For the descendents of Richard Dearie and his son John Russell

The Straits Times, 12 May 1924, Page 12 , also printed in the Malayan Tin and Rubber Journal Vol. XIII No 10, 31 May 1924. p. 627 and 628.

MALAYAN COLLIERIES LTD. Directors' Report for the Past Year. The directors of Malayan Collieries, in the course of the tenth annual report and statement of accounts, for the year ended December 31, 1923 state: - Property. - The position remains the same as reported last year. No title has issued by the F.M.S. Government to the company for its extra 100 acres at Kundang. Kundang Sand Pits. - The company continued to win tin ore from this property, which ore to some extent off-set the cost of sand-stowage. Batu Arang. - Operations at this colliery functioned smoothly throughout the year. The property is in sound condition and well maintained; while the problem of underground fires, which at one time threatened its existence, seems to have been effectively solved. The colliery is capable of a considerably increased output should a local demand for more coal arise. Labour Trouble. 0. Pamoekan Bay. -The operation of this colliery unfortunately sustained a very serious set-back during the year, due to an incident arising out of friction between the Chinese Underground miners and the Javanese surface labour, which antagonism culminated in a grave disturbance attended with considerable loss of life to both parties. Owing to the request of the Dutch officials to the effect that the Chinese labour concerned in the riot be deported, unskilled Javanese had to be drafted into the underground workings. These men being unused to underground work, the output of the mine was most adversely affected, being temporarily reduced to small proportions incidental to the initial stages of development. Although the Javanese at present being employed underground have gained in experience and are showing improved mining capacity, it is evident that they are not entirely suited to work of this specialized character and picked Chinese underground Miners are therefore gradually being shipped across to Pamoekan Bay. To avoid further disagreement, the present plan is to open two mines, operating the principal one with Chinese and the other with Javanese miners. The stoppage and subsequent diminution of coal production had a two-fold adverse effect upon the company’s profits. Not only did the reduced output produced by the unskilled labour remaining on the mine cost more to win, but the curtailment increased the overhead charges per ton, and, what was far more serious, rendered idle for some time the company’s fleet of three colliers, the liability for charter money upon which vessels (an exceedingly heavy item) continued to accrue. In consequence of this fatal riot, the year’s operation of the Pamoekan Bay Colliery resulted in a trading loss of $76, 089.56. It is the more regrettable because the virtual stoppage of output occurred at a time when, the quality of Pamoekan coal having been established, the demand for it had considerably increased and still is increasing, a demand which the mine can as yet only partially supply; but it is hoped that it will shortly be able more fully to meet. Pamoekan Bay Option. Your Board has recently considered an offer made to it to acquire from the company for the sum of $60,000 an option to purchase the Pamoekan Bay property at the price of $4,000,000. Your board, however, does not consider the offer to be sufficiently attractive. Should an offer be received which in the opinion of your board it might be desirable to accept, this offer, together with the board’s recommendation, would be submitted to the shareholders for their consideration. It should, however, be stated that your board is not contemplating disposing of the property, and no sale at any price would be entertained unless the purchaser bound himself and his successors not to compete with Malayan Collieries, Limited, within the area of the F.M.S. Local Coal market. - Although the year opened badly it closed firmer and with greater demand, due mainly to the improved conditions in the tin mining industry. Guilder Fluctuation. - The company’s average rate of exchange for the conversion of Straits Dollars to Dutch Guilders for 1922 was Straits $100,00= guilders 134.19, while the average rate for 1923 has been $100.00= guilders 140.02. This depreciation of the Dutch guilder, it will be observed from the accounts, has been written off. Suit by Mr. Peck. - This case has now been heard and is still sub-judice, judgment having been reserved.. Profit. The profit for the year under review, subject to directors’ fees, and audit fees, amount to $871,193.19, to which is added the unappropriated balance from the previous account of $148,347.63, totalling $1,019,540.82. Two interim dividends of 5 per cent and 7 ½ percent respectively, were paid during the year, absorbing $387,500 and leaving $632,040.82. You will be asked to sanction fees to the directors in respect of 1923 $12,000, the Auditors have rendered their account for $2,000, leaving available $618,040.82, which your directors recommend should be dealt with as follows: - Payment of final dividend of 10 per cent (making 22 ½ per cent for the year) $310,000, write off mine development account $155,457.02, balance to carry forward to next year’s account $152,583.80 (Subject to an appropriation for staff bonus, to be left as formerly to the discretion of the board.) 0. Directors. - The retiring Directors are Mr. Alexander Grant Mackie and Mr. John Archibald Russell. Mr. Alexander Grant Mackie is retiring from the country at an early date, and does not seek re-election. Mr. John Archibald Russell being eligible offers himself for re- election. The Hon. Mr. Dugan Homfray Hampshire, having been invited to join the board, offers himself for election. Auditors. – Messrs. Evatt and Company retire, but being eligible offer themselves for re-election. (885 words)

