For the descendents of Richard Dearie and his son John Russell

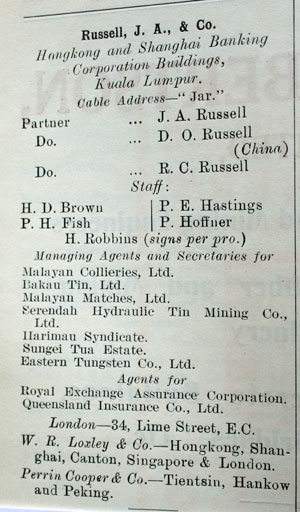

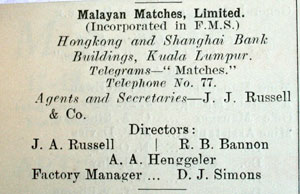

Page 3 Advertisements Column 3 [Advertisements] 0. The Straits Times, 5 January 1922, Page 3 and Page 7 Advertisements Column 1 [Advertisements] 0. The Straits Times, 7 January 1922, Page 7 MALAYAN COLLIERIES, LTD DIVIDEND OF TEN PER CENT. PAYABLE ON JANUARY 16, I92I. NOTICE is hereby given that the Transfer Books of the Company will be closed from January 9, 1922, to January 16, 1922 (both days inclusive), for the preparation of Dividend Warrants. 0. By Order of the Board, 0. J. A. Russell and Co., 0. Managing Agents and Secretaries 0. 0. For the information of Brokers and others only completed transfers lodged at the Company’s office by 4.30pm on the 8th instant will be given effect to before the closing of the books. 0. Certified transfers will remain registered in the name of the Transferor unless completed transfer is lodged as above. (153 words)

