For the descendents of Richard Dearie and his son John Russell

The Straits Times, 7 April 1926, Page 8

The Malayan Collieries report was issued on March 31, and shows a profit of $1,021 255, being an increase of approximately $20,000. The directors recommend a final dividend of 12% per cent, making 32% per cent, for the year, an improvement of 2% per cent, on the previous year. General reserve is increased by $65,000 odd, bringing it up to $1,100,000.

Malay Mail Saturday April 10, 1926 page 9 and 16

MALAYAN COLLIERIES Final dividend of 12 ½% Per Cent. AN OPTIMISTIC OUTLOOK. The twelfth annual general meeting of Malayan Collieries, Ltd., was held yesterday at the Hongkong and Shanghai Bank Buildings, Kuala Lumpur. Mr. H. N. Ferrers, the chairman of the company presided, and the others present were; - Messrs. R.C. Russell, James Barr, F. Cunningham, W.H. Martin (directors), P. K. Paul, Yap Pow Ching, H. C. Joass, B.J. Joaquim, C. J. Chisholm, H. Hopson Walker and H.D. Brown (secretary) The secretary having read the notice convening the meeting, and the minutes of the last annual meeting being taken as read and confirmed the chairman addressed the meeting.

(Rest as Straits Times, 12 April see below except:” The directors and the General Manager’s reports for 1925 will appear later”. Note: These have not yet been found and transcribed.)

The Straits Times, 12 April 1926, Page 10 Malayan Collieries. Another Revenue Record 32 and half PerCent, in Dividends. (From Our Own Correspondent.) Kuala Lumpur, April 9. The annual meeting of Malayan Collieries, Ltd., was held in the company's offices, Hong Kong and Shanghai Bank Building, at noon, to day. The chairman, Mr. H. N. Ferrers, presided. The Chairman addressed the meeting as follows: - He said: Gentlemen, the report and accounts have been in your hands for the required period and I propose, with your consent, that they be taken as read. I do not know that they need much by way of explanation: - They are drawn up in the same form as in the past few years and those of you who are sufficiently interested will, no doubt, have already compared this years figures with those of last year and noted the satisfactory expansion of our trade and the growing strength of our financial position. Financial Result. The financial result of the year’s trading is again the largest on record and the gross revenue shows the substantial expansion of $373,789. Considerable additions have been made to railway sidings, buildings and plant and machinery during the year, but the liberal depreciation provided more than counterbalances the additions, the net result being that these items, though substantially added to, stand in the balance sheet at some $15.000 less than the figure brought in from the previous year. Additions, less depreciation of wharf, result in this asset standing at around $100,000. This completes the construction work and the wharf, with its mechanical loading appliances is capable of handling 2,000 tons daily, which will meet our requirements for some time to come. One of our sea going steam launches showed defects of the hull and had to be thoroughly reconditioned at the cost as shown. These launches have to weather severe seasonal conditions each year and there must be no doubt about their sea worthiness. Both of them are now in thoroughly sea going condition and are covered by the underwriters of Lloyd’s for marine insurance. They earn a substantial contribution to their running expenses by carrying local passengers. Stores, coal stock and sundry debtors, are all normal and compatible with the exigencies of our trade expansion. The sundry debtors reserve of $75,000 is ample provision to meet all contingencies. The expenditure on development account is confined to the cost of extensive underground development, in driving the new tunnel referred to in my speech of last year, in opening out the workings generally to cope in an economical manner with the greater outputs expected, and to win the superior coal of the bottom seam. It is recommended that this item be written down to a round $275,000. Litigation Suspense Account. The closing of the litigation suspense account and the consequent effect on the share capital account and investment account is clearly shown by the accounts and needs no further comment from me except that the unappropriated balance of $34,522.59 has been added to our general reserve. This course was decided on in preference to carrying the item into profit so as not to disturb the normal and real trading profits of the company. An appropriation to general reserve from profits, you will notice, is recommended of $65,477.41, the two items together making an addition to general reserve of a round $100,000. In last year’s speech I referred to the effect of the cloud-burst at Pamoekan Bay and its possible effects on production. The normal production was interfered with to the extent that it was decided to sub charter our large collier for two short trips from Saigon to Hong Kong to enable coal stocks to accumulate to normal levels at the mine. Unfortunately on the second of these two trips she was caught in the Hong Kong shipping strike, or more correctly political agitation and boycott, and delayed there for nearly a month. The question of her demurrage while at Hong Kong has yet to be settled by arbitration, the possible result of which has been fully provided for in the accounts. Misfortune at Pamoekan. Our next misfortune at Pamoekan Bay was an underground fire which occurred just a day or two before the close of the year. This matter has been dealt with in the general manager’s report and, I am pleased to be able to tell you, not withstanding the disorganisation that must ensue from such an occurrence, situated as the trouble was adjacent to the main underground transport road, that production was resumed within a fortnight and steadily improved till normal production was reached within a few weeks. Incidents such as the two just mentioned must be regarded as the normal risks of mining and trading but our share of them does seem to have been abnormal. We seem, however to profit in a way by these incidents. Steps are taken to prevent and cope with a recurrence of such troubles and the same type of trouble has not so far repeated itself or rather perhaps the experience we gain has prevented a repetition. Perak Hydro-electric Scheme. The Perak hydro-electric scheme has now taken definite shape. The local Government has granted a concession to Sir. W. G. Armstrong Whitworth and Company Limited, for the supply and distribution of electric energy in the State of Perak, but the said concession is not a monopoly. We, as well as other suppliers of power, are not shut out from Perak, and this being so we are optimistic enough to believe that even if the hydro-electric scheme becomes an accomplished fact it will have little effect on the prosperity of this company. The general trade position at the moment appears to be particularly healthy. As a result of this satisfactory condition of trade throughout the peninsula the railways are called upon to haul more goods and this means that more coal is required. In addition the growing inaccessibility of firewood and its accompanying higher price are causing many power users to turn to us for coal. With the help of the railways we hope to be able to give supplies to all who ask for them and while on this subject I should like to express the company’s appreciation of the efforts which the F.M.S. Railway officials have made to deal promptly and satisfactorily with largely increased traffic. No questions being asked, the formal business of the meeting was proceeded with. A final dividend of 12 and half percent was passed, making a total distribution of 32 and half percent for the year. Messrs. James Barr and F. Cunningham, the retiring directors were re-elected as were also Messrs. Evatt and Co., the auditors. A sum of $12,000, as in previous years was voted as directors’ fees for 1925. The meeting concluded with a vote of thanks to the chair.

