For the descendents of Richard Dearie and his son John Russell

THE MALAY MAIL, SATURDAY, FEBRUARY 21ST, 1925 AND THE MALAYAN TIN AND RUBBER JOURNAL 15/3/1925 Vol. X 1 V No 5 page 308

Standards of Commercial Morality. RESOLUTION TO COMPROMISE ADOPTED Mr. Peck in Small Minority. An extraordinary general meeting of Malayan Collieries, Ltd., was held yesterday at the offices of the company, with Mr. H.N. Ferrers, the chairman of directors, in the chair. The others present were: Messrs. James Barr and Cunningham (directors), F.C. Peck, H. Hopson Walker, Mrs. King, Messrs. Tan Chong Chew, C.H. Huxtable, J. Weston, B.J.P. Joaquim, E.D. Shearn, F. Clyde Jeavons, Cormack, Burn Murdoch, Codner, Wakefield, Fearon, M. Cumarasami, Yap Pow Chin, John Hands, Whitehead, and H.D. Brown (secretary.) After the notice calling the meeting had been read, the chairman said that it was with a certain amount of trepidation that he faced for the first time the shareholders of the Malayan Collieries, Ltd. It had so happened that although he had been for so long interested in the company, he had never been in that position before, and he esteemed himself particularly fortunate that the circumstances with regard to the company should be such as they were that day. It should be a matter of very great satisfaction to all shareholders that their shares should stand so high as $33-$34. They had never stood so high before. So that if any shareholders wished to realise they could do so now at a profit. Further, the reputation of their company as an industrial security stood as high as, if not higher than, any other, and comparing with other well established industrials, like the Straits Trading Co., in the country, they stood nothing to lose by the comparison. They had a magnificent property and until the saw it they could not realise what A Magnificent Property it was, and how much the State of Selangor and British Malaya generally owed to the enterprise, energy and courage of Mr. Archibald Russell. Those who had not seen it before could form some idea of the property by looking at the pictures which adorned the walls of that room. It was to him remarkable that the stretch of land which the collieries now occupied and which he knew as jungle before the Malay Forest Guard Wahab first discovered the coal, could have been so magnificently developed. Where there was once virgin jungle there was now a small town. That remarkable progress was due to Mr. Russell, and if Mr. Russell were left alone and allowed to continue his pioneer work in the industrial sphere of the country they might see as vast improvements as they witnessed at present. Before he actually put before the meeting the resolution there were one or two things he wished to say, particularly because he saw before him an energetic set of reporters. In the first place everyone who was interested in the welfare of the company would be glad to know that they had every prospect of continuing to have the services of Mr. James Barr as general manager. Russell and Co.’s position. Another point that would be of very great interest to the people at that meeting would be to know what the relation of the firm of Messrs. J. A. Russell and Co. to the Malayan Collieries was going to be. The directors had decided that it would be very much against the interest of the Malayan Collieries, Ltd., if they could not rely in the future, as they had done in the past, upon Mr. Russell’s vast experience, and his knowledge of the whole country and all the industries carried on within it. Therefore the directors had come to the conclusion that they should retain the services of Messrs. J. A. Russell and Co., but only in a consultative capacity. They would not have any administrative power and would not be fettered in their general work. The exact terms of the arrangement proposed to be made with them would be communicated to the shareholders in due course. The directors were quite determined that it was very advisable that they should be able to avail themselves of the services of Messrs. J. A. Russell and Co. and of their knowledge and experience. It had been stated in the press that because Mr. Justice Whitley found that Russell and Co. had, in breach of their duty, diverted the Seboekoe expedition to visit Goenoeng Batoe Besar, it was grossly wrong to have Russell and Co. in any way actively concerned in the affairs of Malayan Collieries, Ltd. He did not propose to delve into the evidence given at the trial and the facts which were then proved, beyond saying that he considered it A Sufficient Answer to any press criticism to state that when the Goenoeng Batoe Besar property was offered by Mr. Russell to the board and the board bought from him as a principal, the directors fully knew that the expedition which had started out to go to Seboekoe had gone to Goenoeng Batoe Besar first, and that Mr. England, the company’s manager, had not from thence gone on to Seboekoe personally, but sent his subordinate, Mr. Brickman, to Seboekoe, and had himself returned to Kuala Lumpur. Mr. Brickman later on reported adversely to the board upon Seboekoe, and the board turned it down, and he believed he was correct in saying, the Seboekoe property still remained awaiting a purchaser. There was no question but that the board were at the time perfectly satisfied with the diversion of the expedition to Goenoeng Batoe Besar, and it was clear that the directors saw nothing improper in Mr. England going to Goenoeng Batoe Besar and reporting to his board on that property instead of carrying out the original plan of going himself to Seboekoe. The directors knew all these facts before they bought the property, and there was no concealment as to them by Mr. Russell, with whom they also knew that they were dealing as a principal. There was time for the directors to have sent Mr. England back to Seboekoe had they so desired but they did not do so and at no time did they suggest that it would have been better had Mr. England carried out his original instructions and gone to Seboekoe himself instead of sending Mr. Brickman there. Position of Mr. Peck. Up to this point he had been merely dealing with regard to the continuing of the intimate connection which had always existed between the Malayan Collieries and the firm of Messrs. J. A. Russell and Co. Nobody could deny the fact that the prosperity of the company was largely due to Mr. Russell and Messrs. J. A. Russell and Co. Another point which he could not sit down without alluding to was the position of Mr. Peck in the matter. They all realised, and it was a fact that could not be disguised, that had it not been for Mr. Peck this large sum of money would not have been available to them and the question of dealing with it or with the resolution would not have arisen. At the present time they were anxious to know what Mr. Peck’s position was. Mr. Peck was accustomed very freely to communicate on the affairs of their company to the Press and in one of his last letters he came to the conclusion that the previous directors, the gentlemen who disappeared somewhat suddenly a few weeks ago, had “dished” him. He did not know what meaning to attach to the term “dishing”. Mr. Peck apparently did not get the treatment which he expected to get at the hands of those directors. They (the present directors) would be able to improve on that. They had no desire, neither his colleagues nor himself, to meet Mr. Peck anything but fairly. They wanted thoroughly to understand what his position was, and they hoped that they would succeed in settling that very complicated litigation which had lasted so long, cost so much, and stood in the way of the development of the magnificent property which they possessed. The Resolution. Mr. Barr then moved: That the conditional agreement dated the sixth day of February, 1925 and made between Malayan Collieries, Ltd. of the one part and J. A. Russell and J. A. Russell and Co. of the other part a copy whereof had been circulated to shareholders should be and is hereby approved and that the same should be carried into effect. Mr. Cunningham seconded. Mr. Peck, at the outset, protested against the meeting and the way in which it had been called without giving him anything more than the minimum time to put his views before all the shareholders. He regarded the resolution as being put forward more in Mr. Russell’s interests than in the interests of the company. It had undoubtedly been put forward by Mr. Russell’s own nominees. Mr. Barr: You are absolutely wrong. Mr. Peck: Are you not Mr. Russell’s nominee? Mr. Barr: No, I am not. Mr. Peck: Directly or indirectly you are his nominee. The chairman: You must address the chair, Mr. Peck. Mr. Peck, continuing, said that reading the circular one would think that the directors had persuaded Mr. Russell to withdraw the suit on the terms proposed. Mr. Russell himself had wanted to withdraw the appeal, and these very terms were proposed by Mr. Russell to him before and he rejected them because they were