For the descendents of Richard Dearie and his son John Russell

Malayan Collieries Report Accounts and A.G.M. 1933

Malayan Collieries, Ltd.

(INCORPORATED IN F.M.S.)

DIRECTORS' REPORT

AND

ACCOUNTS

For the Year Ended 31st December, 1932.

TO BE PRESENTED AT THE

NINETEENTH ANNUAL GENERAL MEETING OF

SHAREHOLDERS

TO BE HELD AT THE

Registered Office of the Company,

Hongkong & Shanghai Bank Buildings, Kuala Lumpur,

ON

Wednesday the 29th March, 1933, At Noon.

J. A. RUSSELL & COMPANY,

General Managers & Secretaries,

The Chest of Distinction

Malayan Collieries, Ltd.

(Incorporated in Federated Malay States.)

Directors,

JOHN ARCHIBALD RUSSELL, Esq. (Chairman.)

HUBERT HARRY ROBBINS, Esq. (Deputy Chairman.) FREDERICK CUNNINGHAM, Esq.

WILLIAM HENRY MARTIN, Esq.

ALBERT JAMES KELMAN, Esq.

General Managers and Secretaries..

J. A. RUSSELL & Co., Kuala Lumpur.

Consulting Electrical Engineers.

SPARKS and PARTNERS, London.

Registered offices

HONGKONG & SHANGHAI BANK BUILDINGS, KUALA LUMPUR.

NOTICE IS HEREBY GIVEN That the Nineteenth Annual General MEETING of the Members of the Company will be held at the Registered Office of the Company, Hongkong and Shanghai Bank Buildings, Kuala Lumpur, on Wednesday, 29th March, 1933, at Noon, for the following purposes: —

To receive and consider the Balance Sheet and Accounts to 31st December, 1932 and the Reports of the Directors and Auditors.

To Declare a Final Dividend for the year 1932.

To Declare Directors' remuneration for the year 1932.

To Elect Directors in place of those retiring.

To Elect Auditors for the ensuing year.

The Share Registers will be closed from Thursday, 23rd March, 1933 to Thursday, 30th March, 1933, both days inclusive.

By Order of the Board,

J. A. RUSSELL & Co.,

Secretaries.

Dated 8th March, 1933,

Hongkong & Shanghai Bank Buildings,

Kuala Lumpur, F.M.S.

Malayan Collieries, Ltd.

(Incorporated in Federated Malay States.)

Directors' Report for the Nineteenth Year of the Company ended 31st December, 1932.

The Directors have pleasure in submitting their Nineteenth Annual Report and Statement of Accounts for the year ended 31st December, 1932.

As is customary, the working of the Company's undertakings is reviewed by the General Managers in their report which is appended.

Batu Arang Colliery. The continued depression in trade, combined with certain special circumstances entirely beyond the control of your Board, is reflected in the production figures, the actual sales being only 67.93% of those of the previous year.

The year was an extremely difficult one, calling for the closest co-ordination of all factors to ensure the winning of any material profit. The current year is likely to be one of still lower demand for our product, but everything possible is being done in an endeavour to ensure that the earnings will not shew a corresponding decrease.

In the meantime, all plant is not only being maintained in an excellent state, but is actually being reorganised by additions and improvements against the day when it will once again be called upon to produce tonnages more in keeping with its capacity.

Pamoekan Bay Colliery. This property continued in charge of a caretaker and there is still no indication of the time when it may pay to resume operations.

General. The capital expenditure during the year was of a general nature and included the purchase of a considerable quantity of railway materials, timber getting and milling equipment, all of which were purchased upon favourable terms.

The subsidiary undertakings of the Company suffered in keeping with all industry, but being operated in conjunction with the Company's general organisation, achieved much better results than undoubtedly would have been the case had they operated as entirely independent enterprises.

An application was lodged with Government for a timber area within working distance by rail of Batu Arang and there is every hope that this will be granted. The timber requirements of the Company are steadily increasing, and as a secondary consideration, it is proposed to respond to the insistent demand of Empire markets for timber of Empire origin, by supplying some of the Malayan timbers which have been favourably reported upon, but which have not hitherto been available in a suitably manufactured form, or with any assurance of continuity of supply.

A wood distillation plant, which was installed new sometime ago in Pahang by a company now defunct, was acquired at only a fraction of its original cost, and it is hoped during the current year to prove that wood distillation, though not hitherto successful in Malaya as a separate entity, may be made a technical and financial success when developed and operated as a department of an existing undertaking for the utilisation of an at present waste product.

Government for an unexplained reason did not grant our application for a lease over an area of clay-bearing ground near Bidor.

Investigations into all phases of the manufacture of cement, and its transportation and marketing have been completed. As such matters as Royalties, Excise Duties, Leases and Way Leaves are involved, our complete proposals have been placed before Government and we hope for decisions at an early date.

Investments. Advantage was taken of the high prices for gilt-edged securities ruling during the latter part of the year, to realise upon £31,000/-of 4% Funding Loan 1960/90. The profit on realisation amounted to $59,375.78 which amount has not been incorporated with the trading profit, but has been allocated as to $35,000 to Bad Debts Reserve and as to the balance of $24,375.78 to the adjustment of the remaining investments.