Mr. Nutt and the Tin Trade. [Articles] 0. The Straits Times, 20 January 1922, Page 9 Chinese Miners Views on his policy. FOOC KL January 19. The Hon. Mr. W. F. Nutt, O.B.E. received a hearty reception at the hands of the Selangor Chinese this evening, when he was entertained at a sumptuous Chinese Tea at the Chamber of Selangor Miners. There was a big gathering, including the Hon. Mr. W. George Maxwell, C.M.G., Chief Secretary, the Hon. Mr. F.O. Stonor, British Resident of Perak, the Hon Mr. R. C. M. Kindersley, Messrs. Argyll Robertson, J. A. Russell, A. Grant Mackie, W.T. Chapman, Richards, D. Freeman, A.S Bailey, Eyre Kenny, F.M Price, Wee Hap Lan, Yap Tai Chee, S.A. Yell, San Ah Win, Khoo Keng Hooy, Dr. E.A.O. Travers, D. Graham, Harris. The Hon. Mr. Choo Kia Peng presided and made a splendid speech in the course of which he read out two telegrams from Perak. The first one from the Chairman of the F.M.S. Chamber of Mines stated:- “ On behalf of the Chamber of Mines please thank Mr. Nutt for the great help rendered to the industry. The best wishes of the Chamber go with him” The telegram from Mr. Mair stated:- Most anxious to associate myself with your remarks Nutt today.” Mr. Kia Peng continued:- Gentlemen our guest, the Hon Mr. Nutt, requires no introduction. The function to-day is the only means of expressing the true feeling of the Chinese community towards a friend who has worked ungrudgingly for our welfare and for that of the general community for over twenty years. Though he has been away from Selangor for the last few years, we have not forgotten him, and I am sure that that feeling has been reciprocated by him. Up to yesterday evening I have no thought of saying anything with reference to Mr. Nutt's relation with his company. When I saw the paper I realized at once there has been a terrible misunderstanding to which our friend is the victim. Of two things I am positively convinced and they are, firstly, that the action which Mr. Nutt so courageously took was in the best interests of this country as a whole, and therefore ultimately and of necessity, in those of the Straits Trading Company itself and, secondly, that Mr. Nutt was not actuated by any spirit of reckless speculation or any desire, by deviating from the traditional policy of his predecessors, to make illegitimate gambling gains for his shareholders. No one who knows Mr. Nutt and the high minded and disinterested course of action for which he has always stood, can for a moment doubt this fact. (Applause.) Mr. Nutt has our deepest respect and sympathy for being the victim of what is I think, a shortsighted and I trust only a temporary deviation from the Straits Trading Company’s traditional policy of preserving the local tin mining industry even if it means some little and momentary curtailing of its own consistent earning of phenomenally high profits. (hear, hear). Public Spirit. During the war measures were passed by the score, he was always active in safeguarding the interests of the various communities, whilst on council the amendments of the banishment Enactment and various others affecting more particularly the welfare of the Chinese community have been chiefly due to his indefatigable energy. He held a unique public position in Malaya as being the only official member who has sat on two councils- The Federal and the S.S. legislative Councils. (Applause) So much for our friend Mr. Nutt in his public capacity. Now I must speak of his social side. I know that my friend does not claim anything special in this connection but with very great aid of his better half he has for many years been a power for good in our social life. Gentleman, there is another side of the question why we appreciate the good works of a man like Mr. Nutt. It is because public spirit in this country is not too common. I have not the slightest doubt that in the hearts of most people in this country there is a genuine feeling to do good for our fellow countryman and for the country from which we derive our protection, freedom and prosperity. That that public spirit as a rule has not been conspicuously displayed is partly due to the modest character of all communities and partly due to the diverse nationalities we have in our midst. So that when the public curtain rises we find on the stage a few players striving with all their might to please the audience. Every wrong step or every false note is detected. They have to stand the racket. It may be applauses or hisses. You will I think realize how difficult is their position sometimes. But there is one compensating factor in our works. We are often assisted in our works by the responsible officers of the Government. Take our case, we are fortunate in having a very firm, impartial, and sympathetic man in the person of Mr. Maxwell, our Chief Secretary, whose knowledge and experience of Malaya stand second to none (applause). The Asiatic communities are always assured of sympathetic treatment by him. I have seldom failed to enlist his assistance for any Chinese cause if I can manage to put a fair proposition before him. When I appealed for out Chinese Maternity Association he said take me to see it. After the visit the Government gave us an increased annual contribution and told us to proceed with the extension of the building by again helping us to a dollar per dollar contribution. When I wrote an appeal to him on behalf of the Asiatic Unemployment on a Saturday, he at once sent for out committee to meet him on the following Monday and gave us a handsome donation. These are only a few examples. Gentleman, if there is anything more that I desire to take this opportunity to impress upon the mind of this gathering it is this. We are all in this country on a similar mission, to make an honest living and to build ourselves up. To do successfully it is essential we must have peace. Each community cannot adopt an indifferent towards the other, because the general interest will suffer. Neither the Government nor the governed can afford to go on in separate paths towards different directions, for we can never meet at a common point. Therefore let us Chinese, other Asiatics, Europeans and Government work together and help one another by showing one another the shortest route to reach the common ground upon