not fair to the company. He was satisfied that Mr. Russell had not a ghost of a chance of winning in appeal on the main part of the judgement. There would certainly be some argument on four points regarding the relief. Mr. Peck’s Analysis The circular and the agreement which accompanied it asked the shareholders to give this large sum of about a quarter million dollars in order to protect the remaining 91 or 92 per cent. He maintained that 91 per cent. was absolutely safe, and he wanted to have it absolutely and clearly established in a court of law that there was no doubt whatever that such a transaction as that which Mr. J. A. Russell and J. A. Russell and Co. put through was illegal and fraudulent and that any person putting through any such transaction was accountable to the company. The directors were now proposing to throw a certain amount of doubt on that. That was the main basis of the agreement and the circular. They who proposed this compromise had no right whatever to the judgment. He himself obtained that judgment against the opposition of the company and they had no right to deprive him of the moral satisfaction, one of the reasons which prompted him to bring the action being his desire to establish a higher standard of commercial morality in this country. The chairman: Really! Mr Peck, continuing, said that he did not any doubt whatever cast upon that main part of the judgment. He had taken legal advice and he had been advised that the agreement was illegal and that it could not be carried into effect against a dissentient minority. In November 1922 the company by a very large majority decided to defend the suit which he brought. The company put in a defence. The company now had no right to overrule the judgment given in his favour. This same company which was overruled with regard to its defence that he had no right to sue, now proposed to overrule the order of the court. They proposed to give away 8 or 9 per cent. Why not give away 80 or 90 per cent.? That would be a farce, and no court would tolerate such an interference with its powers. The latter part of the agreement proposed to indemnify Mr. Russell against any further relief which he (Mr. Peck) might obtain. That amounted to a tacit admission by the directors that he had a perfectly legal right to go on with the cross appeal. The chairman: Certainly. Contempt of Court. Mr. Peck, continuing, said that what the directors said if effect was that they were not going to take any notice of what the appeal court might say. They admitted that he had a perfect right to go before the three judges, but whatever order those judges might make it was not going to be carried out. What was that, if not a contempt of court? He wanted to take the matter to the most impartial tribunal they had. He had taken it to the Supreme Court and he wanted it to remain there, except on certain terms satisfactory to him, one of which was that with regard to the main judgment there should be no possible doubt. With regard to the judgment as a whole he had little doubt that Mr. Russell would not go to appeal. He was satisfied that Mr. Russell stood to lose more by going on with the appeal than he stood to gain. They were proposing to give away more than Mr. Russell had the slightest possibility of winning even f he succeeded on all the four points which he had previously mentioned. Mr. Russell was asked to deliver 8,676 shares. He would not get more if he went to the appeal court, at least not more than the equivalent of 8, 676 shares at $21.50 a share. That was the amount which was awarded to him in respect of 10,000 shares which Mr. Russell did not deliver. He could not possibly get more shares in the face of that. They were now proposing to give some $100,000 more than there was the slightest possibility of Mr. Russell getting, assuming that all the four points were decided in his favour. He had spent money in preparing for the appeal before the superior tribunal. That appeal was quite close at hand. The main incentive to his pursuing the case was not to put unearned money into the pockets of shareholders who had opposed him. They had no moral right to it at all. What right had those shareholders to propose to disburse the property which he had obtained by his own efforts? How could two co-defendants compromise without the permission of the plaintiff? He said that this compromise was “ultra vires” and in his opinion could be prevented from being put into force. He understood that in some quarters he was characterised as a litigant; but he thought that that term could be applied with greater force to Mr. Russell. Mr. Russell had threatened litigation and bluffed, sometimes with a certain amount of success, at every turn. By a threat of litigation he got the directors of the board out recently. The chairman: That was my threat. Mr Peck: I say you are Mr. Russell’s agent. The chairman: You are making a big mistake. If you do that again I shall have to call you to order. Confine yourself to the truth. Mr. Russell’s Bluff. Mr. Peck: I am confining myself to the truth as far as possible. Continuing, Mr. Peck said, that they had first the bluff of Mr. Russell with regard to a large number of his supporters, then they had the great litigation against Hong Guan. That was another bluff which did not come off. Then they had another bluff with regard to the Loke Yew estate votes. Now they had more threats with regard to expensive litigation in his taking the matter to the Privy Council. His own opinion was that Mr. Russell would not dare to go to the Privy Council or even to the Court of Appeal. Mr. Barr: You are assuming too much, aren’t you? Mr. Peck: I do not believe it. Continuing, Mr. Peck said that the effect of the resolution was that they were going to tell Mr. Russell that he could defraud the company to the extent of a quarter million dollars at least, leaving aside the main judgement, in a position of trust, and if a shareholder attempted to bring him to book other shareholders would come along and exonerate him. Looking at it another way, Mr. Russell might again defraud the company to the extent of another 2 ½ million dollars, and if anyone with the knowledge of recent happenings dared to take legal action and carry it to a successful issue, Mr. Russell had only to threaten an appeal and the shareholders would be giving him 8 or 9 per cent, and they would be going on doing that “ad infinitum.” What was there to prevent Mr. Russell from further defrauding the company? Mr. Barr: That is a very strong word to use. The chairman: That is another of your lies. Mr. Peck: That is what is said in the judgment. The Chairman: No. Mr. Peck: The judge said that this transaction was “per se” of a fraudulent character. You get the judgment and I shall show you where he said it. I am usually very careful as to what I say, but I am not an expert at extempore speaking. The judgment was produced but the matter was not pursued. Unpaid Costs Mr. Peck, continuing, said that if that agreement was carried through any one of the shareholders who was absent could come along and could sue the board and hold it personally responsible for it on the ground that he had not acquiesced. Mr. Peck said that he was not speaking for himself alone but also for others who had sent proxies to him against the resolution. He also understood that proxies had been sent to the directors direct against the resolution. There were one or two other matters to which he wished to refer. One was the question of costs which, it had been stated, had been paid. He wished to inform the shareholders that not a cent had been paid. Of these costs only about 10 per cent. consisted of his personal costs, costs of journeys to Kuala Lumpur to frequent meetings and to Soerabaya and Amoy in connection with the litigation. Mr. Hopson Walker said that Mr. Peck had been asked to address the chair, and he too had to do so, although what he had to say was mainly intended for the shareholders. The position was somewhat peculiar, and Mr. Peck had gone into it. He wished to remind the shareholders that it was Mr. Peck who had brought the action, and it was he who had recovered for them about 2 ½ million dollars. The company itself did not bring the action. It stood out of it, and further, placed every possible obstruction in Mr. Peck’s way to prevent him from making the exposures which the evidence in the case undoubtedly proved. Under these circumstances he doubted very much, Mr. Peck being against that proposal, whether it was possible for the company to come to any compromise as proposed. The company were not plaintiffs. They did not apply to be made plaintiffs even after it had been shown that their late chairman had defrauded the company. Now two defendants who had been working together proposed a settlement, and he doubted very much if it could be carried into effect. That was the second time they had met to confound the machinations of The Persistent Mr. Peck and he called attention to the previous