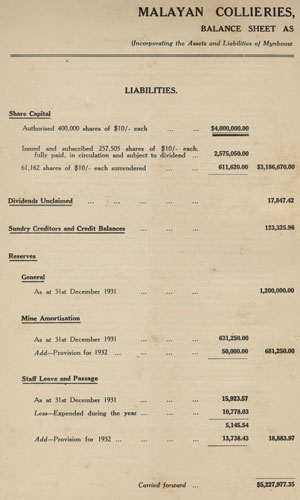

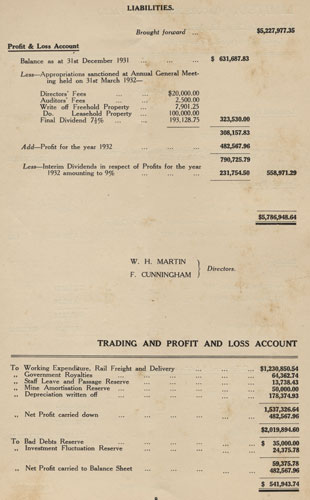

Profits. The profits for the year under

review, subject to the Directors' and Auditors’ fees amount to ... ... $482,567.96

To which is to be added the unappropriated

balance from the previous year of ... 308,157.83

$790,725.79

Three Interim Dividends each of 3% totalling

9% on 257,505 shares were declared during the year absorbing ... ... ... 231,754.50

$558,971.29

You will be asked to sanction fees to Directors

in respect of 1932 at the rate of $20,000.00

Auditors' fees at the rate of ... ... ... 2,500.00

and Donations to the Malayan Unemployment

Committees ... ... ... 500.00 23,000.00

Leaving available $535,971.29

Which your Directors recommend should be dealt with as follows:—

Final dividend of 6% making 15% for

the year ... ... ... $154,503.00

Write off Leasehold property 100,000.00 254,503.00

Balance to carry forward to next year's account $281,468.29

Directors. Mr. J. A. Russell being the Director longest in office, retires under the provisions of the Articles of Association, and being eligible, offers himself for re-election.

Auditors. Messrs. Evatt & Co. retire and being eligible, offer themselves for re-election.

By Order of the Board, J. A. RUSSELL & CO.,

Secretaries.

Kuala Lumpur,

8th March, 1933.

Malayan Collieries, Limited

The Directors,

MALAYAN COLLIERIES, LTD.,

Kuala Lumpur.

Gentlemen,

We have pleasure in submitting herewith our report upon the working of the Company's undertakings during the year ended 31st December, 1932.

BATU ARANG COLLIERY. The sales of coal were down almost 33% on the previous year.

The demand was rather less erratic than during 1931, and though the monthly figures shew considerable variation owing to the incidence of tin restriction, the quarterly averages have more or less kept step with releases under the Tin Restriction Legislation.

It has been our endeavour to retain all possible labour on the property, and wherever practicable in the actual winning of coal, labour has been given preference over machines. All machinery so displaced has been kept standing by for use in case of emergency. Our costs were a little increased by this policy, but it was agreed that this was fully justified, as any loss of experienced colliery labour, as a result of our inability to keep it employed at this time, might well result in its permanent loss, much to the detriment of the country and ourselves when conditions improve.

All plant was maintained at a high standard of efficiency and a number of additions and improvements in plant, layout and practice were carried out.

There was a considerable slowing down of capital work which called for any outlay other than on labour, the principal individual item completed on colliery account being the washery, which installation was put to commercial production just before the close of the year.

Underground Production. Owing to the lack of demand, the North Mine was taken off production early in the year, and it was closed entirely just at the end of the year.

The East Mine continued on production throughout the year. A fire occurred in the No. 17 Level Rise District, and to cope with this in the most effective manner, the district was temporarily sealed off. As all requirements can be obtained from other districts of the mine, it is not proposed to re-open the No. 17 Level Rise District until demand justifies it, and this will, in the meantime, result in a considerable amount being saved in maintenance, while the district will be perfectly safe against further fires.

Underground Development. The area of coal opened out being more than sufficient for present or early future requirements, no further extensions were made. The main dip section was, however, brought to the production stage by the completion of all preparations for the extension of the main haulage to the 34 Level, and the complete development and equipment of two new longwall districts, each having an independent ventilating system and capable of producing 10,000 tons per month.

With the employment for hydraulic stowage of a lower grade material containing a considerable percentage of slimes, the pumping arrangements in the mine called for revision. After considerable investigation and trial, series pumping and settling in Nos. 34, 26 and 18 Levels were adopted. This, with the secondary stowage of the settled slime product, has proved satisfactory and indications are that, even with full production, the water as delivered to the high lift pumps will be sufficiently clear of suspended solids to be pumped to the surface system without undue wear upon the pumps.

In this matter of pumping and in all other respects, the hydraulic stowage system functioned satisfactorily with the material available, the bulk of which was won in the course of coal or clay stripping, railway cuttings and other excavation work about the property.

Opencasts. Shale stripping proceeded throughout, but ceased with the close of the year. Reserves of stripped coal are such that it is not expected that stripping need be resumed for at least two years.

Buildings and Plant. Maintenance throughout was of a satisfactory nature.

Two Tamil Coolie Lines, each of 20 rooms and complete with water-borne sewage arrangements, were completed, while four blocks of clerks quarters were commenced. The heavy machinery store was extended, and a new coal testing laboratory was erected at the washery.

The power plant operated satisfactorily at a capacity in keeping with the demand.

Water Supply. The major works in connection with this having been completed in the previous year, work was confined to the extension of the supply and this work is still in progress.

PAMOEKAN BAY COLLIERY. This property continued in charge of a caretaker, and prospects are still against any serious thought of a resumption of operations.

SUBSIDIARY UNDERTAKINGS. Clay Workings. Production amounted to 6,006,400 bricks, while the quantity sold or utilised on the property was 2,971,400. The stocks as at the end of the year being 4,772,500 bricks, it was decided to shut down the continuous kiln and to continue the production of fire-bricks, facing bricks and special shapes in the intermittent kiln.

Progress made with trials and experiments in the manufacture of Roofing Tiles was such as to justify a decision to proceed with the installation of plant for small scale commercial production.

