For the descendents of Richard Dearie and his son John Russell

The Malay Mail, Thursday, April 27, 1922 and Malayan Collieries. [Articles] The Straits Times, 28 April 1922, Page 11 Malayan Collieries. The Directors' Report for Last Year, and short summary in The Straits Times, 26 April 1922, Page 8 and short version The Singapore Free Press and Mercantile Advertiser (1884-1942), 1 May 1922, Page 11

Malayan Collieries, Financial Position, The Underground Workings. The directors’ eighth annual report and statement of accounts of the Malayan Collieries, Ltd. for the eighteen months ended 31st December, 1921 is as follows: - Alteration of the Company’s financial year, - In order to agree with the accounting period of the company’s subsidiary Dutch company, the Mynbouw en Handel Maatschappi Goenoeng Batoe Besar, the end of the company’s financial year was altered from the 30th June to 31st December; so the statement of accounts now submitted covers a period of eighteen months. Shareholders were circularized on 15th November, 1921, regarding this alteration. By a special resolution of shareholders, passed on the 14th November, 1920, the authorised capital of the company was increased from $2,000,000 to $4,000,000. By an extraordinary resolution of shareholders, passed on 30th December, 1920, the capitalisation was authorized at $300,000 of the undivided profits, and 30,000 fully paid bonus shares of $10 each were subsequently issued to shareholders appearing on the register; which distribution was equivalent to a dividend of 29 per cent in shares upon shareholders’ holdings. A further 130,000 shares of $10 each were issued, and subscribed, bringing the issued capital to up to $3,100,000. Of these share 30,000 were issued at a premium of $6 per share, producing $180,000, which sum was transferred to general reserve. With the aid of the new issue of 130,000 shares, the whole of the share capital of f.1,500,000 together with the mining and timber leases of the Mynbouw en Handel Maatschappij Goenoeng Batoe Besar, in Dutch South East Borneo (Pamoekan Bay Colliery), were acquired. The development of this property has been financed from the company’s amortization and general reserve, for which reserve funds it has formed a legitimate investment; being one connected with the company’s trade, but independently of the Batu Arang ( F.M.S.) colliery, from which property the funds derived. The company has now obtained from the Government possession of the remainder of its Batu Arang titles. Application to the Government has been made for a further 100 acres, which area is required in connection with the company’s sand stowage operations. The titles to the Pamoekan Bay property are also in the possession of the Company. All titles are free from mortgage and encumbrances. Mines and Plant - An account of these will be found in the General Manager’s subjoined reports. In order to cope with the extra traffic, due to higher output and to sand stowage operations, the line and sidings at Batu Arang were considerably extended during the period under review. Output. The total output from both mines for the period, amounted to 489,243 tons; of which Batu Arang contributed 472,859 tons and Pamoekan Bay 16,384 tons. At Batu Arang 24,451 tons were consumed for generating power in and about the mine and at Pamoekan Bay 1823 tons were consumed for power and in bunkering the company’s vessels. Coal sales for the period amounted to 462,969 tons - 448,403 tons from Batu Arang, and 14,561 tons from Pamoekan Bay. The health at Batu Arang has been excellent throughout the financial period. By the introduction of hydraulic sand-stowage, not only is the mine being rendered safe from its former greatest danger of internal spontaneous fires, but, by rendering total extraction of coal possible (instead of having to leave half of it behind in the form of pillars to support the roof) the life and value of the mine have been doubled. It will, however, be some time before the whole of the old underground workings have been dealt with by this system. Opencasts. - The economic life of these workings is limited, and it was never intended that they should become permanent. At present while the underground workings are being re-organized for sand stowage, they are producing most of the coal, but eventually they will be entirely superseded by the underground workings. In March 1922, when the crisis in the tin mining industry became so acute that many tin miners were in an exceedingly critical position, and in need of every aid to prevent them from financial collapse, the company gave a special rebate of 15 p.c. to all its mining customers, whether these had contracts or not. This concession on the contracts of those consumers who had entered into definite agreements to take monthly quantities of coal at fixed prices, represented a loss to revenue to the company of $86,148.30. In march 1921 Mr. James Barr, B.E., M.I.Aust. M.M., was appointed General Manager. Pamoekan Bay When this property was acquired the price of bunker coal in Singapore was between $40.00 and $50.00 a ton; and it was anticipated not only that the development work would pay for itself, but that it would even show a profit. Coal prices, however, rapidly fell; and the coal won incidental to development- although rapidly sold for a total sum of $335,888.71- did not go very far towards reducing the total development expenditure. On the expiry of the charter of the s.s. Nanyo Maru, the s.s. Passat was chartered for six months; but at the end of her time, as development work on that particular stage was not producing much coal, it was decided not to charter another vessel, and to stop coal sales in the meantime. The property was taken over in Feb., 1921 but - due to handing over - practically no coal was produced during this month. Owing to labour troubles, underground development and coal production was again suspended from November until the end of the year. Coal was therefore only being won during nine out of the eleven months that the company has owned the property. The same applies to underground development which was temporally suspended principally owing to labour troubles. Development work, entailing coal winning, has, however, now resumed; and the s.s. Hydra having been chartered, coal sales will shortly recommence. A coal storage ground has been leased in Singapore, while arrangements have also been concluded to acquire one in Soerabaya. The company has experienced no difficulty in selling such coal as been produced, and see a ready and wide market for Pamoekan Bay coal in the Straits Settlements and Netherlands East Indies; but until the output reaches the neghbourhood of 10,000 tons a month, charges and development expenditure will be too heavy to admit of the profits made on coal sales showing a surplus sufficient to pay a dividend. Due to the present changed circumstances, Pamoekan Bay Colliery will not be fully developed, and thus earn a fair return on capital expended until near the end of 1922; but the coal won from development work will help materially in equipping the mine, and after a new jetty has been constructed it is not expected that any further considerable amount will require to be expended on capital account. The company has now examined coal from all parts of Borneo, and can confidently state that it has found no Borneo coal equal in quality even to the company’s second grade Pamoekan Bay Coal whilst most Borneo coals are decidedly inferior to it. The Company’s first-grade Pamoekan Bay coal is equal in calorific value to the best Australian bitumous coals; but- as explained by the General Manager’s report- it is not yet advisable to mine this high-grade fuel, and only the second grade is being at present produced and sold. Profits. The profits for the 18 months, subject to the directors’ fees and auditors fees, amount to $1,286,032.14 to which must be added the balance, brought forward from the previous account, of $5,985.44 making 1,292,017.58 which less a final dividend of 10 per cent paid on 16th January of $310,000.00 leaves $892,017.58 .You will be asked to sanction fees to the Directors for the past 18 months of $15,00.00 and the auditors have rendered their account for $2,500.00 which total deducted from the previous one leaves available $964,517.58 which the directors recommend should be dealt with as follows:- Transfer to general reserve, bringing same to $1,000,000, $670,000.00; Write off mine development, Batu Arang $1,000,000.00 write off primia and survey fees on mining leases, Batu Arang $40,609.60. Balance to be carried forward to next Year’s account, $153,907.98, Total $964,517.58. It will be the policy of the directors to endeavour, in future, to pay an interim dividend on each succeeding June 30th; but this year they will pay the same at the end of May, when an interim dividend of five per cent in respect of the financial year 1922 will be distributed. The retiring directors are Mr. Alexander Grant Mackie, and Mr. Robert Peebles Brash, who, being eligible offer themselves for re-election. Messrs. Evatt and Co. retire; but being eligible offer themselves for re-election.