occasion. The previous occasion was when the shareholders were called to decide whether they would have the case tried in open court or referred privately to some referees. Mr. Peck did not appear before those referees, but the report of those referees had never yet been made public. They were entitled to draw any conclusions they liked. It was clear that that report had been kept back. Mr. Barr: At the wish of the referees themselves. Mr. Hopson Walker: I shall, at a later date, ask for the report. The Chairman: I have asked for it myself. Mr. Hopson Walker: The fact is that the report has not been disclosed. The Chairman: That is quite true. Mr. Walker: Mr. Joaquim tells me that the report has been open to shareholders. The Chairman: You shall have an opportunity of seeing it. Mr. Walker: I have been refused. Mr. Barr: I understand that there has been some legal difficulty. Mr. Walker: The fact remains that it has been kept back. Mr. Barr: By whom? Mr. Walker: By the late board of directors. Mr. Barr: Which late board? Mr. Walker: All the late boards. Now we have another board as subservient as the others. Mr. Barr: Subservient to whom? Certainly not to you. Mr. Walker: Oh no. Not to me. No one imagines that for a moment. Continuing, Mr. Hopson Walker asked what the compromise was which they had been asked to accept. Mr. Peck had explained it very fairly. He thought it was not commenting on a case which was “sub judice” to mention that the judgment of 2 ½ million dollars stood, and he did not think it was improper to mention that there was not the slightest prospect of any appeal reversing that. Mr. Russell had given his opinion on it by proposing that settlement in which he abandoned two million dollars. He did not think they could ask for better proof of what Mr. Russell himself thought, about his chances in appeal. Therefore the bogey of appeal had gone. Mr. Russell had proposed to give up his claim to appeal, but he wanted an indemnity from that company for anything which Mr. Peck might obtain by his cross-appeal. That again showed Mr. Russell’s opinion of the value of the cross-appeal. It showed that he was fairly certain that Mr. Peck would succeed, and he asked the company to indemnify him. Mr. Peck had given his opinion on that, and he (the speaker) endorsed that opinion. The threat of costs was another bogey. Another Bogey. The costs amounted to about 30 cents per share, which was less than any dividend which had been paid for a long time. If a further appeal was heard, the lawyers present would know, that no evidence had to be called. The calling of witnesses was one of the biggest and heaviest charges. Mr. Peck had pointed out that the company had to pay $45,000 as costs to Mr. Peck, for liabilities incurred by him on behalf of that company, but the company had not paid it. The last directors, in spite of an order of the court, and in spite of an expression of opinion by the shareholders, had neglected to pay it. Any excuse now put forward for neglecting to pay would be entirely specious. The reason for keeping it back was to prevent Mr. Peck from receiving the financial help necessary to carry on with his appeal. The chairman: What costs are you referring to? Is it as between solicitor and client as we say? Mr. Hopson Walker replied in the affirmative. Continuing, he said that he did not know whether the shareholders were even aware of the fact that Mr. Peck, even when he was fully successful in that case, stood to make not one cent of profit for himself. He knew it from the start. There was a possibility that the company might be grateful. But from what he saw the majority of shareholders were not grateful for the disclosure made regarding one of their friends. Mr. Russell would still control the voting with regards to any proposal to reimburse Mr. Peck, the man who made those disclosures. The way that that control would be used could only be guessed. Mr. Peck had only a very small interest in that company. Because he was a poor man some people seemed to think that he was a blackguard. The chairman: No, nobody said that. Continuing, Mr. Walker said that his financial position was even less strong than Mr. Peck’s. When Mr. Peck started that litigation he held more shares than the three which he had now. Who made him sell those shares? It was the company, by asking him to produce security for the company’s costs. The company got him to sell those shares and it was disgraceful that the statement should be thrown in his face that he owned only three shares. It was not possible for the company to compromise because it was a defendant in the case. With regard to proxies. Mr. Hopson Walker said that he had a few. There was, however, a big shareholder in London who had sent him a proxy to use at his discretion. That gentleman had been approached by cable on Mr. Russell’s behalf and he himself had received a cable from that gentleman asking him not to use the proxy against Mr. Russell. Methods had been adopted by the company to obtain votes which were not familiar to him. He was very doubtful as to whether the cable which he had received was authentic. He was however informed by Mr. Shearn that it was authentic. He was therefore not using that proxy one way or the other. He wished also to mention that he received the cable before the fact of the proposed compromise was made public in Kuala Lumpur. Chairman Replies. The chairman, replying to the points raised, referred first to the question of the referee’s report. He read a letter from a file which he had written in Oct. 1923, asking for that report. He was refused. He wrote again last year to the Board but it was again refused. There was probably a chance of Mr. Peck modifying his plaint if he had seen that report. He was doing everything possible to get that report to show it to Mr. Peck. In spite of those efforts Mr. Peck now got up and said that he was Mr. Russell’s nominee. He was in favour of that report being produced so that they would all see it. At present it might only be of historical interest, but he was now in a position to order its production and he would do so. But what he particularly objected to was being called Mr. Russell’s nominee, which was perhaps technically correct……….What actually happened was that when the late board of directors suddenly disappeared Mr. Russell was left alone and he could not carry on the work of the company without having even the minimum number of directors. In the position he was then in he approached the biggest shareholder of the company. He (the speaker) was the biggest individual shareholder and he was asked by Mr. Russell to become a director. Could anything be more proper? There was another big shareholder in Singapore who was a supporter of Mr. Peck, who was asked, but he declined. Mr. Russell and he had approached the most respectable supporters whom Mr. Peck had, or was ever likely, to have. Mr. Peck was very fond of picking up a few Latin tags, a habit of his friend Mr. Still, and then using phrases like ultra vires and intra vires. There was another phrase which he would use and that was infra dignitatem. He (the speaker) considered it infra dig to answer Mr. Peck in the language which he had thought fit to use. He cautioned Mr. Peck to limit himself to the truth. Mr. Peck had made the statement, and Mr. Still had published it, that when those directors disappeared it was ultra vires, invalid, void, and everything else. It was Mr. Peck’s opinion, and of Mr. Still, an equally great lawyer, that the resignation of those directors was ultra vires and that the four of them would remain directors willy nilly for a month or six weeks. That was the sort of truth and law which they got from Mr. Peck. Question of Costs. With regard to this question of costs there was not the slightest doubt that the costs of the action as recoverable from Mr. Russell had been paid. The account was a very large one. There was another part of the decree in which the judge said the company should reimburse to Peck what he paid to his solicitors. That was what the company had to pay. But Mr. Peck did not pay a cent to Mr. Braddell. They all knew that Mr. Peck had not paid a cent to Mr. Braddell. Braddell Brothers did not get a cent from Mr. Peck, not a word of gratitude and they had parted brass rags. They had to re-imburse Mr. Peck what he had disbursed, but he had not disbursed six pence to his solicitors. Here was on the one hand a man who had succeeded in a great industrial achievement. Mr. Barr, who had vast experience in the industry, would tell them what Mr. Russell’s achievement was like. Against him they had Mr. Peck who spent his time in the back room of an insignificant Singapore hotel hatching litigation, and more litigation, and he came there before them and talked about commercial morality. “This is the pride of Singapore, this fellow Peck, the pet of Mr. Still, the apostle of commercial morality,” continued the chairman. “These gentlemen seem to think that we do not know them.”