Plywood. The production reached the full capacity of the initial plant. Sales were for the most part in the form of rubber chests, but enquiry and demand for our product for other purposes were encouraging. To cope with the potential demand which the reception of our product has led us to expect, arrangements are now in hand for the doubling of the output.

Agriculture. Work in this connection has been confined to the maintenance of the area under experimental crops. The results obtained from the pineapple area are entirely unpromising and we have arrived at the definite conclusion that our soil is unsuitable for this crop.

Cement Manufacture. All investigations were completed and the results summarised to facilitate decisions in due course.

Timber. Considerable work was done in connection with the timber requirements of the various departments and applications were made for an area calculated to serve our general requirements for a number of years.

Wood Distillation. The plant of the liquidated Malayan Wood Distillation Ltd., was acquired during the year and re-erection at Batu Arang is well advanced. It is proposed to operate this plant upon the waste cores and slabs from the plywood works and the proposed enlarged sawmill.

GENERAL. The resident population at Batu Arang shewed some reduction as compared with the previous year but the number of families remained about the same.

The general health remained exceedingly good.

During the early part of the year we had the pleasure of shewing round the property H.E. The High Commissioner Sir Cecil Clementi accompanied by the Hon. Mr. A. C. Caldecott, Chief Secretary, F.M.S. and party, H.H. The Sultan of Selangor and staff, and the Hon. Mr. T. S. Adams, British Resident, Selangor.

We are, Gentlemen, Yours faithfully,

J. A. RUSSELL & Co.,

General Managers.

Kuala Lumpur,

6th March, 1933.

Malayan Collieries, Ltd.

(INCORPORATED IN F.M.S.)

19

DIRECTORS' REPORT

AND

ACCOUNTS

For the Year Ended 31st December, 1932.

TO BE PRESENTED AT THE

NINETEENTH ANNUAL GENERAL MEETING OF

SHAREHOLDERS

TO BE HELD AT THE

Registered Office of the Company,

Hongkong & Shanghai Bank Buildings, Kuala Lumpur,

ON

Wednesday the 29th March, 1933, At Noon.

J. A. RUSSELL & COMPANY,

General Managers & Secretaries.

Malayan Collieries, Ltd.

(INCORPORATED IN F.M.S.)

PROCEEDINGS

AT THE

NINETEENTH ANNUAL GENERAL MEETING OF

SHAREHOLDERS

HELD AT THE

Registered Office of the Company, Hongkong & Shanghai Bank Buildings, Kuala Lumpur,

ON

Wednesday the 29th March, 1933,

At Noon.

Malayan Collieries, Ltd.

(INCORPORATED IN F.M.S.)

PROCEEDINGS

AT THE

NINETEENTH ANNUAL GENERAL MEETING OF

SHAREHOLDERS

HELD AT THE

Registered Office of the Company, Hongkong & Shanghai Bank Buildings, Kuala Lumpur,

ON

Wednesday the 29th March, 1933,

At Noon.

Malayan Collieries, Limited.

(Incorporated in Federated Malay States.)

Hongkong & Shanghai Bank Buildings, Kuala Lumpur, F.M.S.

The Shareholders,

MALAYAN COLLIERIES, LTD.

Dear Sir, or Madam,

We have pleasure in reporting to you the proceedings at the Nineteenth Annual General Meeting of the Shareholders of the Company which was held at the Registered Office, on Wednesday, 29th March, 1933.

Yours faithfully,

J. A. RUSSELL & CO.,

Secretaries.

Dated 29th March, 1933.

Malayan Collieries Limited.

(Incorporated in Federated Malay States)

Proceedings of the Nineteenth Annual General Meeting

The Nineteenth Annual General Meeting of Malayan Collieries Ltd., was held at the Hongkong & Shanghai Bank Buildings, Kuala Lumpur, at noon on Wednesday the 29th March, 1933.

The Deputy Chairman, Mr. H. H. Robbins presided and the others present were: —Messrs. W. H. Martin, F. Cunningham (Directors) and P. W. Gleeson, John Hands, C. W. S. Gardner, Seymour Williams, Colin J. Chisholm, E. D. Butler and A. Arbuthnott (Shareholders).

The representative of the Secretaries having read the notice convening the Meeting and the Auditors' Report, the Deputy Chairman, before moving the adoption of the Balance Sheet and Accounts to 31st December, 1932 and the Reports of the Directors and Auditors, addressed the Meeting as follows: —

Gentlemen,

The Report and Accounts having been in your hands for the prescribed period, I will assume it is your wish that they be taken as read.

It is with deep regret that I have to announce the inability of your Chairman, Mr. J. A. Russell, to be present, due to a serious illness. I am sure you will join with me in wishing him a speedy recovery and with your permission I will read to you the address which Mr. Russell, up to a day or so ago, hoped to have the pleasure of delivering in person.

The year through which we have just passed has been a gruelling one for most of us, and it will not come as a surprise to you that a further restriction of trading figures and profits falls to be recorded. I, therefore, trust that the figures presented are not regarded as unduly disappointing.

The Pamoekan Bay Colliery still remains shut down and I am afraid that it will be some considerable time after the return of prosperity, before the Eastern bunker market will sufficiently improve to justify the re-opening of this mine.

The sales of Malayan coal ex our Batu Arang Colliery shewed a further material falling off as compared with the previous year. As an indication of the shrinkage in our sales, I might say that those of 1932 were less by 120,075 tons than those of 1931, and 239,155 tons less than the average for the five years 1927/31. The present production is less than one third of that for which the colliery is equipped to produce. With such indications, it will not be difficult to visualise the problems with which your Board, and the management of your Company have been confronted.