(N.B. No General Manager’s report has yet been found.)

The Malay Mail, May 5, 1922, ps.9 and 16 Headlined: Malayan Collieries. The Dutch Property. The Chairman and Mr. Peck.(Copied with different headlines in-). MALAYAN COLLIERIES. [Articles] The Straits Times, 6 May 1922, Page 9 and

MALAYAN COLLIERIES. Mr. Peck Asks For Information. An Unexpected Breeze. The eighth annual general meeting of Malayan Collieries, Ltd., was held in the Boardroom of the Company, Kuala Lumpur, on Thursday. Mr. J. A. Russell presided and the others present were Messrs. Grant Mackie, H. A. Henggler (directors), A.S. Bailey, Fred. C. Peck F.P. Harris, E.P. Hargreaves, Col. A. J. Hull, and H. D. Brown who also represented Messrs. J. A. Russell and Co., agents and secretaries. 0. The notice convening the meeting was read and the minutes of the previous meeting were taken as read and confirmed. 0. Chairman’s Speech 0. The chairman in moving their adoption said: Gentlemen the report and accounts having been in your hands for the specified period, I shall with your kind permission take them as read. Both the report and the accounts are the full ones and I believe are sufficiently self explanatory, and I think there is no great need for me to amplify them to any extent this morning; but before moving their adoption, I will nevertheless make a few comments upon some of the items. Sundry creditors amounting to $191,767.51 represents the current trade liabilities and has since been completely discharged. An appropriation from the profits was made of $18,867.11 to Staff leave and Passage Reserve, which reserve now stands at $15.000, a sum considered ample to meet the accruing liability towards those of the staff who are due for leave during 1922. The other reserves are the general reserve, the mine amortization reserve and the bad debts reserve. The bad debts reserve of $50.000 is shown on the other side of the balance sheet as a deduction against sundry trade debtors. The general reserve was increased during the period under review by $330.000, but against this increase the sum of $300.000 was capitalized by the distribution to shareholders of 30.000 bonus shares; so the net increase is only $30,000. You will be invited to make a further appropriation to this reserve when dealing with the profits. The amortization reserve was automatically increased by $56.250, bringing the total to $206,250. Both the general and the amortization reserves have been utilized in further developing the Batu Arang Colliery and by investment in the Pamoekan Bay Colliery. 0. Mine Development Account for Batu Arang remains at $100.000 at which figure it has stood for some time. It is now proposed to write off this sum entirely. During the period covered by the accounts, the sum of $40,609.60 was paid to the Government as premia upon the balance for the Company’s Batu Arang titles. In conformity with the hitherto practice of the Company, it is proposed to write this sum off. Mine buildings at $206.000 shows an increase of $89.146.13 due to the replacement of temporary buildings by those of a more permanent nature. Mining plant at $793.324.92 shows an increase of $126,882.03 and the Batu Arang Colliery is now well equipped to deal with, if required, a considerable output. 0. Sundry debtors total $454,596.57 against which a reserve for bad debts of $50.000 has been provided, which is considered ample to cover contingencies. The company also holds a certain amount of security against some of its outstanding accounts. The big outstandings which we had some months before the end of the year have been largely reduced. 0. Mining stores at $117,021.12 shows a substantial increase over the figure in the last balance sheet of $52,956.38. The increase is justified by the intermittent and irregular arrival of supplies from home which, during the early part of the financial period under review, coincided with expanded demand for coal making the carrying of larger stores necessary. The cost of these larger stores was also considerably enhanced. The position in all these respects is now greatly altered. 0. Profit and Loss 0. Turning to the profit and loss account, the revenue from coal sales and other sources amounts to $4,800,944.68, while interest, difference on exchange and transfer fees amount to a further $18,289.49 It will be observed how substantially your company contributes to Government Revenues, for during the period of these accounts it has paid to various Government departments by way of royalty, freight, quit rent and premia a total sum of $753,913.96. Rebates to tin mines absorbed another $86,148.30, while depreciation of plant etc. accounted for $213.195.61 The question of depreciation has been gone into carefully and the above figure represents in our opinion a just estimate to cover wear and tear. 0. From the profits of the period amounting to $1,286,032,14, a dividend of 10 per cent. has already been paid, absorbing $310,000, and in view of the distribution of rights and bonus shares which, at the time it was made, and if the shareholders had cared to sell the same, was equivalent to a handsome interim dividend in respect of the period covered by these accounts; it is not proposed to pay any further dividend in respect of the period covered by these accounts, but it is intended at the end of the