The Straits Times, 14 May 1924, Page 9, and the Malay Mail, (with slightly different wording) of Wednesday May 14, 1924, ps. 9 and 16. Also covered in the Malayan Tin and Rubber Journal Vol. XIII No. 10, 31 May 1924, p 625-628.

Malayan Collieries. Proceedings at the Annual Meeting. (From Our Own Correspondent.) Kuala Lumpur, May 13 The tenth annual general meeting of the Malayan Collieries, Ltd., was held at noon to-day, at the offices of the secretaries, Messrs. J. A. Russell and Co. There were present Messrs. J. A. Russell, (in the chair), A.A. Henggeler, R. P. Brash, Chew Kam Chuan, (directors), N.E.S. Gardner, F. C. Peck, J. Bligh Orr, Russell F. Gray, H. Hopson Walker, F. Cunningham, E.E. Deacon, B.J.P. Joaquim, F.B. Ivens of Bannon and Bailey (Company solicitors), by attorney: H. N. Ferrers, Mrs. F. G. Boddington, Mr. H. D. Brown (Representing the Secretaries J. A. Russell and Co.). F. Thorogood, attorney for Mr. H. N. Ferrers. The notice convening the meeting was read by Mr. Brown. 0. The Chairman addressed the meeting as follows: The Report and Accounts having been circulated I am assuming that you will accord me the customary permission to take them as read and I will therefore, proceed to make a few remarks upon the Balance sheet before you. Taking first the left hand side of the Accounts, you will see that the Capital issued and subscribed remains the same as formerly. With a larger turn over the amount due at the end of the year to sundry creditors stands at $251,645,59, showing an increase over the previous year of $13,815.15. The whole of the sum due to sundry creditors has since been discharged, with the exception of a liability to the Netherlands East Indies Government in respect of Government Royalty, the exact amount of which has not yet been definitely ascertained but has nevertheless been fully provided for. The warrants represented under the heading “Unpaid Dividends” have also since been practically all presented and paid. Reserves remain at the same figure except for an increase of $37,500 to mine amortization and of $2,500 to Staff Leave and Passage Reserve. The Total of Reserves now stands at $1,308,750 but this does not include the Bad Debts Reserve of $75,000. Turing to the assets side of the balance sheet, our lease-hold property remains at its written down figure of $1,000,000, which sum, however, does not contain the book value of the Pamoekan Bay lease. The Dutch Government leases of the Pamoekan Bay Colliery and the adjoining timber concession are comprised under the heading Investments, being shown there as being the whole of the Share Capital at cost of the Mynbouw en Handel Maatschappij Goenoeng Batu Besar, the company holding these leases. The book value of this investment being $1,600,000, the total value in the Company’s books of its landed property is consequently $2,600,000. 0. Comparative Statistics. 0. Development Account amounts to $530,457,02 as against $499,472.44 for the year 1922. Railway sidings are written down to a round figure of $100,000. Our buildings, after being depreciated by $25,481,19 stand at $300, 877 as compared to with $289,815,75 for the previous year. After allowing for depreciation, wharf and harbour Account has increased from $31,235,17 to $59,721. During the year $95,316,91 was spent upon additional plant and machinery, $85,019,26 has been written off by way of depreciation, and the total account now stands at $835,800 as against $ 825,502 for 1922. An extra $19,035,85 has been spent upon the Steam Launch account, but the sum of $24,035, 85 having been written off it, the balance at $25,000 is less by $5,000 than the former total of this account. The aggregate of all sums of depreciation written off assets for 1923 is $139,768,47 as compared with $121,956 written off assets for 1922. This depreciation figure does not include the sum of $35,118,18 written off the Guilder Fluctuation Account. The mining and other stores and requisites carried by the company to facilitate its operations have been valued on a conservative basis at $229,478,12. The stocks of unsold coal on dumps and afloat at the end of the financial year were valued at $117,923,26. Sundry Debtors at the end of the year owed the company a total sum of $476,160,74, which sum is shown in the Balance Sheet as an asset worth $401.160,74, the ample reserve of $75,000 having been allowed for contingency of bad debts. At the close of the previous year the sum due to the company was $417,984,37 and the reserve allowed for bad debts was $60,000. Out of this reserve for $60,000 the sum actually written off for bad debts during 1923 was $8,381,90 or less than one quarter of one per cent. of the Company’s revenue for that year. 0. It was considered the wiser course to write off the amount of depreciation incurred upon Dutch Guilders rather than to carry the same to a suspense account until such time as the conversion rates improves. 0. At the end of the year the company had cash in hand and at Bank to the extent of $109,302,26, having just disbursed a Dividend on December 21. 0. The Year’s Profit. 0. Looking at the profit and loss account you will see that the cost of operating our Collieries during the year was $1,813,960,26. Of this amount $230,984,58 was spent on Development, leaving $1,582,975,68 as the actual cost of winning the coal. We paid a further sum of $741,159,07 in transporting the coal and $138,833.23 in royalties upon it. These three items, less the money spent on Development amount to $2,462,967,98. The corresponding figure for the previous year was $1,977,570,85. Our total revenue was $3,576,681,63 as against $2,999,923.59 for the previous year, and our net profit is $871,193.19 as against $764,869,65 for the previous year or an increased profit of $106,323.54. To the above profit has to added the balance brought forward from the previous account of $148,347,63 making a total of $1,019,540,82. Out of this latter amount the Company has already paid two interim dividends totalling to 12 and a half per cent, absorbing $387,500, - and leaving available a balance of $632,040,82. Your Directors recommend the distribution of a final dividend of 10 per cent for the year, which final distribution will absorb $3,100,000, - and that the sum of $155,457,02 be written off Mine Development Account reducing this item to a round figure of $375,000. 