Malayan Collieries A.G.M. 1926 (Reports and accounts printed in Malay Mail but not yet found.)

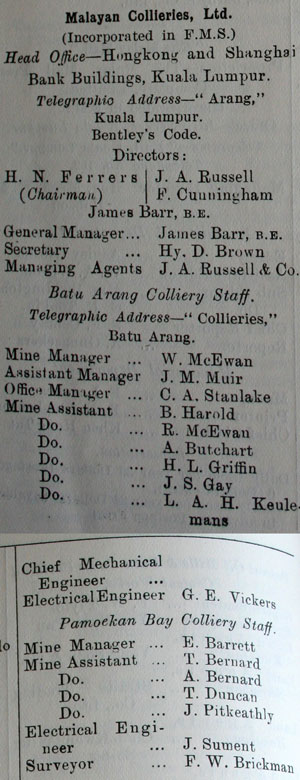

Malayan Collieries, Ltd.

(Incorporated in F. M. S.)

Head Office-Hongkong and Shanghai

Bank Buildings, Kuala Lumpur

Telegraphic Address-"Arang"

Kuala Lumpur

Bentley’s Code

Directors:

H. N. Ferrers J. A. Russell

(Chairman) F. Cunningham

James Barr, B. E

General Manager James Barr, B. E

Secretary Hy. D. Brown

Managing Agents J. A. Russell & Co

Batu Arang Colliery Staff

Telegraphic Address—“Collieries” Batu Arang

Mine Manager W. McEwan

Assistant Manager J. M. Muir

Office Manager C. A. Stanlake

Mine assistant B. Harold

Do. R. McEwan

Do. A. Butchart

Co. H. L. Griffin

Do. J. S. Gay

Do. L. A. H. Keulemans

Chief Mechanical

Engineer

Electrical Engineer G. E. Vickers

Pamoekan Bay Colliery Staff

Mine Manager E. Barrett

Mine Assistant T. Bernard

Do. A. Bernard

Do. T. Duncan

Do. J. Pitkeathly

Electrical Engineer J. Sument

Surveyor F. W. Brickman