the existing condition had arisen. Mr. Hopson Walker also referred to that portion of the Chairman’s speech in which the Chairman had stated that the Company had inspected areas in Siam, and China, and asked if the idea of going into foreign countries was that the Company might find a coal which they could mix with the Rawang coal. He thought it was a danger to outside the British flag. The Chairman replied that from time to time, as he said in his speech, outside properties had been offered to the Company which it had inspected with the idea primarily of extending its market and secondly that it might perhaps find a coal which by mixing with Rawang would make the latter more suitable for bunkering. The second reason was by no means a vital matter for the Company as briquetting its own coal would answer the same purpose. The briquetting plant should be in operation towards the end of the present financial year. There being no further questions, Mr. Grant Mackie seconded the Chairman’s motion to adopt the report and accounts, which was carried. The Chairman then moved the payment of a final dividend of 20 per cent making 25 per cent for the year upon the issued capital of the Company, the placing of $150,000 to General Reserve and the carrying forward of the balance to next year’s account, which was seconded by Dr. J. M. Crago. The sum of $10,000 was voted to the directors in remuneration of their services for the past year. Mr. J. A. Russell and Mr. A.A. Henggeler were re-elected to seats on the Board. Messrs. Evatt and Co. were re-elected auditors for the ensuring year at a fee of $1,000. A vote of thanks was passed to Mr. McCall, to the acting Mine Manager, Mr. England, and to the staff on the mine for their services during the past year and a bonus of one month’s salary granted as a mark of the Company’s appreciation. The meeting concluded with a vote of thanks to the Chairman and the directors.

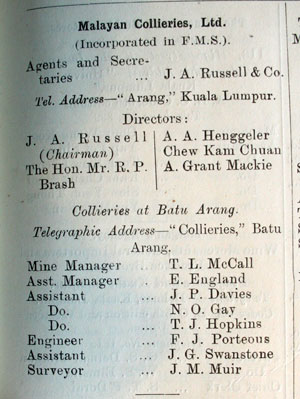

Malayan Collieries, Ltd.

(Incorporated in F. M. S.)

Agents and

Secretaries J. A. Russell & Co

Tel. Address-"Arang" Kuala Lumpur.

Directors:

J. A. Russell A. A. Henggeler

(Chairman) Chew Kam Chuan

The Hon. Mr. R. P. A. Grant Mackie

Brash

Collieries at Batu Arang

Telegraphic Address—“Collieries” Batu Arang

Mine Manager T. L. McCall

Asst. Manager E. England

Assistant J. P. Davies

Do. N. O. Gay

Do. T. J. Hopkins

Engineer F. J. Porteous

Assistant J. G. Swanstone

Surveyor J. M. Muir