0. The auditors have rendered their account for $2,000 and you are requested to sanction a sum of $12,000 as directors’ fees. These appropriations will leave a balance of $152,583,80 which amount, subject to payment of a bonus to staff, your Directors recommend should be carried forward to the 1924 account. As in previous years, the amount of the staff Bonus your Directors ask you to leave to them to fix in consultation with the General Manager. 0. I do not think there is need for me to add much more to what I have said, as such general information as I could give you is already contained in the Directors’ Report and the General Manager’s Mine Report before you. The consumption of Batu Arang Coal continues to expand, even if only slowly so. On the other hand the demand for the product of our Pamoekan Bay Colliery has increased greatly and, could we but supply it, we could sell more of this fuel than we can of Batu Arang Coal. Unfortunately, our output at Pamoekan Bay has not yet recovered from the disastrous episode of last year referred to in the Directors’ Report. The result of the repatriation of the original force of skilled Chinese Miners, entailing as it did, the training of a new underground gang of Javanese operators and the re-constitution of a fresh force of Chinese miners, has been far reaching in its consequences and, temporarily, economically detrimental in its effects. This re-organization of the whole labour force has been a slow process and is even not yet accomplished. I fear I must confess that the Javanese have been most disappointing as underground workers and that there seems to be little chance of any marked improvement in outurn until we have again several hundred Chinese, this time men of selected character, upon the Mine. More of such men are being sent to Pamoekan Bay each month, and before the end of the current year we ought to have quite as many skilled miners of this nationality as we possessed on the mine before last year’s calamity, Our output is once more creeping up, in another two or three months’ time we trust that it will have arrived at the daily figure to which it had obtained when the trouble occurred, while before the completion of the year we hope it will have greatly surpassed that figure. With this contingency in mind, we are now negotiating further charters and hope shortly to be able to supply our customers with greater quantities of coal. 0. Changes in Staff. 0. Certain changes have also been made to the European staff at the mine, the services of five members of which have been discontinued, and new men have been or are being engaged to replace them. 0. During the year one of your directors, the Hon. Mr. R. P. Brash, upon behalf of the Board, visited Pamoekan Bay, and inspected the Company’s property there. Incidentally Mr. Brash was present on the mine when the riot took place. 0. The lower seam of better coal which I mentioned last year is still untouched, as it would be unwise to embark upon additional workings until our old ones are again on a stable basis. 0. Reference is made in the Directors’ Report to the Company having been approached for an option over the Pamoekan Bay Colliery. I think that may be no harm in my saying that the offer comes from one of the Company’s customers who has been unable to obtain the quantities of Pamoekan Bay Coal for which he requisitioned. He has indicated that he is willing to pay $60,000 for a three or four month’s option, giving him and his backers the right to purchase for $4 million. Your Directors consider the property to be worth more than this sum and have written declining the offer. Despite the labour troubles, your Directors are not at all anxious to dispose of the property; they do not forget the obstacles encountered during the first four years of the Batu Arang Collieries’ existence, troubles which at the time seemed far graver than anything now afflicting Pamoekan Bay. 0. I wish in conclusion on behalf of the Company to thank the General Manager, Mr. Barr, the Manager and staff at Batu Arang and the Manager and such of the staff as are remaining at Pamoekan Bay for their work during the year, and in this I am sure you will heartily join me. 0. I now beg formerly to move that the report of the Directors produced, together with the statement of the Company’s Accounts as at December 31, 1923, duly audited, be now received, approved and adopted, which motion I will ask Mr. A. A. Henggeler to second; but before putting it to the meeting I shall first endeavor to answer, if I consider that I can and should properly do so, questions upon the Report and Accounts which shareholders present may care to put. 0. Mr. Henggeler seconded the motion. 0. Mr. Peck Speaks. 0. Mr. F. C. Peck said he would like to propose that such business as would not likely to be controversial be dealt with at the meeting and that the meeting should then be adjourned until after the judgment in the case. In the present circumstances, he could not speak freely with regards to the suit and other matters which were directly or indirectly connected with it. One of his reasons was as to the advice which would be given on the question of appeal. He certainly had no wish to speak on a matter which was sub judice. 