which all our future salvation depends. For Mr. Nutt our earnest wish and hope is that, after short rest in England, Malaya may attract him back to carry on the splendid work to which he has devoted himself for the last quarter of a century. (applause) 0. Mr. Nutt’s Reply 0. Mr. Nutt, who was greeted with applause, said in reply:- Mr. Choo Kia Peng, members of the Selangor Miners association and Chamber of Commerce and gentlemen: I thank you first Mr. Kia Peng for your very kind and sympathetic expressions which at the present time I greatly appreciate. I thank the Chinese gentleman of the Selangor Miners Association and Chamber of Commerce for giving me the opportunity of meeting you here this afternoon to bid you goodbye. It is with feelings of sadness and regret that I take leave of Maya and when Mr. Kia Peng intimated to me that you Chinese gentlemen wished to take leave of me in this manner I was very grateful to him for the opportunity of meeting you and saying a few words on the very trying time all those connected with the mining industry have been through during 1919/1920. The history of this commenced with the first crisis of 1914 when the miners were deprived of a market for their produce. This was of short duration. The Government for the first time in the history of this of this country came forward and became buyers of tin. I well remember the incident as I was asked by the unofficial community to go to Singapore to interview Mr. Wilkinson the Acting Governor and Mr. Cook the head of the Straits Trading Company ltd. To see what could be done to mainstay the mining industry. In March 1918 I was appointed Managing Director of the Straits Trading Company Ltd. I had not had this position more than a few months when the tin market became disorganized by the intervention of the Home Government control and Messrs. Boustead and Co Singapore on July 12 1918 were appointed the sole Agents for tin in the straits which appointment ceased on December 12 of that ear. Tin was therefore controlled during this period and this control has, in the opinion of many, been responsible for what occurred afterwards. 0. Resume Of Tin Position 0. Hostilities, as you are aware, ceased on November 11, 1918. Towards the end of December 1918 tin prices fell very rapidly from the control prices and there was no demand and I came to Kuala Lumpur and saw Sir Edward Brockman and put certain proposals before him by which the straits trading Co Ltd would finance miners on the basis of $90 per picul which would naturally have been limited by the finance available. I also met in this hall members of your association and conveyed to them my proposals but these were not acceptable for reasons known to you all. I then saw the Chief Secretary again and urged that the Government should again come to the assistance of the industry and they agreed to buy tin ex FMS ores to carry the position over the Chinese New Year. Buying commenced for the Government account on January 5, 1919 at $118 and ceased on April 26 of that year at $100 per picul, the two smelting companies being appointed as Government Agents. The result was that large unsold stocks of tin were accumulated by the FMS Government and also by the straits trading Co. In March 1919 at my suggestion with the authority of Sir Arthur Young who was then Governor of the Straits Settlements and High Commissioner of the FMS I went to Batavia to confer with the Netherlands Indies Government to the scheme being to hold off combined stocks for a minimum price of $119. The scheme though not entirely acceptable was the means of reciprocal feeling between the two Governments on the question of tin stocks. The Netherlands Indies Government did not sell so that nominally the position of the Eastern tin holders was sound and of mutual benefit to both Governments and the smelting interests. In July 1919 the market re opened and by the middle of August 1919 the whole accumulation of Straits tin had been disposed of to buyers at Singapore with satisfactory financial results to both the FMS Government and the Straits Trading co. From August 1919 to February 1920 the tin market reflected high prices, demand was good and the highest price ever recorded for tin in the history of the world were reached, £422 in London and $212.75 at Singapore. Speculation seemed to be rife and in March very violent fluctuations in the tin price took place, the movement being downwards. Big drops in the Sterling price took place and the position seemed to be out of control. From January to March 1920 the dollar bids for tin in Singapore were at high premium over the London parity and there seemed to be no stability in the position. Big falls in the sterling price brought out large sales from the FMS producers and ore held against advances was unloaded and demand showed signs of falling off. The market would not absorb the supplies coming forward, but the Straits Trading Co continued in accordance with its policy ever since its inception, buying ore daily, with the result that it soon found itself accumulating tin, for which there was little or no demand. This condition maintained for a considerable time and the position was fraught with anxiety. During that time I kept the Government fully informed of the situation and the miners sent a deputation to the Government urging upon them to take action similar to what they did following the Armistice and on December 6, 1920 the FMS Government became buyers of tin as before from the FMS ores at $110 per picul. The price was subsequently increased to $115 then reduced to $100 at which price Government buying ceased on February 8, 1921 0. The Bandoeng Agreement 0. On February 20, 1921 I saw the Hon. Mr. A B Voules, the Acting chief Secretary of the FMS and suggested that I should go to Batavia to endeavor to come to some agreement with the Netherland Indies Government in the matter of accumulation of stocks and I also had interviews with His Excellency at Government House, Singapore and with his written authority I sailed with Mr. George Penny for Batavia on February 25, 1921 and on February 28, 1921 at Bandoeng a conference was held at which the now well known Bandoeng Agreement was arrived at in the matter of accumulated stocks of Straits, Banka and Billiton tin.