The Straits Times of 21 February 1925, Page 9, version of this exchange was:

“Referring to the order of the Court that Mr. Peck’s lawyers costs should be paid by the company, the chairman said: “We know perfectly well that Mr. Peck has not paid Braddell a cent. Not a word of gratitude or a cent of money has Braddell received. We know that Peck has not disbursed a sixpence, and they all took it (the case) up as a spec. We have got to reimburse Peck for money he never took out of his pocket” “Is Mr. Peck going to set up as a professor of commercial morality?”, the chairman continued. “ Do these gentlemen ( Mr. Peck and Mr. Braddell) really suppose that we do not know who they are and what they are? I look upon them both as belonging to the same camp, and following the same methods, and we don’t thank Singapore for sending up these examples of commercial morality. We have in Mr. Russell a gentleman who has built up a magnificent industrial achievement, and who has created a property of which anyone might be proud…Against that you have a fellow like Peck, who has never done a decent stroke of work in his life, who spends his time in a back room in Singapore Hotel trying to get up more litigation, and he comes up here and talks about commercial morality. This is the pride of Singapore and the pet of Still, who comes and lectures us on commercial morality.”

THE MALAY MAIL, SATURDAY, FEBRUARY 21ST, 1925 continued:

Mr. Hopson Walker: Will you bracket me with those remarks? The chairman: Yes. But you don’t say you are an authority on commercial morality. Mr. Hopson Walker: I fully endorsed what Mr. Peck said about commercial morality. The chairman: It is all right. Why shouldn’t you? I think your methods are to be regretted. Continuing, the chairman said that had Mr. Peck adopted a different tone from what he had adopted it might have been possible to come to some settlement. Mr. Hands: With regard to the referees’ report you said that it would be open to the inspection of Mr. Hopson Walker and Mr. Peck. Would it be available to us? I want to see it. The chairman: Yes. Mr. Peck: I notice the company’s solicitors are not present. I regard the agreement as illegal. How is it that the company’s solicitors are not here to give the benefit of their opinion to the shareholders? The chairman: Mr. Peck, you know all about the law. Mr. Peck: But all don’t accept it. With regard to the directors being nominees of Mr. Russell one point I omitted to make, Mr. Barr is an employee of the company. I do not want to say much about him. Mr. Ferrers and Mr. Cunningham both supported Mr. Russell in this litigation. The chairman: Hear, hear. Mr. Peck: That is the sort of chairman you have, ladies and gentlemen, who supported Mr. Russell in his litigation, and then puts forward this resolution as being in the interests of the company. They not only supported Mr. Russell but……… The chairman: From the beginning to the end. Mr. Peck: How can you then say that you are really thinking of the shareholders in proposing this compromise? Mr. Cunningham: As far as I am concerned, I did not vote against the granting of costs. Mr. Peck: You sent in your proxy but I admit it was not used. Mr. Cunningham: I am in the country now. Mr. Peck: I certainly hope you will not adopt the attitude of the chairman. Mr. Cunningham: I have never been against remuneration being given. Mr. Peck: I only say that you are Mr. Russell’s nominee. Mr. Barr said that in the discussion one point had been entirely lost sight of. The shareholders were given an opportunity now of finishing with the litigation. The company’s business was to produce coal and dividends for shareholders. The company had a perfect right to express its opinion as to how the money should be disbursed. He felt very strongly that in that matter the minority should be bound by the majority. That was a commonsense view to take. In commercial life compromise was the order of the day. He wished to refer to the innuendoes which Mr. Hopson Walker had thought fit to make. Mr Peck fought hard, but apparently he fought cleaner than some of his supporters. Mr. Huxtable deprecated the heat which had been shown in the discussion. He agreed with Mr. Barr that this litigation should be stopped. But he did not think that they realised that the great benefits which the company had derived had been the result of Mr. Peck’s action. The bigger the shareholders the greater their gratitude to Mr. Peck should be. The directors should have shown greater gratitude than had been shown to Mr. Peck. Mr. Peck: I hope it will be noted that I do not know this gentleman, and I have never spoken to him. I say this because a lot of nonsense is spoken about my supporters. Mr. Huxtable: I have not known Mr. Peck, and I had to ask one of those present here who Mr. Peck was. Mr. Cunningham said that he wished to associate himself with Mr. Huxtable’s remarks. The chairman said that he had always held the opinion that Mr. Russell was entitled to what he had made. That was why he had supported him Mr. Peck said that if Mr. Russell did the same thing again the chairman would allow him to keep the 2 ½ million dollars which Mr. Russell made and which belonged to the company. The chairman: certainly. Why not? If he is clever enough to make another 2 ½ million dollars. I have no doubt that when this matter is settled he will make another large fortune. Mr. Peck: Since you say that he is entitled to keep this money will you return to Mr. Russell your share of it? The chairman: No. Mr. Barr: I take it you will not abide by the wishes of the majority? Mr. Peck said that if it was admitted that the main judgment remained intact and undoubted, and if they cut down the amount which they proposed to give to Mr. Russell to $50,000 or $100,000, the matter would be very different. What he was prepared to do was if the present board made way for a board to be selected by him and his supporters who had obtained the judgment in the face of the opposition of the majority of the shareholders, he would be prepared to accept a compromise within limits. The chairman: If Mr. Russell withdraws his appeal it means that he accepts the judgement and leaves you in full possession of it. If Mr. Peck would give the names of the ? whom he wanted on the board they would be carefully considered. Mr. Huxtable asked whether Mr. Peck had been approached with regard to a compromise. Mr. Ferrers: He was strongly advised by Mr. Braddell to effect one. Mr. Peck: That is not true. Mr. Hopson Walker: That is what you have heard. Mr. Peck said that Mr. Russell approached him with a view to compromise with almost the identical terms which were now proposed. He rejected them and his supporters endorsed his action. The resolution was put to the vote and carried the poll resulting in 106, 017 votes being cast in favour of it and 11,179 votes against.