current month to declare and distribute an interim dividend of 5 per cent. in respect of the present financial year. It will also be the policy of the board to endeavor in future years to pay an interim dividend, even if only a small one, about the end of each June. To refer back to the distribution of bonus shares and rights, it may be remarked that even at today’s quotation, and allowing for loss on taking up the rights, should shareholders care to sell their bonus shares they will receive in cash a dividend of 15 per cent. So perhaps in a way we can claim to have paid 25 per cent in all for the last financial period. Had share holders sold their bonus shares and rights at the average quotation obtaining for the same at the time of their issue, the cash obtained after deducting their par value, would have been equivalent to about a 50 per cent interim dividend or, with the final 10 per cent, 60 per cent., in cash for the eighteen months covered by the accounts. This of course may be an exaggerated and wrong way of looking at things, but I am aware of several shareholders who, requiring a cash dividend, did dispose of the whole or part of their bonus shares and rights within a short time of receiving them, and after making allowance for the par value of the same received what was in effect a substantial interim dividend. The suggested director’s fees are at the same rate as those sanctioned last year. 0. It is proposed, as I have already mentioned, to write off from the Batu Arang Colliery property the total sum of $140,609.60, to transfer to the general reserve the sum of $670,000, bringing this fund up to $1,000,000, and to carry forward to next year’s account the balance of $153,907.98 0. Pamoekan Bay Colliery 0. You will see from the general reserve the company has advanced the sum of $594.249.24 to its Dutch subsidiary, the Mijnbouw en Handel Maatschappij Goenoeng Batoe Besar, in order to develop the company’s colliery at Pamoekan Bay, and at the end of the accounts you will find a financial statement showing how this money has been expended. All payments made whether for equipment, development, Government or other charges and fees, etc. are included. And if not specifically set forth are entered under the heading of Development and trading and will later on be treated as working cost. The condition and prospects of this property have been described in both the directors’ and the general manager’s reports and I do not think there is much that I can add to what you have already been told. I do not want to pretend that matters have run as smoothly as was hoped. Mr. England was incorrect in his estimate of the time and money required to develop the property into a profit earning colliery, and this taken in conjunction with the fall in the price obtainable for bunker coal in Singapore of from over $40 to under $20 a ton, seriously affected the company’s plans and hopes of speedily earning a profit. With coal selling at over $40 a ton, speed of production was relatively of more value than cost of production; but when the prices of local bunker coal fell to less than half that figure, cost of production was incomparably the more important factor, and costs had to be reduced, even though the process of such reduction inevitably resulted in strikes and stoppages. Methods and exactions which could temporarily be tolerated when the price of coal was high, in order to push ahead with development and production, became impossible when coal won incidental to such development work fell to a much lower figure. The mine, was therefore, reorganized, a change of management made, and as the labour still demanded the exorbitant rates which were being paid for skilled underground miners when these men were originally engaged, they were all shipped back to the F.M.S. and allowed to realise, not only that we were not afraid to part with them, but that conditions in the F.M.S. had greatly changed since they first went across to Borneo. We have now re- engaged and sent across other and more chastened miners. The cost to the company of all this was naturally expensive, and the waste of time great; but under the altered circumstances it was the only possible course to pursue, and we can now confidently say that owing to the quality of our coal and the situation of our mine on a harbour, we shall be able with our newly effected reorganization and after the mine is fully developed to produce coal at a cost that will compete with any imported bunker coals, and which should show quite a good profit on the sum expended in acquiring and developing the property. We have not hitherto been producing our best coal nor marketing it in its best form; but these defects will disappear as development proceeds and screening improves. It took three years to develop the Batu Arang Colliery, during which time the shares fell to as low as $2.59. Those connected with the mine and who could see the development proceeding, that is to say, several of the staff on the mine and myself and other of your directors, never lost confidence in the colliery’s ultimate success and continued to buy all the shares they could afford. I have equal confidence in the future of Pamoekan Bay. It has many disadvantages to compete against as compared with Batu Arang; but it contains by the far the best coal I know in Borneo, either British or Dutch, while the pit mouth is only a mile from the Company’s deep water jetty. 