(Ed.: following text faded and hard to decipher) This, gentlemen, is briefly a rough resume of the unprecedented position in which the tin industry finds itself after the world war, and only those who have been associated with the management of a large organization like the Straits Trading Co. from March 1918 to the to the present time can appreciate the stupendous problems, difficulties and anxieties that I have faced during that period. It is true that the economic conditions of the period following the Armistice are different from those which pertain now and it is problematical and a debatable point whether the present position would have arisen had the practical system of control exercised by the British Government on the tin industry during the war not been in operation. Government control put a ban on statistical information which created a false position, as was instanced by America having 10,000 tons tin bought under the control which was subsequently sold to consumers at the control price of 72 cents (gold) per lb. while buyers were not permitted to buy tin from producing countries at a much lower figure. Tin metal and tin ore imports were embargoed, as we know. 0. The work that the Straits Trading Co. Ltd. did though its management on behalf of the F.M.S. mining industry both here and in England during this anxious period can never be fully appreciated, in fact in certain directions it is misunderstood. I have always felt that the prosperity of the Straits Trading Co. was intimately bound up with the prosperity of the mining industry and in continuance of that policy which has characterized the operations of the Straits Trading Co. since its incorporation the Company finds itself to-day the holders of a quantity of tin that the market could not absorb. 0. Object of Mr. Nutt’s Policy 0. During the past few days the Straits Settlements and F.M.S. has been placarded with the results of my policy and from this you have no doubt read the criticism which is heaped upon my head. It was not my intention to refer to this in my speech today as the matter is one largely between myself and the shareholders of the Straits Trading Co. but as such publicity has been given to the issue from the side of those who are now in authority I think it only reasonable that I should endeavor to clear away any misunderstanding. It is for that reason that I have led up so fully to the culminating point of my resignation. I took up a definite policy from the beginning of the tin crisis and have stuck to it, whether my policy is right is a matter of opinion. Mr. Kia Peng has broken away from his promise to me quite rightly I think in defence of one who has done his best for the industry. To state that I went in for a rash speculation is unjust and incorrect. My whole aim and object in my policy has been to protect the mining industry during the most critical time in its history, to assist the F.M.S. Government and to keep up the Good name of the Straits Trading Co. with whom I have worked for nearly 27 years. My policy may give the appearance of speculation i.e. to buy more ore than you can sell tin or not to sell tin on every occasion when the market was willing to offer a price for it. If I had met the merchant speculator or the market operator on every occasion when he bid for tin I fear we should have seen the price of tin down to $50 and the industry on its knees. I am quite satisfied that the policy I adopted was the right one and I am also satisfied that it will in time be acknowledged to be so, and though I have suffered the greatest ignominy during the last three months and particularly at the meeting of the Straits Trading Co. on 16th instant the result will ultimately prove that I was justified. No one has yet put before me a clear exposition of what would have been the result if I had not adopted the policy I did. I have a very clear idea of what would ?be conveyed and no doubt anyone who cares to think also has. The public may say why did I not reply to the criticisms at the meeting on 16th. I can only reply that I had stated my case to those who were adjudicating on my policy and as agreement became impossible we agreed to differ and I was satisfied to allow time to prove my policy, but owing to the publicity given to the whole question as in ?my knowledge this is the first occasion that the proceedings of the Straits Trading Co. General Meeting have appeared in the Press. I decided to break away from my original intention and I thank you Gentlemen for giving me this opportunity. 0. It is a serious position for me to be in after a career of 27 years in Malaya to be leaving it shall I say under a cloud when my own friends and acquaintances are weighing up in their minds as to whether I did right or wrong. I can only assure you I did the best my conscience told me and what I have given of my best to the Company I have served and the country that has sheltered me. I am sorry to have clouded the proceedings by this my dissertation. I should like before I conclude to say how pleased I was that the F.M.S. Government has recognized the genuine qualities of your chairman the Hon. Mr. Choo Kia Peng in making him a member of the Federal Council. Nothing pleased me so much as when I read of his appointment. Mr. Kia Peng is one who is full of public spirited ideas, full of the wish to protect those in not such a favourable position as himself and full of love and loyalty for the country in which he lives, and the tone and spirit of his speech is genuine to the core. I should like to make reference to the your benevolent Government who as I have already stated have stood by the mining industry on three occasions. This has not only assisted the miners but has allowed the smelters to continue their industry undisturbed and the various heads of Government during the period I have referred to deserve the greatest thanks for their courageous policy. In your present Chief Secretary the Hon. Mr. W. G. Maxwell you have man of marked ability and integrity, a man who has a staunch affection for the F.M.S., and I feel sure that so long as these States are under his guiding hands that the administration will be one of steady advancement in the many directions necessary. I fully sympathise with him over the present position, the result of the disturbed condition of the economics of the world, but the period of marking time may in the end be the best for us all. 0. I cannot conclude without again thanking you for this kind reception and for the expression of sympathy which have been of the greatest support to me during the trying period I have recently been passing. (applause) The proceedings then terminated. (2299 words)