0. The chairman thought it would be better to deal with each item as they came along, and Mr. Peck could if he desired object to each item at the proper time. 0. Mr. Peck asked whether by that the chairman intended to object to his proposal. 0. The Chairman: Will you form a proposal that the whole of this meeting stands adjourned. 0. Mr. Peck said that the general matters as to the directors’ remuneration and election of directors should be considered after the suit. 0. The chairman said that if Mr. Peck was not prepared to propose that the whole meeting stand adjourned they would have to continue. 0. Mr. Peck then agreed to the Chairman’s suggestion. 0. Mr. Peck: There is another little matter. I notice that on the agenda there is no item of “ general”. That item had always appeared in previous reports. It is a small matter and no doubt a slip. 0. The Chairman said that the meeting had been called only for the particular purposes mentioned on the agenda. 0. Mr. Hopson Walker said it was usual to have another item on the agenda. It had always been there before. 0. The Chairman inquired what the item was. 0. Mr. Hopson Walker: To transact any other business which might arise. 0. The Chairman replied that there was no justification to have any special item. 0. Mr. Peck then said that it was only right that that company should have absolutely independent legal advice. He did not intend to say anything against Mr. Ivens but Messrs Bannon and Bailey, who had been appointed as the company’s solicitors in connection with his suit, had previously been consulted by Mr. Henggeler and perhaps by others in the matter of his suit. In the circumstances he thought they should have another firm of solicitors. 0. Mr. Peck was speaking further on the point when the chairman interrupting, said he could not allow him to go on speaking further. If Mr. Peck desired to discuss such a matter he could call a meeting of his own, but that meeting had been called to discuss the balance sheet and accounts before the meeting. 0. Mr. Hopson Walker said that this agenda differed from those issued in other years. 0. The Chairman: The item was left out deliberately because that company had been called for those particular purposes and not to give a chance to Mr. Peck for a little propaganda. 0. Mr. Peck next inquired with regard to the 51,000 shares which were admitted to have been in fictitious names and deposited with the company’s solicitors, whether he was right in thinking that they had really been issued. It was a small point, but it seemed to him a difficult thing to decide on. 0. The chairman: Those shares have been allotted. 0. Mr. Hopson Walker: In accordance with the enactment? 0. The Chairman: Yes. In accordance with the enactment. 0. The proposal for the adoption report and accounts was then put to the meeting and carried, there being three dissentients. 0. The Chairman proposed the payment of a final dividend of 10 per cent making 22 and a half percent for the year. 0. The Hon Mr. R. P. Brash seconded. - Carried. 0. Mr. Deacon proposed the payment to the directors of $12,000 as fees to be divided amongst themselves as they may agree. 0. A member (Mr. Cunningham according to the M.M.) seconded. 0. Mr. Peck thought that no fees should be paid to the directors at the present time. This, he thought, was one of the controversial matters. 0. Mr. Hopson Walker agreed with Mr. Peck. He thought this matter should stand over. 0. The resolution was put to the meeting and carried with three dissentients. 0. Mr. Deacon proposed the re election of Mr. Russell as director a shareholder (Mr. Cunningham M.M.) seconded. 0. Mr. Hopson Walker: I propose that this be allowed to stand over. It is a matter which should be held over for the present. 0. Mr. Peck seconded. 0. Mr. Deacon’s proposal on being put to the meeting was carried with two (three according to the M.M.) dissentients. 0. Mr. Henggeler proposed and Mr. Russell Gray seconded that D. E. Hampshire be elected as a director. 0. Mr. Peck said that he had that morning attended a meeting of the Utan Simpan Rubber Company when Mr. Russell was re elected to that board of which Mr. Hampshire was chairman. In those circumstances he did not think Mr. Hampshire should be allowed to come to the board. (From M.M. Mr. Peck: “ Sir, this morning I attended the meeting of the Utan Simpan Rubber Co., at which Mr. Hampshire presided, and at which he proposed the re-election of yourselves to the board of that company. Under those circumstances Mr. Hampshire’s election should not be approved” 0. Mr. Hopson Walker thought this was another of the matters that should be held over. He did not oppose Mr. Hampshire joining the board, but he thought it should be held over for the present. 0. The original motion on being put to the meeting was carried two voting against. 0. The Chairman, in reply to Mr. Peck, said that all the items on the agenda having been dealt with there was no reason why the meeting should be adjourned. But if desired another meeting can be called and no doubt would be called. Mr. Peck can always call a meeting and the directors were always willing to give him every facility. He further explained that as certain matters were sub judice it was desired to confine that meeting to the five items on the agenda. 0. Mr. Hopson Walker: Do I take it that this meeting is adjourned sine die? 0. The Chairman: No, this meeting is concluded. 0. A vote of thanks to the chair terminated the proceedings. 0. (N.B. Slightly different wording for last section of meeting in “Malay Mail” and “Tin Mining and Rubber Journal”) (2824 words)