0. If your company had not purchased this property, it would have been developed by others and might have eventually, in fact would almost inevitably, proved a serious competition to your Batu Arang Colliery, for when fully developed it will probably be able to place coal on the F.M.S. market, after paying cost of production, transport and royalty, at a price which will compare, considering its higher calorific value, not unfavourably with the cost of Batu Arang coal. I know of no other Borneo mine which could do this. 0. I now beg formally to move that the report of the Directors produced together with the statement of the Company’s accounts as at December 31, 1921, duly audited, be now received, approved and adopted, which motion I will ask Mr. A.A. Henggeler to second; but before putting it to the meeting I shall first endeavor to answer to the best of my ability, and if I can properly do so, any reasonable question bearing upon the Report and Accounts which shareholders present may care to put. 0. Mr. Henggeler seconded the motion. 0. Mr. Peck’s Questions 0. Mr. Peck- Mr. Chairman, I am very much surprised to find that you have not given full particulars in regard to the purchase of the Pamoekan Bay property. I myself wrote a letter to the Straits Times in November last expressing my desire for full particulars, and asking among others, three important questions namely (1) what were the terms of purchase originally agreed upon (2) who were the middlemen; (3) what are the present terms for working the concession. In view of the magnitude of the question these are extremely reasonable questions and shareholders have full right to have that information in full. I have had my expenses to come here and attend this meeting paid by a few shareholders in Singapore representing more than 5,000 shares. 0. The Chairman: How many shares Mr. Peck? 0. Mr. Peck: More than 5,000 shares, I am told, and I have been requested by them to ask for full information with regard to the purchase of this property. I have received certain information from Singapore, and I have only this morning been to the office of the Registrar of Companies, and been looking at the agreement of purchase dated June 10, 1921, between Messrs. J. A. Russell and Company on the one hand and the Malayan Collieries Ltd. on the other. The commencement of the agreement read as follows:- 0. By virtue of an agreement dated 5th October 1920, made between the Eastern Mining and Rubber Co., Ltd. and Ng Hong Guan…and by virtue of an agreement dated 19th November 1920, made between Khoo Wee Chuan, and the vendors Messrs. J. A. Russell and Co., the vendors become the holders of the said option…. and whereas the vendors have agreed to sell to the company all that property mentioned in the agreement dated 5th October 1920, subject to the terms mentioned therein etc… 0. Now, Sir, the further information which I received in Singapore is somewhat as follows, and the most important part of it appears to be omitted entirely from this agreement. There is mention of the agreement entered into by Hg Hong Guan and there is mention of the agreement dated November 19 1920, between Khoo Wee Chuan and the vendors, but nothing is said as to the reason for the transfer of the option Ng Hong Guan to Khoo Wee Chuan. My information, which I cannot vouch for, is that Hong Guan was the representative of the Malayan Collieries Ltd, having been authorized by Malayan collieries to secure options on coal properties in the Dutch Indies, and he was in a position I believe to have made over the option direct to the Malayan Collieries Ltd. That was not done. On November 19, curiously the very next day on which Khoo Wee Chuan made this agreement with J. A. Russell and Co. Hong Guan transferred his agreement to Khoo Wee Chuan instead of direct to this company. I’d like to know why there was a necessity for the transfer of that agreement Hong Guan to anyone except the Malayan Collieries. I should like to mention some things that strike me in this agreement, especially the enormous difference between the consideration received by the former owners and the consideration which has been charged by the company. According to this agreement my information is that the Eastern Mining and Rubber Co. agreed and sold their property for $600.000 in cash and 20.000 shares. This is excluding the royalty about which not a word is said either in the report, in the accounts, or in your speech today. I am going to leave that out for the purpose of this calculation. The consideration charged to this company has been $600.000 in cash and 100.000 shares showing a difference between the selling price by the Eastern Mining and Rubber Co., Ltd and the purchase price by Malayan Collieries Ltd. of 80.000 shares, of a nominal value of $800.000 and calculating on the same value as the shares given to the Dutch Company as part consideration the difference amounts to more than $2,000.000. Putting these figures on a percentage basis taken at their nominal value the difference was 100 per cent. Today I am credibly informed that 10 per cent of that went to the option holder Mr. Hong Guan. If we take the shares at $30, which was the valuation placed on those given to the sellers, the increase represented 200 per cent. 0. Terms of Purchase Questioned. 