The Straits Times 26 January 1922 page 8 and The Straits Echo Mail Edition 31 Jan 1922, p.117 Quite a little military expedition was to be seen going through the streets of Kuala Lumpur yesterday accompanied by Major Fish, of Messrs. J. A. Russell and Co. They were conveying over $100,000 to Malayan Collieries to pay the monthly wage bill. News had been received said the Malay Mail, that an attack was planned to be made on the money this payday, hence the warlike escort. (69 words)Untitled [Articles] 0. The Singapore Free Press and Mercantile Advertiser (1884-1942), 8 February 1922, Page 2 Quite a little military expedition says Wednesdays Malay Mail was to be seen going through the streets of Kuala Lumpur this morning accompanied by Major Fish, of Messrs. J. A. Russell and Co. They were conveying over $100,000 to Malayan Collieries to pay the monthly wage bill. News had been received, that an attack was planned to be made on the money this payday, hence the warlike escort.

THE ROYAL VISIT. [Articles] The Straits Times, 26 January 1922, Page 9 (Malayan Matches Limited are showing two machines in operation…)

TOPICS OF THE WEEK. [Articles] The Singapore Free Press and Mercantile Advertiser (1884-1942), 4 February 1922, Page 1 0. TOPICS OF THE WEEK. 0. There was no arriere pensee in the Hon’ble Mr. James ‘ mind the other day when in detailing the attractions of the Malaya Borneo Exhibition he mentioned the sleeping coach of the F.M.S. railways in close company with the menagerie of wild animals, but the topicist can hardly absolve a brother scribe from a mean joke when in his account he said that the Malayan Matches Ltd. would show a machine making a match. Probably he holds shares in the Company. Mine Models.

[Articles] The Singapore Free Press and Mercantile Advertiser (1884-1942), 3 February 1922, Page 7 and Mine Models. [Articles] The Singapore Free Press and Mercantile Advertiser (1884-1942), 2 March 1922, Page 7 and MALAYA-BORNEO EXHIBITION [Articles] The Straits Times, 2 March 1922, Page 10 MALAYA-BORNEO EXHIBITION Mine Models. Among the exhibits in the Minerals : Section are ……”From Selangor…specimens of coal from the Malayan Collieries”

F.M.S. RETRENCHMENT COMMITTEE. [Articles] 0. The Singapore Free Press and Mercantile Advertiser (1884-1942), 18 February 1922, Page 6 FMS RETRENCHMENT COMMITTEE FOOC KL Feb 17 0. Retrenchment Committee has been appointed consisting of Messer’s W. S. Gibson (President), J. H. M. Robson, G. P. Bradney, E. A. Dickson, D. H. Hampshire and J. A. Russell. The terms of reference authorise a full enquiry into the establishments and organisation of the various Government departments, their expenditure, supervision and control of same, allowances of all kinds and emoluments other than salaries drawn by Government officers. (60 words)

Untitled [Articles] 0. The Singapore Free Press and Mercantile Advertiser (1884-1942), 8 March 1922, Page 2 0. Mr. H. H. Robbins, of Messrs. J. A. Russell and Co., has returned from leave.

LETTER FROM: - J. A. Russell & Co. TO: - The Collector of Land revenue, Kuala Lumpur. 20th March 1922 Kuala Lumpur. 20th March 1922 Sir, Sub-Division of Plan 14831 C.T. 1418 Mukim Ulu Kinta I have the honour to enclose herewith Form of Surrender of that 1600 sq. ft. of the above Title acquired by Government for the purpose of an Electrical Sub-station. Also enclosed is the Issue copy of Title, for excision of the portion surrendered. I shall be pleased to receive cheque for the sum of $1600/- in due course. I have the honour to be, Sir, Your obedient servant, Per pro J. A. Russell H.H. Robbins. From National Archives of Malaysia. Transcribed by P.C.