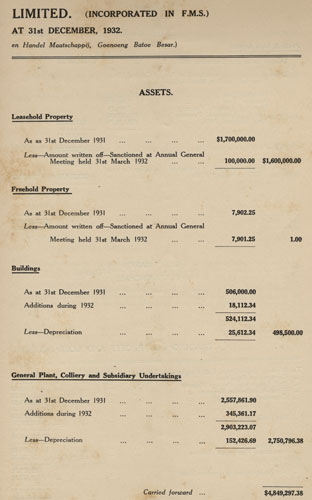

The Accounts before you are set out in the usual manner. The expenditure on capital account, though less than during the previous year, was somewhat higher than was intimated by me when last addressing you. This is due to the presentation of a favourable opportunity to purchase a quantity of logging and sawmill equipment, to which matter I propose referring later. The balance of expenditure on capital account on plant of other than a general colliery nature, was upon the purchase of a complete wood distillation plant which was some time ago installed in the State of Pahang, and which was operated for a matter of a few months only. To this item also I will refer later.

The amount allocated to depreciation is $178,000, which amount, especially having regard to the limited wear and tear on the plant, may be regarded as a fair one.

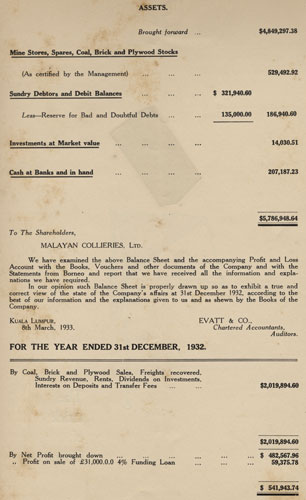

The item "Mine Stores, Spares, Coal, Brick and Plywood Stocks" is higher than that in respect of the previous year, owing principally to heavier coal and brick stocks, and to the purchase of a quantity of railway materials. This figure of $529,492.92 is made up as to $408,697.04 for mine stores and spares, $25,108.20 for railway materials in stock and $95,687.68 for coal, brick and plywood stocks.

"Sundry Debtors and Debit Balances" is down on the previous year by $120,569.16, this of course being due to the reduced turnover. It will be seen that, with the addition for the year, the Bad Debts Reserve now stands at $135,000. "Sundry Creditors and Credit Balances" is also down by $78,983.19, again due to the smaller volume of business.

"Unclaimed Dividend." This item is somewhat higher, due to the payment of the December 1932 dividend rather later in the month than was the case in respect of the corresponding dividend for the previous year.

"Staff Leave and Passage" is slightly increased, but calls for no special comment.

"Investments." With the appreciation in value of gilt-edged securities, the £31,000/- in 4% Funding Loan 1960/90 was returning us only 3.7% on the market prices for the stock, and as it seemed to your Board that prices were likely to deteriorate, and in view of the extremely uncertain outlook, it was decided to sell. The peak prices were not obtained, but the realisation has returned us a profit on cost of some $59,375.78.

Though it is not proposed immediately to utilise the balance of the proceeds of the sale of these investments, it may, a little later on, be considered advisable to do so in the installation of plant, the operation of which would tend to broaden the basis of our dividend earning capacity.

By this it is not suggested that your Board consider that gilt-edged investment reserves should not be accumulated, on the contrary, with the return of prosperity it is hoped that it will be possible to build up such liquid reserves from the increased profits made by money which has been spent during the last few years, and from that which it is proposed to spend. We, as a company, cannot stand still, for not to progress would, for a business of our type, only be the first stage of a retrograde movement. Reluctant though anyone may be under conditions at present prevailing to incur expenditure upon new undertakings, plant and equipment, it is essential for us to plan for the day of revival; especially as all soundly conceived and progressively and efficiently managed undertakings must then, we think, inevitably benefit.

"Cash in hand and at Bank" at the close of accounts was $207,187.23 which included the balance of the proceeds of the sale of investments, of which $150,000 has since been placed on fixed deposit at a satisfactory rate. This item should of course be read in conjunction with "Sundry Debtors" the bulk of which amount was received during January.

The "Trading and Profit & Loss Account" has been drawn up in such a way as to shew the ordinary trading receipts and expenditure. It will be seen that the turnover was down on that of the previous year by the large sum of $1,125,933.85. The payments on account of Government Royalties are, of course, down in keeping with the turnover.

The profit on the sale of investments has not been taken to swell our trading, profit; it being absorbed as to $35,000 in increasing the Bad Debts Reserve (thus bringing this to $135,000) and as to the balance of $24,375.78 in adjusting the difference between the book value, and year end market value of the undisposed of balance of investments. These investments are made up of HK. $20,000/- of Hongkong Government 6% Loan, and 2,441 shares of £1.0.0 each in the Singapore Traction Co., Ltd. In the case of the Hongkong Government Loan the depreciation is as a result of exchange, which we trust will eventually right itself. The Singapore Traction Company's shares do not represent a purchase, but were taken over by this Company in settlement of the old Singapore Tramway Company's indebtedness to us for coal supplied. We trust that this investment also will ultimately improve in value.

The foregoing summarises the position as set out by the accounts. The happenings of the year under review are known to all, and I would be detaining you needlessly by attempting to review the numerous natural, as apart from the special causes which have contributed to such a tremendous shrinkage in our figures. When I had the pleasure of addressing you last year, the immediate future was extremely obscure. Part of the future then confronting us is covered by the year under review, and about the only thing that one can quite safely and unquestionably say is, that we are twelve months nearer a recovery.

In a country situated as Malaya is, I am not prepared to suggest that we have reached bottom, for with the passing of every week the country's resources are being steadily drained. It is astonishing the degree of fortitude that is being displayed and this can only have as a basis the supreme confidence of the individuals in the resourcefulness of the country and its ability to survive.