0. It seems to me sir, that it was within your power as representing the company to have obtained this property for $600.000 and 20.000 shares plus a reasonable remuneration for Mr. Hong Guan, but over and above such reasonable remuneration 72.000 shares have been distributed between a number of persons. I have an official list of them here. The Eastern Mining and Rubber Co., received 20.000, 5,000 direct to Hong Guan and 3,000 to his nominees, 17,500 shares were allotted to Khoo Wee Chuan for whose intervention in this transaction I see no reason. Then there are shares allotted to about a dozen other people 12.000 have been allotted to Teng Hong whose address is given as c/o Koo Wee Chuan and 15.000 to Tan How Soo whose address is also given as c/o Koo Wee Chuan. Taking the number of shares allocated to Khoo Wee Chuan and his two friends, it will be seen that 44,500 went to this man who, I believe, received this option on November 19, the very day on which he transferred it to Messrs. J. A. Russell and Co. Then you Sir, were allocated 3,000 shares. What I would like to have full information about are the transactions that took place after Mr. Hong Guan got that option, what was the necessity for that option to be transferred to any one else but the Malayan Collieries Ltd, and why you as chairman of the board of directors, the head of the company’s agents and head of the secretaries were personally allotted 3,000 shares while you were in that fiduciary position? It seems to me that if you had the opportunity of getting this property at anything like the selling price, it was your duty to the shareholders to have done so, This is the case of which I wish to have full particulars and full information. It is usual in all large transactions for full particulars to be given to shareholders, and if possible unless there is a very good reason for not being able to do so, to get their sanction. But you neither gave the shareholders an opportunity for approving these terms of purchase, nor have you given any information during the last eighteen months. It has not yet been given to the shareholders in spite of requests which have been made. I would also like to mention that the financial year was postponed for six months, thus delaying the opportunity shareholders to ask officially in a general meeting for this information. I would like you to reply to the questions I have asked correcting any mistakes I may have made. I would also ask the directors present to state whether they had full knowledge of these transactions and whether these transactions were carried out according to their wishes. That is the main point which I wish to raise now. Although there are other matters which are of great importance ordinarily they are overwhelmed by the nature of this particular transaction. 0. Just as Mr. Peck was resuming his seat a strong gust of wind from the direction of the embankment blew away all the papers, pencils, etc., which were on the table. 0. The Chairman: We seem to be having a breeze. (Laughter) 0. The Chairman replied:- 0. I am not in a position to answer all the questions which Mr. Peck has asked. I doubt his right to ask many of them, and even if I were able to reply in full to them all, I cannot see what use there would be in my doing so. I think that all I need to say in reply is that as far as Malayan Collieries Ltd. is concerned they acquired from Messrs. J. A. Russell and Co. for the sum of $600.000 in cash and 100.000 fully paid shares of $10 each in Malayan Collieries Ltd., an option which Messrs. J. A. Russell and Co. had acquired over the property and share capital of the Mijnbouw en Handel Maatschappij Goenoeng Besar. In resolving to acquire this option, Mr. J. A. Russell did not vote. The other directors discussed the offer and after full consideration decided to accept it on the terms offered by J. A. Russell and Co. J. A. Russell and Co. were unable to give Malayan Collieries the option in hand for long as their time was short, and if Malayan Collieries did not accept the offer form J. A. Russell and Co. had to make other arrangements before their option expired. J. A. Russell and Co. naturally, did not want to risk losing not only their option but also the time and money already spent and the deposit made. It is conceivable that it might not have been in the best interests of the company for the directors, even if they had wished to do so, first to consult the shareholders; but in any case there was no time in which to take this course. I would remind you that although the slump has commenced, it had not at that time affected bunker coal, which commodity was continuing to fetch high prices with the result that coal properties were still in considerable demand, and J. A. Russell and Co. would thus not have had much difficulty in floating a separate company to work this property or in otherwise disposing of it. 0. Mr. Ng Hong Guan was not the representative in this matter of Malayan Collieries, nor was he authorized by Malayan Collieries to obtain an option over the Goenoeng Batoe Besar property. Mr. Ng Hong Guan has been obtaining options over mining and other properties for J. A. Russell and Co. for the last several years. The deposit of $60.000 on the option was paid by J. A. Russell and Co. on their own account. 