New Serendah Rubber. [Articles] 0. The Straits Times, 23 March 1922, Page 10 0. New Serendah Rubber. 0. The Financial Position Quite Sound. 0. The twelfth annual general meeting of this company was held at the registered office of the Company 1, Embankment, Kuala Lumpur, on Tuesday, with Mr. J. A. Russell in the chair, others present being Major Russell F. Grey, Major H. Gough, Messrs. A.K.E. Hampshire, D.H. Hampshire, C.A.L. Ward and M.D. Fallon. The representatives of the Secretaries, Messrs. Boustead and Co., Ltd. Having read the notice convening the meeting the chairman addressed the meeting as follows:- 0. Gentlemen, - Following the usual course, I will take the report and accounts as read. There is little that it is necessary for me to say in explanation of them, for you will find contained in the report most of the figures and particulars which you may require to form an idea of the recent position of the company. I think that all I really need add this afternoon is to say that the financial position of the company is quite sound. I greatly regret that it is not possible for your directors with prudence to recommend the payout of a dividend. It would be unwise to do so at a time like this, and so to jeopardize the future safety of your property. Our liquid investments and cash at Bankers to-day total $72.000, and we estimate that if it becomes necessary to cease tapping entirely, this sum will enable us to keep the estate in first class condition for a period of quite three years. We hardly think that the worst in the depression of the rubber plantation industry is likely to last for a longer time than this. Our buildings, factory and machinery have been well written down in the course of the past years, a rough valuation at the end of 1921 putting them at $90.000 against the $13.381 at which figure they stand in our books. As, however, in the event of liquidation, other than by selling the estate as a “going concern”, they would have little realisable value. I should really like to see them stand at the nominal figure of $1 and I trust that in time they will actually do so. 0. Restriction Policy. 0. Owing to the Company’s policy of restriction the loss on the year’s working is heavy, but had the company tapped all out it could undoubtedly have made a profit. Your directors however have considered that as this company can afford to restrict, in the interests of the rubber industry as a while it should most certainly do so. The rest from which the trees are benefiting will probably eventually more than repay us. In considering this loss, shareholders must also bear in mind that in conformity with the Board’s established policy extending over the last 6 years all expenditure on account of general charges is charged against Revenue, if the proportion expended on immature areas were charged against Capital, the loss on the year’s working would have been reduced approximately to $14.000. Although every possibly economy has been and is being exercised, it is not being exercised to the detriment of the estate which has been fully upkept during the past year, cultivation by means of silt pits has been carried out throughout the immature area. Bud grafting of 100 acres of immature rubber is not yet quite complete but it shortly will be so. I can think of nothing further to say, but should shareholders present like to question me about points on which they are in doubt, I will do my best satisfactorily to answer them. 0. A Development Reserve 0. Mr. Ward suggested that an amount should be transferred from Profit and Loss account to a Reserve for Development account, as this would make the position of the Company clearer. 0. The Chairman replied that this would receive the consideration of the Directors. 0. Mr. Ward asked some other questions in regard to the balance sheet and profit and loss account to which the chairman replied. On the proposition of the Chairman seconded by Major Russell Grey the report and accounts were adopted and passed. 0. Mr. J. A. Russell was re-elected a director and Major Russell Grey was appointed to fill the other vacancy on the Board. 0. The retiring auditors Messrs. Neill and Bell were re-elected. 0. The Report 0. The following is the report of the Directors:- 0. Acreage Statement.- Mature Rubber 1,064.7 acres, Rubber Planted 1915, 30.0 acres, 1916 41.0 acres, 1917, 41.9 acres, 1918 15.0 acres, 1920 100.0 acres, total planted area 1,292.6 acres; Reserve Jungle 504.7 acres; Swamps 23.4; Building Sites 15.4; Total acreage 1,836.1 acres. 0. After providing for depreciation the loss for the year amounts to $19,765.43. The balance profit brought over from the previous year is therefore reduced to $99,572.39 which your directors recommend to be carried forward. 0. Crop,- The crop harvested for the year was 202,501 lbs against an estimate of 372,350 lbs. In February it was decided to voluntarily restrict and an area of 585 acres was taken out of tapping round and rested right through the year which accounts for decreased output. 0. Costs.- The all- in cost per lb was cts. 41.08 and the gross price realized was 30.37 cts. per lb. It is to be noted that 100 per cent of general charges has been charged to revenue. 0. (904 words)