The Straits Times, 5 May 1925, Page 11 .

Malayan Collieries, Ltd. Directors' Report for the Past Year. The directors of Malayan Collieries, Ltd., in their eleventh annual report for the your ended December 31, 1924 states: - 0. Share Capital. — At the end of the previous financial year the issued capital of the company was 310,000 shares. By reason of the judgment of Mr. Justice Whitley in Civil Suit No. 613 of 1922 given in June, 1924, there were surrendered to the company and held in suspense by it 61,162 shares, balance 248,838 shares. 0. The two interim dividends paid in the year 1924 were declared on the total capital of 310,000 shares, the dividends upon the 61,162 shares held in suspense being carried to litigation suspense account. The balance of 248,838 shares shown above has now been increased by the issue of 8,667 shares (pursuant to the agreement dated February 6, 1925, between the company and Mr. J. A. Russell and J. A. Russell and Company) making at the date of this report an issued capital of 257,505 shares. The opinion of counsel in London experienced in company law is being obtained as to the proper manner of dealing with shares now at the disposal of the company. 0. Civil Suit No. 613 of 1922. - This judgment and decree have already been circulated and, shareholders are aware that as a result thereof 61,162 shares were surrendered to the company and cash amounting to $703,784.26, representing the sum of $21.50 in respect of 15,505 shares and dividends on 76,667 shares and interest thereon, was paid to the company. 0. Litigation Suspense Account. - After the judgment was delivered notice of appeal was entered and, in consequence, the 61,162 shares mentioned above were held in suspense and the cash amounting to $703,784.26, was carried to a suspense account. Shareholders have had full details given to them by circular of the agreement of February 6, 1925, come to between the company and Mr. J. A. Russell and Messrs. J. A. Russell and Co. As the result of the confirmation of that agreement, the suspense account has been closed and, in accordance with the advice of the company’s auditors, the balance standing to its credit appropriated between capital and revenue accounts. The shares will be dealt with in accordance with the legal advice which is being obtained from counsel in England. 0. Property. - The position remains the same as reported last year. 0. Kundang Sand Pits. - the company continued to win tin ore from this property, which ore to some extent has off-set the cost of sand-stowage. 0. Mines and Plant. - The general manager’s annual reports on these are subjoined. 0. Batu Arang. - Operations at this colliery functioned smoothly throughout the year, the only incident of note being a breakthrough of water from the artificially flooded south mine areas into the north mine, which break-through caused temporary stoppage of coal output from the lower levels of the latter mine. The property is in sound condition and well maintained: while the problem of underground fires, has been solved. The colliery is capable of a considerably increased output and met without any difficulty the enlarged demand experienced during the year. 0. Pamoekan Bay. - As foreshadowed at last year’s meeting, the adverse effects of the fatal riot which occurred on the mine unfortunately lasted until the end of the year under review. After a full trail the Javanese were found to be completely unsuitable for underground working by the bord-and–pillar system; but they could not be entirely replaced by Chinese in these workings and normal conditions regained until the end of the year. As a consequence of this disorganisation, outputs had not fully recovered to their pre-riot standard before the close of the accounting period. Bunker coal prices, moreover, dropped considerably as the year progressed. The trading loss upon the year’s working was therefore about the same as that incurred during the previous year, although it appears a higher figure in the company’s accounts owing to all general charges and items of non-recurrent special expenditure having been charged to revenue instead of capitalised to development account as heretofore. The only increase in development account has been the driving of the new main tunnel into the lower seam. Conditions are now improved and the mine is operating at a profit. 0. In order to minimise the possibility of future vitally serious labour difficulties, a trial is being made of a change of method of mining from the bord- and-pillar to the long wall system. Preparations are well advanced for the mining of the bottom seam where the coal is of better quality and the ground less faulted and disturbed than the upper seam. 0. Investments. - While the 61,162 shares continue to be held in suspense, it was not feasible to write down the figure at which the acquisition of the Mijnbouw en Handel Maatachappij Goenoeng Batoe Besar stands in the balance sheet. The question of now writing this sum down by the surrendered shares await the legal opinion from England. 0. Local Coal market. - An increased demand was experienced but at a reduced selling average. 0. Profit. - The profits for the year under review, subject to the director’s fees, and audit fees, amount to £1,002.434.13 to which is added the unappropriated balance from the previous account of $144,108.80 = $1.146,542.93. Two interim dividends of 5 per cent and 7 ½ per cent, respectively upon 310,000 shares were declared during the year, absorbing $387,500= $759,042,93. You will be asked to sanction fees to the directors in respect of 1924 $12,000. The auditors have requested owing to the increasing volume of work that their fee be increased to $3,000, leaving available $744,042,93, which your directors recommend should be dealt with as follows: - payment of final dividend of 17 ½ per cent (on 257,505 shares) $450,633.75, write off mine development account $110,149.74. Balance to carry forward next year’s account $183,259.44 (subject to an appropriation for staff bonus, to be left formerly to the discretion of the board.) 0. Secretary. - In June Messrs. J. A. Russell and Co. resigned their position as secretaries to the company and Mr. H. D. Brown was appointed by the Board to be secretary. 0. Managing Agents: - Messrs. J. A. Russell and Co. acted as managing agents of the company throughout the whole of the year under review. 0. Directors. - The changes in your directors were notified to you by the circular, dated February 10, 1925. Mr. J. A. Russell and Mr. H. N. Ferrers being the directors longest in office retire under the provisions of the articles of association and being eligible offer themselves for re-election. 0. Auditors. – Messrs. Evatt and Company retire, but being eligible offer themselves for re-election.

THE MALAY MAIL, SATURDAY, MAY 9TH, 1925.