0. I think that these are the only questions really concerning Malayan Collieries Ltd. but I will explain that the business of my private firm of J. A. Russell and Co. is largely connected with dealing in mining properties, and that they have at various times held options on, and inspected and dealt in, mining properties, coal and otherwise, in Malaya, Burma, Siam, China and the Netherlands East Indies. The whole financial risk involved in acquiring their option over the Borneo property and all expenses and advances in connection therewith were borne by J. A. Russell and Co. J. A. Russell and Co. did not make a profit of 72.000 shares out of the transaction, though it is true that such profit as they made was paid in shares and not in cash. Although part of the consideration named in the option was payable in Malayan Collieries shares, J. A. Russell and Co. possessed ample shares in Malayan Collieries with which to satisfy this part of the purchase price, and in fact had J. A. Russell and Co. exercised the option themselves, as they were quite prepared to do, they would certainly have welcomed this method of paying, ready money at the time already becoming somewhat tight. If Malayan Collieries had not purchased J.A. Russell and Co.’s rights the latter would, as I have said, either have acquired the property themselves or have floated it as a separate company. They gave to Malayan Collieries the first refusal to buy. 0. Finally I would like to add that J. A. Russell and Co. are by far the largest shareholders in Malayan Collieries Ltd., and have immeasurably the most to gain or lose by its success or lack of success. After the purchase of the Borneo property J. A. Russell and Co. invested an additional sum of about $100.000 in taking up Malayan Colliery new issue shares. As an illustration of what I mean, I may say that at one time during the period covered by the accounts before you, the position of Malayan Collieries was temporarily exceedingly difficult owing to the sudden fall in the price of tin having given the miners no time in which to adjust themselves to the greatly altered conditions. A large number of tin mines could therefore not for a month or two pay for their coal supplies; yet if those supplies had been cut off such mines would have had to close down, a course which would have been disastrous to the country in general and to Malayan Collieries in particular. Your company took as security charges over several tin mines and plant; but such security however ample, was of no use with which to pay coolies wages and the other costs of winning coal. Just at that time, too, drafts for the plant ordered a year previously began arriving and needed meeting. Our cash reserves were first exhausted and then the limit of our overdraft reached. Our bankers were exceedingly good to us, but they naturally at such a critical period were not prepared to go too far in the way of assistance without prior investigation and the company’s need was urgent. Although I have little doubt that when their limit was reached our bankers would have assisted us further rather than have seen us, through being unable to obtain payment for coal supplied, temporarily forced greatly to diminish so vital a necessity to the country as coal production, fortunately they had not to be appealed to again, for J. A. Russell and Co. advanced to Malayan Collieries at the bank rate of interest and without security the sum of $150.000 and by the help of this little extra amount the critical period was safely passed and not a single coolie had to wait day for his wages nor was a single ton of output curtailed. That the large outstandings for coal then incurred have since been nearly all recovered and with but small loss to the company for bad debts, proves that the policy adopted during the tin crisis by your Board was the right one. Perhaps you will consider it unnecessary for me to mention all this: I do so, after Mr. Peck’s remarks, merely to show that my private firm, who act as agents and secretaries for this company, legitimately decline to stop conducting their own business, they have a very large interest, in fact the largest interest, in the success of Malayan Collieries. They will thus continue always to support and further the interest of Malayan Collieries to the best of their limited ability and amongst other things to offer to Malayan Collieries the first refusal of any coal properties which they may have purchased or over which they have acquired options; although in this later connection you may be interested to hear that from a close examination of the F.M.S. and surrounding countries I am in a position to say that the contingency of such again happening is exceedingly remote. Good coal properties workable at a profit are unfortunately exceedingly scarce; despite constant search we have not found any more. 0. Gentlemen, I will not trouble you or take up your time with any further remarks, but there are apparently no questions form others, will proceed with the motion before the meeting. 