PRINCE IN MALAYA. [Articles] 0. The Straits Times, 30 March 1922, Page 9 PRINCE IN MALAYA. 0. Kuala Lumpur's Enthusiastic Reception. 0. "Friendship at First Sight." 0. (From Our Own Correspondent.) Kuala Lumpur, March 29. 0. From an early hour this morning all roads appeared to converge on the Padang in front of the Government offices where the first public reception to the Prince was held amidst never to be forgotten scenes of joy and enthusiasm. The Padang itself was one sea of heads while the verandahs and balconies were all crowded, although admission to these was confined to ticket holders. The royal dais stood at the porch of the Selangor Club behind which seats were reserved for officials and the Sultan’s retinues. From the dais to a special enclosure by the roadside in front of King Edward V11 statue a way was prepared between thousands and thousands of Malays from 4 states. The Prince, who was accompanied by Sir Laurence Guillemard was in Khaki military uniform. He arrived sharp at 11 and stopping the car outside the first arch walked up to the MSVR guard of honour drawn up on the left hand side of the road. The guard gave the Royal salute when the prince was about ten yards away. After the inspection of the guard His Royal Highness stepped under a covered way where the following gentlemen were presented to him:- (long list of names including J A Russell at about number 72 out of 90 on list) (Summary: The Prince in his speech congratulates the rulers and the people on astonishing results in progress and development, knows that they are suffering from severe depression in tin and rubber industries, is confident that as the world recovers from the effects of the Great War, that these industries will recover. Their loyalty is treasured by the King his father, notes Malaya’s gift of the battleship Malaya to the British Navy, and says that it is friendship at first sight. Prince then walks past singing schoolchildren. Then goes to Government House where he meets the rulers in private. Invested the Sultan of Pahang, and Sir Lionel Woodward. Met ex servicemen in the afternoon full programme not carried out due to heavy rain. Played polo at the racecourse in front of a cheering crowd. After 8 at night drove to the Selangor Club for Governors Banquet, then went to Town hall for a State Ball. Shook hands with the ladies. Danced with 2 ladies and left the hall shortly after 11.) 0. (1546 words)

PRINCE IN F.M.S. [Articles] 0. The Straits Times, 31 March 1922, Page 10 0. PRINCE IN F.M.S. 0. State Ball at Kuala Lumpur. 0. Luncheon and Departure. 0. (From Our Own Correspondent.) Kuala Lumpur, March 30. 0. Last night's banquet at the Selangor Club and the ball at the Town Hall far surpassed in splendour anything so far done in honour of the Prince. (Summary Description of the ball, electric fans, 500 people, arrival of guests along Java Street. Luncheon at the Station Hotel, the Railway Station and the dining room of the Railway Station were decorated with greenery and flags. HRH arrived at 1 pm. Lists of guests at main table. He is flanked by Maxwell and Dr. Travers, at the main table are among 50 guests including J. A. Russell. Another is Lord Louis Mountbatten. Another approx 60 guests listed. Toast. Prince shook hands with all the guests. Left for Government House, presented with flowers, guard of honour. HRH reached station at 3pm entered the Royal Train. The engine was decorated with Prince of Wales feathers. Cheered by large crowd, at every station. Arrived Port Swettenham. Embarked on The “Renown” for Singapore. Reception committee had worked for 2 months. Police were efficient. Crowds well behaved.) 0. (1558 words)

The Straits Times, 31 March 1922, Page 7 Malayan Collieries To the editor of the Straits Times Sir, _ What is wrong with Malayan Collieries? So far as I can learn the last accounts were made up to 30 June 1920, that is about one year and nine months ago. Since that time a new property has been acquired at huge expense, new capital issued whilst shareholders are left absolutely in the dark for this long period of time as to the financial position of the Company. Some intimation was given that the financial year would end on December 31st instead of June 30th, but if the Directors desired to make this change they should have had the usual meeting in 1921 and an extra one in 1922. In any case it is now nearing the end of March and we are still waiting without any account of the Directors’ stewardship, shares have slumped enormously and all that one can hear are various vague rumours. Is there no Registrar of Companies in the F.M.S. and what is the law with reference to the holding of Meetings? Yours etc. SHAREHOLDER Singapore March 29th