In so far as our Company in particular is concerned, it is extremely unfortunate for us that, not only have we had to contend with the results of the natural economic ills of the country generally, but we have also suffered from the results of such actions that have introduced arbitrarily uneconomic conditions which would not otherwise have existed. I refer in the first instance to the Perak River Hydro Electric Power Company Ltd., the operation of which has only been made possible by the investing, and lending by the Government of this Country, of a colossal and irrecoverable sum for bolstering up an uneconomic undertaking which must otherwise have failed. This Power Company has been operating for some time and, had it not been given still further Government aid, its affect upon our sales seemed calculable Not content, however, with sinking into the concern some $12,000,000/-, the F.M.S. Government has now, by foregoing its prior rights, enabled the Power Company to raise funds with which to purchase and close down the steam station of one of your Company's largest consumers in Perak.

The second instance is the purchase by Government of the Ulu Langat Hydro Electric station upon terms which can only be described as fabulously liberal, and I am glad to note that the Hon. the Financial Adviser, F.M.S., is in agreement with this view. I had intended referring to this matter at length, but because of what the Financial Adviser, F.M.S., has said in Council, and to the fact that a Commission of Enquiry has been appointed to go into the question, I will refrain from making any comment, but merely express the hope, and indeed the conviction, that Government will benefit by the experience which has been so costly to itself and so extremely unfair to your Company. We can at least hold our own against ordinary competition, but we are powerless against Government support of our competitors, given without any consideration of economic return, and it is but little consolation to us to surmise that, in the matter of the Perak River Hydro Electric Power Co., Ltd., a large part of that support was given on the instructions of the Colonial Office, and definitely against the wishes and considered opinion of the highest local authorities, and in the case of the acquisition of the Ulu Langat Hydro Electric Power Station, that a grave though gracefully admitted mistake was made.

It is significant, that Government's own Electrical Adviser originally investigated and turned down the Perak River Hydro Electric scheme, yet, when company promoters took up the rejected idea, Government sank large sums into the undertaking, and granted an astoundingly one-sided monopoly to its promoters, so that the Perak River Hydro Electric Power Co., Ltd., while protected from the competition of any other power supply company can, apparently with the aid of Government money, or money the raising of which is made possible by Government sacrifice, offer the most discriminating terms to any user of power who is burning your Company's coal. In fact, while protected and while bolstered up by Government, the Company appears to have no obligations whatsoever, and can use Government money in an attempt to crush its rivals. It is true that the original promoter-directors are no longer on the Board of the Power Company and while one naturally sympathises with the present directors of the Company, and would like to see them succeed in their task, there is not a valid, or even permissible excuse £or a continuance of the sacrifice of the welfare of the F.M.S. to the interests of the Home company promoter, the Home manufacturer and the Home Treasury.

I am not much in favour of those who are asking for a greater measure of local self-government, but when one realises how the F.M.S. is treated by the Home Authorities and ordered to pay out millions of money, apparently with little regard for the interests of the F.M.S. itself, and how the F.M.S. Government is over-ridden in a way in which the Home Government would seldom dare to over-ride a Crown Colony, let alone a self governing protectorate, one wonders whether the evils of local self government could be much more detrimental to the welfare of these States, than is the present system which has also dissipated our reserves as to reduce us from the proud position of being financially one of the strongest and soundest little governments in the world, to our present position of F.M.S. Treasury penury.

The unfortunate fact that Government is deeply financially involved in the Perak River Hydro Electric undertaking, is no justification for a policy of disregarding, or deliberately sacrificing, all other interests, including those of the F.M.S. Railways, in a reckless endeavour to save something from the wreck. That a large part of the huge sums sunk is irretrievably lost seems certain, and a halt should be called to ascertain just how far Government is justified in going in an endeavour to save the other part. I refer to the sacrifice of the interests of the F.M.S. Railways advisedly, as the effect of this latest action of Government upon Railway freight receipts, during conditions of unrestricted tin production, will be from $100,000 to $150,000 per annum. While the recipients of the benevolencies of Government are to be congratulated, Government itself stands to lose enormous sums in capital, and is losing and will continue to lose, very important sums annually in coal Royalties, in coal Freights and in Customs.

Since its inception, your Company has contributed to the F.M.S. Railways some $7,500,000 in freights, to the Selangor Government some $1,700,000 in Royalties and Quit Rent, and to the F.M.S. Trade and Customs Department some $200,000. This Company has employed a labour force rising from nothing to over 3,000 people, the total population supported being well in excess of 5000 souls. The Police protection of this population has throughout been borne by your Company at a cost of approximately $75,000. I calculate roughly that by its policy of supporting these two hydro electric stations, Government stand to lose in coal freights, coal royalties and Trade and Customs Revenue alone quite $400,000 per annum. This is an absolute loss against which there is no corresponding benefit to the State to be credited and a loss which the country can ill afford deliberately to incur.

It is the normal task of the Board of a Company such as yours, to have to conduct its business successfully against all normal hazards in the way of ordinary competition from undertakings financed and operated by private enterprise, and in such conduct I think you will grant us credit for a measure of success. Owing, however, to the lavish financial support by Government in the one case, resulting in the sale of power quite regardless of its cost of production, and to its uneconomic acquisition in the other, we have experienced and are likely to continue to experience, a shrinkage in our normal business. While, for the greater part of the year under review, we have felt the full effect of the Ulu Langat purchase, (from which station, power has been taken by Government since April of last year) and also of the attempt to squeeze us out by the Perak River Hydro Electric Power Company Ltd. and have discounted in our estimates for the current year the further results of the policy of the latter, it naturally behoves us to broaden the basis of our earning capacity in such ways as we can in order to make up for the ravages of this subsidised uneconomic competition. I will, therefore, now briefly refer to our subsidiary undertakings.