0. Further Questions 0. Mr. Peck: Mr. Chairman, you have stated that Mr. Hong Guan was never authorised by Malayan Collieries to get options. I believe there is a letter purporting to be signed by Messrs. J. A. Russell and Co. on behalf of the Malayan Collieries Ltd. authorizing Mr. Hong Guan to get options on properties in the Dutch Indies. In view of what you have just stated this letter is undoubtedly a forgery and I think the matter should be looked into. I cannot agree with you Mr. Chairman, that no further particulars with regard to this transaction can be given. It is a matter, I think, on which absolutely full particulars should be given to the shareholders. If Mr. Hong Guan did not get this option, and that is what I understood from what you said just now, I cannot understand this agreement which says that he did get the option. One peculiarity about this agreement is that it is dated June 10 1921 whereas six months earlier it was stated that the matter was receiving the full attention of the board. There appear to have been two agreements, and I notice that the shares were allotted on January 31. Can you tell me Mr. Chairman the date on which you obtained the option? As far as I can gather from your remarks you appear to imply that Mr. Hong Guan was acting as an agent for J. A. Russell and Co. This matter should be cleared up in the interests of all concerned. 0. The Chairman: In replying to Mr. Peck I omitted to say that a royalty of $2.50 a ton which is treated as mining cost and so appears in the account, is payable to Messrs. the Eastern Mining and Rubber Co. Ltd. but on the fall of the price of coal Malayan Collieries negotiated a reduction of this sum to a royalty of 50 cents a ton at which amount the royalty now stands. With reference to his further remarks I did not say that Hong Guan did not obtain the option; what I said was that he was not acting for Malayan Collieries Ltd. With regard to the purchase from Messrs. J. A. Russell and Co. of their option, although this was dated June 10, the actual purchase was made on November 23 1920, and was so recorded in the minutes, Mr. J. A. Russell abstaining from any decision in the matter. 0. Our lawyers were instructed to prepare a formal agreement embodying the terms of purchase for the purpose of filing the same with the Registrar of Companies, but by an oversight they did not do this and the formal agreement was not ready for signature until June 10. This agreement was not regarded as important. Messrs J. A. Russell and Co. had been negotiating for some months for the acquisition of an option over this Borneo property and had incurred considerable expenditure in time and money in so doing, making among other payments a deposit of $60.000 on the option. The date on which they actually obtained their option was some time before they sold the same to the Malayan Collieries Ltd. 0. Mr. Peck: Can you tell us the exact date say within a week? Was it in October 1920? “Some considerable time before handing over to the Company” is extremely vague and is of no use to the shareholders. 0. The Chairman: Are there any more questions gentlemen? If there are no more I shall proceed to put the resolution that the report and accounts be received and adopted. 0. Mr. Peck: I would propose that this meeting stands as adjourned. The information which I have put before this meeting is probably new, and I consider that shareholders should have an opportunity of considering it before this report and accounts are passed. Therefore I would propose that this meeting is adjourned for a reasonable time with that object in view. There seems to be no urgent necessity for passing these accounts today. It seems to me advisable to give all shareholders an opportunity to consider the matter. 0. The Chairman asked Mr. Peck to find a seconder. 0. Mr. Hargraves. I beg to second the motion formally. 0. Mr. Peck suggested that as it was a matter for the shareholders to decide, the directors should refrain from voting. The amendment was put to the meeting and lost, Mr. Peck alone voting in its favour. 0. The report and accounts were passed, Mr. Peck voting against. 0. The Chairman then moved the final dividend of 10 per cent paid on January 16, 1922, be confirmed, which was seconded by Mr. Henggeler. And carried after Mr. Peck had objected to the chairman’s previous remark that the issue of bonus shares was the equivalent to the payment of an interim dividend. Mr. A. Savage Bailey proposed and Mr. F. P. Harris seconded the payment of $15.000 in fees to the directors for their services during the last 18 months. Mr. F. C. Peck protested against any payment of any director’s fees as a mark of the shareholders disapproval of the directors’ management of the Company’s affairs, but found no seconder and the original motion was carried, Mr. F. C. Peck being the sole dissentient. The Chairman proposed and Mr. F. P. Harris seconded the re election of Mr. A. Grant Mackie, and Mr. P. Harris proposed and Mr. Savage Bailey seconded the re election of Mr. R. P. Brash to the board which was carried. 0. Mr. F. P. Harris proposed and Mr. A. Savage Bailey seconded the re election of Messrs. Evatt and Co. as auditors for the ensuing year. A vote of thanks was passed to the staff for their services during the past year and the question of the payment to them of a bonus was left to the discretion of the directors. 0. The meeting concluded with a vote of thanks to the Chairman and the directors, Mr. Peck not voting. 0. (5245 words)