MALAYAN COLLIERIES Future of Managing Agency. STRONG CRITICISMS BY MR. PECK Chairman on Company’s Prospects The eleventh annual general meeting of Malayan Collieries, Ltd., held yesterday at the registered office of the company in Kuala Lumpur, was presided over by Mr. H. N. Ferrers. The others present were:-Messrs. J. A. Russell and F. Cunningham (directors), H. Hopson Walker, E. D. Shearn, F. C. Peck, B.J.P. Joaquim, J. Hands, J. Bligh Orr, Yap Pow Ching, C. A. Matthews, I. Fearon, and H.D. Brown (secretary.) The notice convening the meeting was read by Mr. Brown. The chairman, in a few preliminary remarks, said that at the last meeting he told the shareholders how very greatly impressed he was with the work which was being carried out at Batu Arang, after a visit to the mine. Since then he had the opportunity of visiting their other mine at Pamoekan Bay, and he was very glad to say that they had there as fine a property, with as good prospects, as they had in the one they had close to their own doors. They all recognised to what extent the industries of this country had benefited by the Batu Arang mine. The railway was actually run on their coal. It was quite reasonable to hope that in the not distant future the coal products of Pamoekan Bay might be as well known in Singapore as those of the Batu Arang mine in the F.M.S. The report and accounts having been in your hands for the required period, I propose with your consent to take them as read. I do not know that I need say much about them because, remembering the various circulars which have been issued by the board since the last annual general meeting, I think that you will find them sufficiently full and clear. The financial result of the year’s trading cannot be considered as other than satisfactory, and is the largest in the company’s history. The gross revenue shows a healthy expansion of nearly half-a-million dollars. You will notice that the additions to railway sidings, buildings and plant and machinery are all more than counterbalanced by liberal allowances for depreciation, and that they stand at nearly $70,000 less than the figures brought forward from 1923. Wharf and harbour account, despite depreciation, shows a net increase, while stores are higher owing to the larger stock of spares which the company has considered it safer to carry. Development account, brought in at $375,000, has increased to $410,000, and is recommended to be written down to $300,000. You will perhaps have observed that we do not give the tonnage won and the tonnage sold. In view of the increased competition with which we are no meeting, we have not considered it advisable to publish these figures, and we do not see how their non-publication can possibly adversely affect the individual interests of shareholders as a whole. Should any large and bona fide investor in the company wish to know our outputs, the board is from time to time in its discretion prepared to let such shareholder have this information privately. Inevitable Incidents. You will see that during the year we had a mishap at Batu Arang in the shape of a flood. These incidents, while alarming at the time, are not permanently injurious if efficiently dealt with. Occurrences of this nature naturally cost the expenditure of time, labour and money to overcome, and during their continuance affect earnings; but in mining a certain number of such incidents are inevitable. They cause your board staff anxiety at the time, because unless they be so regarded there is the danger of their not being carefully and competently treated. Just at the moment, for instance, we are suffering from the effect of a cloud-burst at Pamoekan Bay. During the whole time that we have owned this property we have, if anything, suffered from a shortage of water; but this year there has been a succession of minor floods, culminating in a veritable cloud-burst. Coal production at the mine was not stopped for more than a brief period and was soon resumed; but it may be a few weeks yet before we are back to completely normal conditions. In the meantime Mr. Barr has left for the mine to expedite the recovery. Our “new” tunnel, from which it is intended to work the lower seam, should be producing before very long, and we shall then be placing upon the market a coal of a higher quality than that which we have hitherto sold, and so I am informed, superior to the best of the Manchurian and to most of the Japanese and Natal coals at present being offered in South-East Asia. COAL AND POWER SUPPLY Comparison with Hydro-Electric Scheme. There has recently been correspondence in the local press upon the subject of cheap power supply, particularly in Perak, in the course of which newspaper discussion two letters written to the “Financial Times” of London were reproduced. In one of these letters the author who claimed 30 years residence in this country, definitely stated that no coal existed here. In view of our Batu Arang property, with its visible reserves in the vicinity of 50 million tons, its output of nearly 400,000 tons per annum, its colony of European employees and of over 2000 workmen its contribution to the State Treasury, in royalties, rents and fees of over $100,000 per annum and its freight payments to the F. M. S. Government Railways of about half-a-million dollars annually, this statement is rather misleading. As to the generating costs of power in the F. M. S., which subject was the principal point of the correspondence, I am informed that plants in this country which have been equipped with due regard to economy in the utilisation of fuel, running on Batu Arang coal, show remarkably low figures. I am told that there is a certain power plant in Selangor of 1500 K. W. which, although running at less than half full load, is producing power with Batu Arang coal at an average over 12 months of under 1.4 cents per net unit delivered. This generating cost includes every charge except interest and depreciation. Of the total of 1.4 cents per unit, Batu Arang coal accounts for 1.064 cents, which in turn is made up of the following items: Cost of coal at pit head .822 of a cent, Government royalty .035 of a cent, railway freight .144 of a cent, and handling charges at power plant .063 of a cent. With a power plant of larger units, running at full load, still lower generating costs could be obtained. I furthermore understand that there is a power station in the Kinta valley with an older plant which is generating at costs very approximate to those which I have just mentioned. Cost per Unit. The managing agents tell me that as a general guide it can be taken that, with a suitable plant situated on the railway in any important mining centre in the F. M. S., and with an economically balanced load, power stations burning Batu Arang coal should not exceed in costs 1 ½ cents per net unit delivered to power station transformers. With interest on capital and depreciation calculated at 7 ½ per cent. and 5 per cent. respectively (calculated on plant costing £30 per K. W. and a 70 per cent. load factor), the all-in costs would be, say, 2 cents per unit at the generating station. It is difficult, they tell me, to arrive at the cost of transmission to convenient points for consumers to tap and of transformation at these centres, but if one or two central steam plants were erected this cost would be little more than half the cost of distribution from the point of generation of the proposed Perak hydro-electric scheme, and allowing for interest and depreciation as above, should not exceed half a cent or a total figure of 2 ½ cents per unit transmitted. As against the above figures, which may be taken as maxima, the proposed hydro-electric scheme, it is said, offers to supply power to the larger consumers at a minimum of 3 cents per unit. The figures of steam generating costs which I have quoted are attainable, I am told, in any well-designed and well-managed steam plant of medium capacity. A central steam power station can be started with comparatively speaking, small capital outlay, and gradually added to as the demand for current increases. This is an important point, for in this country numerous more or less efficient plants are already in existence, and it is unlikely that the change over to central-station power would be immediate; it would be gradual, and in many cases a change over would not be made at all. On the other hand, the proposed hydro-electric scheme would require an outlay of quite 75-80 per cent. of its ultimate capital before a unit could be produced for sale. In concluding this subject of cheap power, I would say that my information is that it has been proved in practice that three pounds of our Batu Arang coal is a conservative basis on which to base consumption per kilowatt hour in a well-equipped steam plant. On a rough average of European and American conditions, four tons of water would be required to develop the same power hydro-electrically. Under the conditions existing on the Perak river, however, it is possible that 25 tons of water would be required as a minimum, and this minimum would necessitate correspondingly bulky and costly plant. POSITION OF RUSSELL AND CO. Retention of “Executive Services.” At a meeting some little time ago I mentioned that it was proposed to retain the services of Messrs. J. A. Russell and Co. in a consultative capacity. It was later on endeavoured to formulate a scheme to give effect to this idea. It was, however, found that it was not possible to formulate a satisfactory working scheme on a consultative and non-executive basis, and in view of the difficulties, and having regard to the wishes of the majority, exceeding three-fourths of the shareholders present and entitled to vote at the meeting of the company held last October to consider the question of the employment of Messrs J. A. Russell and Co. as managing agents, it was decided that from the point of view of the company the best arrangement was the retention by it of Messrs. J. A. Russell and Co.’s executive services as managing agents. Subject to the provision that they were in no way to be debarred from conducting their own mining business, which both they and the old board had always previously thought that they were entitled to do, Messrs, J. A. Russell and Co. have consented to remain in the position which with the exception of a period of 16 days in January last, they have occupied from the inception of the company until now. I will now endeavour to answer to the best of my ability, and if I can properly do so, any questions bearing upon the report and accounts which shareholders present may care to put. Opposition from Mr. Peck. Mr. Peck: Mr. Chairman, you have already dealt with one statement that you made at the meeting on Feb. 20, “that the directors had come to the conclusion that they should retain the services of Messrs. J. A. Russell and Co., but only in a consultative capacity. They would not have any administrative power.” That statement, which was made to shareholders, we now find has been over-ruled by the board, and you have actually appointed Messrs. J. A. Russell and Co., and I understand from your speech, appointed them in such a way as will entitle and enable them to put through such a transaction as that which was the subject of litigation. I am strongly opposed to anything of the kind. In support of your attitude, you have stated that at the meeting in October three-fourths of the shareholders present at the meeting and entitled to vote supported the retention of the services of Mr. J. A. Russell and Co. as managing agents. I think that statement is not true. It appears to me that you have discovered that certain votes were admitted which were against the resolution which ought not to have been admitted. On the other side, I find that 8,000 votes which ought not to have been admitted were also admitted. You have discovered, the error on one side, but you have not discovered, or if you have, you have ignored, the error on the other side. Alleged Invalid Votes. There were at that meeting 8,000 votes recorded under proxies, filed by Mr. Cunningham, who held general proxies, or