The brickworks operated throughout the year at below full production, and while we were successful in obtaining orders for the bricks required in the construction of all the principal buildings within our radius of deliveries, such orders were not nearly sufficient to absorb our production, and output has since been still further drastically curtailed.

Experimental work for the production of roofing tiles and other products was continued, and by the end of the year a satisfactory roofing tile was being regularly produced in the experimental plant. Arrangements have since been made for the installation of a small commercial-scale plant, and production should be commenced during the current year.

Our investigations into, and experiments with, the possibility of profitably growing Hawaiian pineapples on our land at Batu Arang were brought to a close with negative results. This is unfortunate, but enquiries and investigations into the possibilities of other likely crops will be continued.

The production of plywood reached approximately the capacity of the plant. Towards the end of the year, arrangements were put in hand for the doubling of the production, and this will be in operation at an early date. The reception given our product, which is marketed under the registered trade name of "MalAply “, has been encouraging, and we hope for a steady increase in support which will enable us to maintain the levelling effect which our product has had upon local prices, and at the same time to make for your company a satisfactory profit. In the meantime, Soviet-Russian and Japanese chests are entering this market in considerable quantities. It is possible that the largest individual exporter to Malaya is Soviet-Russia, and while it is certain that these exports would be less if the chests were marketed under their true colours, one can only hope that the importers have some reciprocal arrangement whereby Malayan rubber is bartered for Russian chests.

What we hope will prove to be an advantageous acquisition by your company was effected early in the year, when the entire plant of the Malayan Wood Distillation Ltd. (Liquidated) was purchased and transferred to Batu Arang. This in practice will operate entirely upon waste timber produced in felling, milling and veneering, and upon this basis should yield satisfactory returns. This plant is now in course of erection, and the products will be charcoal, wood-alcohol, acetate of lime and a wood preservative. All these products are saleable, but the form in which they will be sold will depend upon demand, and present indications are that the production of the works will, to commence with, be disposed of in the form of charcoal, a solvent for use in the cellulose and lacquer industries and a wood preservative for local use.

As an extended source of supply of timber for our existing undertakings, and to enable us further to expand our operations by milling suitable kinds of timber for export, we have applied to Government for an area of 26,000 acres of timber land within a working distance by rail from Batu Arang and for the right to select a further similar area within a period of years. Government has not yet conveyed its official reply, but we understand that our application has been favourably received.

The opportunity presented itself for the acquisition of a complete logging and sawmilling plant, together with some 10 miles of railway track and all necessary rolling stock for conveying logs from the forest to the Sawmill. Though the area of forest land required to justify this plant was not actually granted us, we felt justified in purchasing the plant upon the terms which we were able to negotiate, and it is now at Batu Arang awaiting the decision of Government.

I should like to say that our proposed entrance into the timber milling business with plant of a larger capacity than that which we have hitherto employed, is not as a result of a decision in any sense lightly arrived at. While your Company has not spent a great deal of money or, up to twelve months ago, of time, on the investigation of the possibilities of the conversion of Malayan timbers, my firm in its private capacity has, during the past four years, very carefully investigated every phase of the business, from logging to final utilisation by the purchaser of the lumber, and the whole of the results of this outlay in time and capital has been placed at the disposal of your Company.

The timber land for which we have applied is not large in area, nor are the stands of timber, as an average, remarkably heavy, and in both respects we could no doubt have done better by going farther afield. As against this, the area is reasonably accessible from Batu Arang, which is the centre of our operations, and the value to this company of a concentration of its activities is calculated to out-balance many disadvantages.

The utilisation by your company of modern methods in the extraction and milling of timber should yield interesting results, and if these are as satisfactory as we hope may be the case, the return should be a fair one. While local timber is at present being offered at prices below the cost of production, any material increase in the demand for timber would soon bring prices to a level as high as the present prices are low. In normal times, not only is the cost of local timber for the better class of work prohibitively high, but the quality is such that architects and builders prefer to specify, and to use, either imported timber or substitutes, such as steel.

Though our main objective is the production of timber for our own requirements and for export, it is considered that an established business, such as that which we propose, may in prosperous times not only have an equalising effect upon local prices, but also a reducing effect upon the importation into British Malaya of foreign timber.

By far the largest and most important undertaking which we have under consideration is, of course, the proposed cement works, with its quarry and transportation system. We have indicated in our Report to you that the whole of our proposals have been submitted for the consideration of Government, and as the result of this consideration has not yet been conveyed to us, it would at this stage be inadvisable for me to make any other than general comments.

The condition, of course, of the cement markets in the East is at present little short of chaotic, due to the general curtailment of building works and to the organised dumping of Japanese cement, but we believe that the present state of affairs cannot last and the position is being very carefully watched.

In the meantime, pending the decision of Government, everything which can be done by us, short of actually placing contracts, has been done. The utmost caution has guided us from the commencement of our investigations and this consideration will continue to guide us to the end. In the financing of the undertaking, should it mature, the strictest economy will be practised and due regard will be had for the average shareholder's command of new capital. Technically, the works which we have under consideration are quite the last word in proved efficiency; while financially, the closely estimated initial capital expenditure, per ton of annual production, is as favourable as anything yet achieved in the installation of similar plant. These factors, coupled with our favourable concentration of raw materials, existing organisation and the proposed facilities for export, require only an assurance of demand for the product, at prices based upon the most favourable possible production costs, plus a reasonable profit, to assure us of satisfactory returns. That the demand has in the past existed for several times our proposed initial production, statistics will prove. Cement is so fast becoming one of the staple requirements of civilisation, that it is inconceivable that the demand will not revive, and if this view be accepted, the whole matter is reduced to a consideration of competition. As I have already mentioned, with our proposed facilities, we have no doubt of our favourable position to compete with the production of any country, as long as that production is sold at something above its actual cost plus freight. Against dumping, we, in common with other manufacturers, cannot profitably compete in open markets. In referring to dumping, I naturally discriminate between such and legitimate keen competition.