Malayan Collieries Report and Accounts for 18 months and A.G.M. 1922

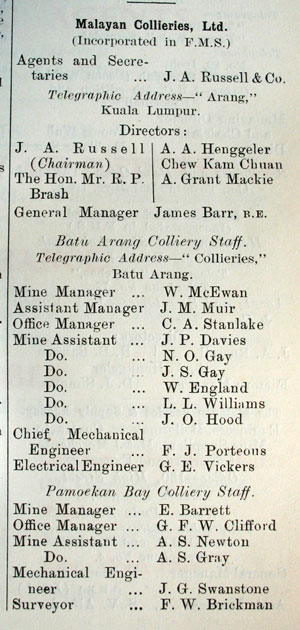

Malayan Collieries, Ltd.

(Incorporated in F. M. S.)

Agents and

Secretaries J. A. Russell & Co

Tel. Address-"Arang" Kuala Lumpur.

Directors:

J. A. Russell A. A. Henggeler

(Chairman) Chew Kam Chuan

The Hon. Mr. R. P. A. Grant Mackie

Brash

General Manager James Barr, B.E.

Batu Arang Colliery Staff

Telegraphic Address—“Collieries” Batu Arang

Mine Manager W. McEwan

Assistant Manager J. M. Muir

Office Manager C. A. Stanlake

Mine assistant J. P. Davies

Do. N. O. Gay

Do. J. S. Gay

Do. W. England

Do. L. L. Williams

Do. J. O. Hood

Chief Mechanical F. J. Porteous

Engineer

Electrical Engineer G. E. Vickers

Pamoekan Bay Colliery Staff

Mine Manager E. Barrett

Office Manager G. F. W. Clifford

Mine Assistant A. S. Newton

Do. A. S. Gray

Mechanical Engineer J. G. Swanstone

Surveyor F. W. Brickman