proxies were given in favour of Mr. Cunningham. Then Mr. Cunningham made further proxies appointing someone else—I think it was Mr. Watson. These votes were recorded by Mr. Watson, and I say those votes were invalid. Article 77 of the articles of association of the company, in respect of voting by proxy, says that votes may be cast either by being present or by proxy, and the instrument of appointing proxies shall be in writing in the hand of the appointer or the attorney. Mr. Cunningham was not the attorney in this case. I claim that those votes were invalid, and the actual result of that meeting was against Messrs. J. A. Russell and Co. holding this position of managing agents. Mr. Cunningham: How many shares did you say? Mr. Peck: 8,000 odd. I can give you the exact figure. The chairman: You must address the chair Mr. Peck. The Chairman’s Character. Mr. Peck: There is another statement which you made at the last meeting. You said: “My business is now to clear my own character of the serious aspersions which have been cast on it. As the head of a great industrial undertaking, it does not become my position to remain here until my character has been cleared…..It is a very serious matter to me, and while these charges which have been made against me exist I shall have nothing to do with the direction of the affairs of this company.” It appears to me that you have had quite a lot to do with the administration of the affairs of the company. You actually signed the report of the board which is before us, and you and Mr. Russell signed the accounts. That shows what reliance can be placed on your statements, and, in the circumstances, I am not prepared to place much reliance on these accounts. I know that they have been passed by the auditors. So were the accounts for 1920-1921. I do not say that they did not do their duty, but it was quite clear that there was a sum of something like two million dollars belonging to the company with which the company had not been credited. INSIDE “INFORMATION.” Unfair to Small Shareholders. With regard to the question of output, I am entirely opposed to non-publication. I have been entirely opposed to the directors of rubber companies hiding the costs of production, etc, and I am entirely opposed to any such policy in this company. The late directors began to give monthly returns of outputs. Now you have gone to the other extreme. You say that if any large investor wishes to know the output you will be prepared to let him have it. I am opposed to that. You have no right to give secret and inside information to anybody. You have no right to allow anyone to make use of such secret information. You yourself, Sir, made use of such inside information in connection with the compromise. You yourself bought something like 3000 shares before that compromise was disclosed to the shareholders. The share register shows that a large number of shares was registered in your name early in February. I am strongly opposed to anything of this kind whereby directors or anyone else could get such exclusive information. Information should be given to all shareholders. “A Disgrace to the Whole Company.” I should next like to refer to the position of the directors, the position of the administration of this company. In my opinion the state of affairs of the company is a disgrace to the whole country. You have Mr. Russell and three other directors. There is Mr. Russell, who has put through a transaction, and has been forced by the court to return to the company something like two million dollars, a transaction which Mr. Justice Whitley held was per se of a fraudulent character, and there is Mr. Ferrers, who said that Mr. Russell was entitled to keep the profits which he had made out of this transaction. It seems to me grossly improper that two such persons should control the affairs of this company. I do not think that the majority of shareholders are satisfied with that state of affairs. There are quite a number of other matters which I wish to refer to, but in view of the proceedings that will take place to-morrow I do not wish to go more fully into them. I have read the referees report which I think the directors should have printed and circulated. It is difficult for me to describe it in a short sentence. It is obvious, however, that the advice given by those referees has turned out to be thoroughly bad advice. I do not know whether they have surrendered the fees which they received. Not Opposed to a Compromise. There is one other point which I wish to mention, and that is my proposed action to recover for the company what has been handed over to Mr. Russell as a result of the meeting held on Feb. 20. In view of the proceedings that are now being taken, I shall take some time to consider that matter. I have suggested a compromise which has not been accepted. What I am particularly anxious to see is the principle established that a transaction of this nature is ultra vires. And in the case of any profits obtained by a minority against the opposition of a majority, the majority cannot give away a part of that profit. I am not anxious to take all or the equivalent of the $250,000 that Mr. Russell has received. I was always willing to make some compromise, provided the company are reasonable, to stop further litigation. I am quite as anxious as anyone to put an end to this litigation. The chairman said that if any shareholder would respond to his invitation to ask any question on the first item of the agenda, namely the consideration of the report and accounts, he would be glad to reply. If any shareholder had anything to say bearing upon the report and accounts, which was what they were considering, he wished them to speak. Mr. Peck: I contest your statement that only questions can be asked on the report. The shareholders can make any comments on the report. Mr. Hopson Walker supported Mr. Peck’s remarks. There being no other questions, the report and accounts were received. The chairman proposed that a final dividend of 17 ½ per cent. be declared. Mr. Russell seconded. —Carried. Mr. Joaquim drew attention to the fact that the report and accounts had not been put to the meeting. The chairman said that they had been received and considered. Directors’ Remuneration. The chairman proposed that $12,000 be voted to the directors in respect of 1924. He wished to mention the fact, which was perfectly obvious, that this resolution did not affect either himself or Mr. Cunningham. Those gentlemen who had joined the board since 1924 would not be affected by it. Those who would be affected were the directors who were on the board in 1924, and there were a considerable number who had acted as directors. —Messrs. Grant Mackie, Dugan Hampshire, Egmont Hake, Kam Chuan, Russell, Brash and Henggeler. As they knew, the policy pursued by some of these gentlemen had not met with the approval of some of them, but there was reason to suppose that during a period of considerable stress, and in circumstances of anxiety and difficulty, all these gentlemen endeavoured to do their best, and advised the company. Therefore it was proposed that the company should follow the precedent which had been set in the past and vote a sum of money to be divided among them. He therefore proposed that directors’ remuneration amounting to $12,000 be approved by the meeting. Mr. Shearn seconded. —Carried. Re-election of Directors. The chairman said that two directors retired, and as Mr. Russell had been the oldest director he proposed his re-election first. He had very great pleasure in doing so. Mr. Cunningham seconded. Mr. Hopson Walker proposed that this was one of the matters which might be stood over for another date, in view of the proceedings announced in the previous night’s paper. He therefore proposed, as an amendment, that the election of Mr. Russell be postponed “sine die,” or until the completion of the proceedings which had been started. The chairman said that he could not admit any amendment. After reconsideration, the chairman said that Mr. Hopson Walker’s proposal did not appear to him to be an amendment but a direct negative. Anyway, he asked Mr. Walker to repeat his amendment, which Mr. Walker did. Mr. Peck seconded, but said that he wanted the amendment worded thus: That the election of a director in place of Mr. Russell, who retires, be postponed until the termination of the proceedings notified in the newspaper last night. This being put to the meeting, was declared lost, four voting for and five against. The substantive motion was then put to the meeting and declared carried by 5 to 4. Mr. Shearn demanded a poll which resulted in 55,411 votes being cast in favour of the resolution and 1,263 against. Neither Mr. Russell’s own votes nor his proxies for 77,203 shares were used in the polling. Mr. Russell was thus re-elected a director. Mr. Ferrer’s re-election was proposed by Mr. Russell and seconded by Mr. Cunningham. Mr. Hopson Walker asked whether Mr. Ferrers was quite sure that he would stay here and serve. Mr. Ferrers said that although he might not permanently settle down in Malaya he would certainly serve. Mr. Ferrers was re-elected a director, the only dissentients being Mr. Peck and Mr. Yap Pow Ching. Messrs. Evatt and Co. were re-appointed auditors. REMUNERATION TO MR. PECK Mr. Ferrers blames the reporters. The chairman said that concluded the business of the meeting, but Mr. Cunningham wished to say something, and he asked the indulgence of the shareholders. Mr. Cunningham said that after the last meeting he received a letter from a shareholder relating to Mr. Peck’s remuneration, and saying that he would be glad to subscribe. He (the speaker) went round to several other shareholders, some of whom were in favour of a “private” subscription, but others were not. He then wrote to Mr. Hopson Walker, saying that he would be very glad personally to subscribe. He wondered whether they should call a meeting to discuss the matter. The chairman said that he had done everything he could in the matter. At the last meeting he stated that it was his intention to leave the State, and the object of that was that so long as he was in the State he could not divest himself of the affairs of the company. He thought that was plain enough, and if the reporters took down something else it was not his fault. When he crossed the borders of the F.M.S. he would be enabled to put some other gentleman, preferably one who might be a supporter of Mr. Peck, on the board, who could deal with this affair. Mr. Peck did not endeavour to do that, and if what he (the speaker) had intended had been successful Mr. Peck would have at least had Mr. Cunningham, who was in his favour, and the other gentleman, in whose favour he was prepared to divest himself. Therefore, it seemed to him that Mr. Peck had as good a chance as possible. That opportunity had passed, and it was useless for him to be dodging about all round the coast of the F. M. S. if his object of leaving the F. M. S. was not realised. Now that the matter had been raised in the form of correspondence between Mr. Hopson Walker and Mr. Cunningham, he would be glad to hear if any other shareholders had anything more to say about the matter. Proposed Circular to Shareholders. Mr Hopson Walker said that he proposed circularising the shareholders asking them what they were prepared to do, supposing the matter was placed before a meeting. His correspondence with Mr. Cunningham was to find out, as he was a director, whether such a meeting could be arranged. He was preparing a circular to the shareholders, and he would ask the directors to bring the matter up before a special general meeting, and give the shareholders plenty of time to reply. The chairman said that to call such a meeting he would want the consent of shareholders representing one-tenth of the capital of the company. As far as Mr. Russell and the other members of the board were concerned, they were willing to help them to call such a meeting, and they would give the fullest facilities to the shareholders. They could have the meeting whenever they wanted to. This concluded the business.