So much for the problems and considerations which confront us in arriving at a decision in connection with our cement works proposals. The whole matter is constantly before us, and it is hoped that a member of your Board will shortly confer with our consulting engineers in London, and with the principal tenderers for the supply of the plant. You will be advised immediately any decision is arrived at, and in the meantime, I repeat that it will not in any case be necessary for you to earmark any capital for this project, as until such time as it may be considered wise to make a new issue of shares, finance can almost certainly be arranged.

I am not asking you to sanction a bonus to the members of the staff, and though everyone has worked whole-heartedly during the year, I am sure all have a full realisation of the times and a due appreciation of the fact that to be employed in these days upon favourable conditions is something to be grateful for. Some small portion of our earnings, however, might be voted to help in lightening the lot of the dependent unemployed, and you will, I am sure, appreciate the suggestion that donations of $250/- each be given to the funds of the European and Asiatic Unemployment Committees.

As I mentioned in my speech last year, His Excellency the High Commissioner and the Chief Secretary and party visited your operations at Batu Arang in January. Later in the year, His Highness the Sultan of Selangor and suite and the Hon. the British Resident, Selangor, Mr. T. S. Adams, similarly honoured your Company.

Mr. Kelman returned from leave and resumed his seat on the Board.

Before concluding I should like to refer to a leading article which appeared in the "Straits Times" since the issue of the accounts, criticising the principle that your Company should make profits while the Railways continue to be operated at a loss.

Like the Railways, your company has been financed very largely out of the revenue of prosperous times, but, unlike the Railways, such revenue has never been added to the capital upon which our profits are calculated.

It would be perfectly easy for us to do as the Railways have done and call our capital the actual amount spent on Capital Account regardless of its origin, on which basis we would now be distributing, not 15% on a paid capital of $2,575,050, but 4.29% on a capital of $9,000,000. We have considered the course which we have adopted preferable and more conservative, but other companies have capitalised from time to time their reserves by the issue of bonus shares, and as one does not hear criticism of profits, which, on the watered capital, look moderate, but which, on the actual subscribed capital, would be very large indeed, one can only conclude that at least one of the merits of inflation is the avoidance of criticism. If the "Straits Times" agree that the steady 10% which they consider sufficient for a colliery Company to make is to be based upon the total capital employed, we agree that this is a fair figure, but if it is suggested that $386,257 per annum is sufficient return upon $9,000,000 of capital, we regret we cannot agree.

It has always been the policy of your Board to plan for adversity, even when this seemed so remote as in 1929, and the fruits of this policy are the moderate dividends which we are now able to pay. It is not suggested that we have any preferential treatment, but perhaps the manner in which our interests have been sacrificed as mentioned by me to-day has not been realised. While we greatly value the support of the Railways I cannot, in the interests of all concerned, too strongly emphasise that the Railways purchase their coal from us strictly because it is the most economical fuel for them to use, and this after extended enquiry and trials of alternatives.

Last year a good deal was heard about Diesel Electric Locomotives, and during the local "Buy British Week" a Danish Diesel-Electric Locomotive was conducted over the F.M.S.R. system to the accompaniment of inspired and often erroneous press articles. It was suggested that the capital outlay of some millions of dollars in foreign Diesel Electric Locomotives may be necessary to relieve the F.M.S. Railways of its at present crushing burden of fuel costs, in order to make them prosperous again. The actual facts are that during 1931, which is the last complete year for which figures are published, the total cost of fuel, in the form of Malayan coal, for the whole of the F.M.S. Railways, represented just 7.3% of the total working expenditure on revenue account (after making due provision to the Renewals and Betterments Funds) or 27 cents only of the total cost of $3.70 per train mile. During 1932, the F.M.S. Railways enjoyed a considerable reduction in the cost of Malayan coal, and so the actual cost per train mile was no doubt correspondingly reduced.

The Straits Times suggests that we should distribute all profits over 10% to our consumers. Actually, if this sum in respect of 1932, amounting to $128,752, had been entirely applied to the reduction of the fuel cost of the F.M.S. Railways, the saving on the cost of $3.70 per train mile would have been 3 cents. It is clear, therefore, that it does not lie within the power of the suppliers of fuel to convert the present temporary losses of the F.M.S. Railways into profits, or even, to any material extent to reduce them. Even on the hypothetical assumption that we were to deliver the coal requirements of the system without charge, the present deficit would not be bridged, and the net result would be two undertakings operating at a loss instead of one.

During 1931, the total tonnage hauled over the F.M.S. Railways system for your Company's account represented as much as 14% of the total tonnage of paying freight hauled. The total freight paid to the F.M.S. Railways for the carriage of coal, machinery and general stores during 1931 represented nearly 10% of the total receipts of the F.M.S. Railways on account of freights. Royalty paid by your Company to the State in respect of coal sold during 1931 under contract to the F.M.S. Railways, amounted to $46,272, and one wonders whether it would not be possible for Royalty to be waived m respect of coal delivered to Government undertakings, in which case our price to the Railways would be correspondingly reduced.