Malayan Collieries Report, Accounts and A.G.M. 1924

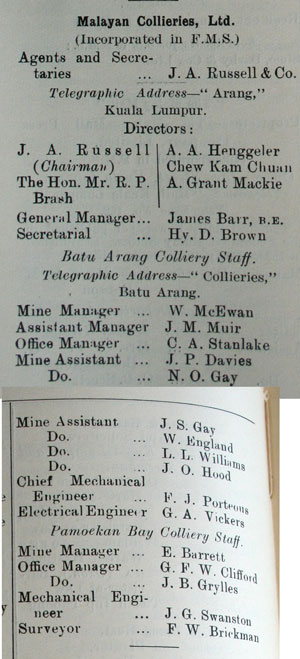

Malayan Collieries, Ltd.

(Incorporated in F. M. S.)

Agents and

Secretaries J. A. Russell & Co.

Tel. Address-"Arang" Kuala Lumpur.

Directors:

J. A. Russell A. A. Henggeler

(Chairman) Chew Kam Chuan

The Hon. Mr. R. P. A. Grant Mackie

Brash

General Manager James Barr, B.E.

Secretarial .....................Hy. D. Brown

Batu Arang Colliery Staff.

Telegraphic Address—“Collieries”

Batu Arang

Mine Manager W. McEwan

Assistant Manager J. M. Muir

Office Manager C. A. Stanlake

Mine assistant J. P. Davies

Do. N. O. Gay

Do. J. S. Gay

Do. W. England

Do. L. L. Williams

Do. J. O. Hood

Chief Mechanical F. J. Porteous

Engineer

Electrical Engineer G. E. Vickers

Pamoekan Bay Colliery Staff

Mine Manager E. Barrett

Office Manager G. F. W. Clifford

Do. J. B. Grylles

Mechanical Engineer J. G. Swanston

Surveyor F. W. Brickman