Malayan Collieries Report, Accounts, Extraordinary Meeting and A.G.M. 1925

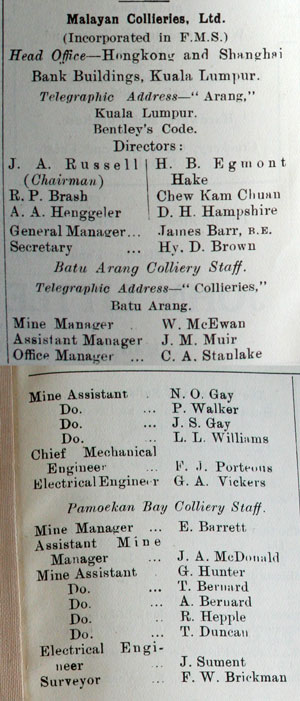

Malayan Collieries, Ltd.

(Incorporated in F. M. S.)

Head Office-Hongkong and Shanghai Bank Buildings, Kuala Lumpur

Telegraphic Address-"Arang" Kuala Lumpur

Bentley’s Code

Directors:

J. A. Russell H. B. Egmont Hake

(Chairman) Chew Kam Chuan

R. P. Brash D. H. Hampshire

A. A. Henggeler

General Manager James Barr, B. E.

Secretary Hy. D. Brown

Batu Arang Colliery Staff

Telegraphic Address—“Collieries” Batu Arang

Mine Manager W. McEwan

Assistant Manager J. M. Muir

Office Manager C. A. Stanlake

Mine assistant N. O. Gay

Do. P. Walker

Do. J. S. Gay

Do. L. L. Williams

Chief Mechanical F. J. Porteous

Engineer

Electrical Engineer G. E. Vickers

Pamoekan Bay Colliery Staff

Mine Manager E. Barrett

Assistant Mine

Manager J. A. McDonald

Mine Assistant G. Hunter

Do. T. Bernard

Do. A. Bernard

Do. R. Hepple

Do. T. Duncan

Electrical Engineer J. Sument

Surveyor F. W. Brickman