Though the F.M.S. Railways enjoyed lower prices for their fuel during 1932, representing a saving of 5.4% and are this year enjoying a further reduction of some 5.5%, their freights rates on the conveyance of coal over distances exceeding 50 miles were increased, and this increase in the case of all tin mining consumers was borne by your Company. Whereas the suppliers of electric power demand a payment to cover the maintenance of, and interest upon, their plant when no power is being drawn, we have done nothing of the kind, and despite contracts, have discontinued and resumed supplies to our mining customers at any time and at a moment's notice. This reasonableness on our part has actually operated against us, in that those customers who also have electric dredges, or are grouped with companies so situated, prefer to operate the otherwise more expensive electric dredges to save the no-demand standby charges payable to the suppliers of power, the steam dredges, which are normally consumers of our coal, and which are more economical to run, being rendered idle.

Your Company has been, and still is, one of the largest individual contributors to the country's revenue, and but for factors beyond our control, and to which I have already referred at length, would be a very much greater one still. We have repeatedly assured the F.M.S. Railways Administration that, as soon as our coal sales increase, we shall be able to reduce still further the price of our coal to them, and the Railways have ample reason, in the form of past voluntary reductions, to realise the substance of such assurances on our part. In addition, our contract is based upon a sliding scale which provides the Railways with a progressive decrease in price with any increase in demand.

When it comes to the Railways finance, your company is by far the most important individual contributor to its revenue, and if we do not actually contribute by delivering coal to the system at a loss, we certainly contribute by paying high freights on coal, which make possible the carriage of higher priced commodities (which higher priced commodities have the roads as an alternative means of transport) at the same or even lower rates. (Applause)

I will now formally propose that the Balance Sheet and Accounts to the 31st December 1932 and the Reports of the Directors and Auditors, be received and adopted, which resolution I will ask Mr. Martin to second; but before I put the same to the meeting, I shall be glad to answer if I can any questions bearing upon the Report and Accounts which shareholders present may care to ask.

There being no questions asked, the Reports and Balance Sheet were unanimously adopted on the motion of the Deputy Chairman, seconded by Mr. W. H. Martin, who said: —

In seconding the proposal that the Balance Sheet and Accounts to the 31st December 1932, and the Reports of the Directors and Auditors be received and adopted, I should like to refer to the regrettable absence of your Chairman. Mr. Russell has been intimately identified with this Company since its inception and of course it is unnecessary for me to say that the measure of success achieved has been primarily due to his guidance. Mr. Russell has presided at seventeen Annual General Meetings in the nineteen years life of the Company, and though at the moment he is too ill to be with us, his thoughts are no doubt with us and I know you will join with us in sending him a message that we sincerely hope he will be spared to preside at our meetings for many more years.

In formally seconding the resolution, I hope that you are satisfied with the results which we are able to shew on operations during an exceedingly difficult year. Moderate though the results are, they represent the product of very hard work by all concerned and the strictest economy, and in this connection I should like to say how much we are indebted to the General Managers and the staff. (Applause)

The Final Dividend of 6% was unanimously approved on the motion of the Deputy Chairman seconded by Mr. F. Cunningham.

The Directors' remuneration of $20,000/- for the past year was unanimously carried on the motion of the Deputy Chairman and seconded by Mr. P. W. Gleeson, who remarked that the results before the meeting fully justified what, in his opinion, was only a moderate fee after taking into account the magnitude and the operations of the Company.

Mr. J. A. Russell was re-elected a Director on the proposal of the Deputy Chairman, seconded by Mr. P. W. Gleeson.

Mr. J. Hands proposed, and Mr. C. W. S. Gardner seconded that Messrs. Evatt & Co. be re-elected Auditors for the ensuing year.

The Meeting terminated with a vote of thanks to the Chair.

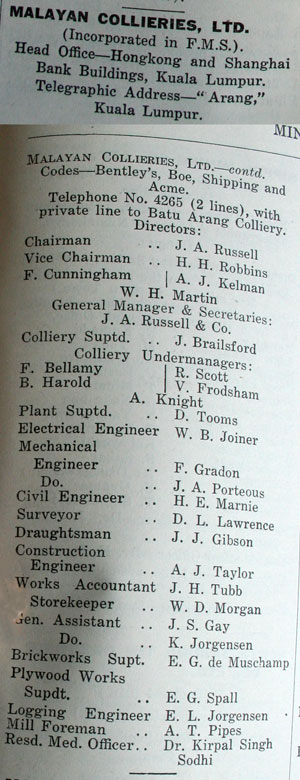

MALAYAN COLLIERIES, LTD.

(Incorporated in F. M. S.)

Head Office-Hongkong and Shanghai

Bank Buildings, Kuala Lumpur.

Telegraphic Address-"Arang"

Kuala Lumpur.

Codes—Bentley’s, Boe, Shipping and Acme.

Telephone No. 4265 (2 lines), with

private line to Batu Arang Colliery

Directors:

Chairman J. A. Russell

Vice Chairman H. H. Robbins

F. Cunningham A. J. Kelman

W. H. Martin

General Manager & Secretaries:

J. A. Russell & Co.

Colliery Suptd. J. Brailsford

Colliery Undermanagers:

F. Bellamy R. Scott

B. Harold V. Frodsham

A. Knight

Plant Suptd. D. Tooms

Electrical Engineer W. B. Joiner

Mechanical

Engineer F. Gradon

Do. J. A. Porteous

Civil Engineer H. E. Marnie

Surveyor D. L. Lawrence

Draughtsman J. J. Gibson

Construction

Engineer A. J. Taylor

Works Accountant J. H. Tubb

Storekeeper W. D. Morgan

Sen. Assistant J. S. Gay

Do. K. Jorgenson

Brickworks Supt. E. G. de Muschamp

Plywood Works

Suptd. E. G. Spall

Logging Engineer E. L. Jorgenson

Mill Foreman A. T. Pipes

Resd. Med. Officer Dr. Kirpal Singh Sodhi