Malayan Collieries. [Letters] 0. The Straits Times, 4 April 1922, Page 10 Malayan Collieries. To the Editor of the Straits Times. 0. Sir,— With reference to the letter appearing in your issue of the 31st ultimo regarding our yearly accounts, shareholders were duly circularised on November 15 last to the effect that the end of the company's year had been altered from June 30 to December 31 This was done in order to make the company’s financial year agree with the accounting period of its Dutch subsidiary. 0. In that circular it was further stated that as it would take some little time to get the company’s accounts audited, it was intended to pay the final dividend of 10 per cent before the issue of the report and the accounts, a preliminary audit having already disclosed the fact that the sum earned to date was sufficient to pay such a dividend. 0. The final dividend on account of profits earned during the last financial period was duly distributed to shareholders on January 16th. 0. In order to waste no time, the books of the company were audited as far forward as possible during September and October. 0. The final accounts for the year including those from Borneo were in the accounts balanced by the end of February, and the final audit commenced on March 13 which for a company our size is a very creditable performance. This final audit has not been yet completed, but should be finished shortly, and it is expected that the report and accounts will be issued and the general meeting held before the end of the present month.- Your etc. . MALAYAN COLLERIES LTD. 0. Per J. A. Russell and Co. Agents and Secretaries 0. Kuala Lumpur April 1

UTAN SIMPAN RUBBER. [Articles] 0. The Straits Times, 5 April 1922, Page 11 UTAN SIMPAN RUBBER. Sound Financial Position Reported. 0. The twelfth annual general meeting of the Utan Simpan Rubber Co. Ltd., was held at the registered office of the company, 1 Embankment, Kuala Lumpur, on Saturday with Mr. V. Utterson Kelso in the chair. The others present were Messrs. A. K.E. Hampshire, M.D. Fallon, R. M. Newton, W.E.H. Ross, F.S. Gread, and Mr. B.G.H. Johnson representing the Secretaries Messrs. Boustead and Co. After notice convening the meeting was read the chairman addressed the meeting as follows:- (Summary: profit for year $13,828.78, cash reserves, should selling price of rubber go below a figure where it no longer pays to tap the reserves should last 2 years or more, trees healthy and well, property in good condition, costs of tapping slightly higher than on some estates due to lay of the land and fact that all labour is Chinese. “ It would be unwise to attempt at present to exchange a well established Chinese labour force for a Tamil force which would probably drift away as soon as conditions improved” come through an anxious and difficult period, stronger position than when they started.) The retiring directors Messrs. J. A. Russell and A.K.E. Hampshire were re -elected, as also the auditors Messrs. Neil and Ball.

KAMASAN RUBBER. [Articles] 0. The Straits Times, 5 April 1922, Page 11 0. KAMASAN RUBBER. 0. Profit Earned for The Year. 0. The twelfth annual general meeting of the Kamasan Rubber Co. Ltd. was held at the registered office of the company, 1, Embankment, Kuala Lumpur, on Saturday with Mr. K. W. Tyler in the chair, others present being Messrs. M. J. Kennaway, J. A. Russell, A.K.E. Hampshire, C.G. Trotter and Mr. G.H. Johnson representing the Secretaries Messrs. Boustead and Co., Ltd. (Summary. Have liquid cash $67,000, in strong financial position, and can carry on for some years if tapping has to stop. Difficult time during last year, continually depreciating price of rubber, profit has been earned for the year, dividend of 5 per cent for year ending Dec 31 1921. Estate in good order, large sum spent on drains, enough labour, health of coolies good, cost of caring for sick coolies very small, they are one of the members of a group hospital in the district and the greater part of the medical expenditure is the upkeep of the hospital. Few pests on the estate, only disease is brown bast. Thanks to Mr. C. G. Trotter in charge of estate.) 0. 0. (614 words)

Power of Attorney dated March 25, 1920 given by said W R Loxley & Company, and the Deed of Substitution and Power of Attorney dated April 6, 1922 given by Mr. John Archibald Russell both in the favour of the said Adriaan van der Harst authorised to act on behalf of W. R. Loxley & Company or John Archibald Russell. Part of legal notice in Page 2 Advertisements Column 1 [Advertisements] The Straits Times, 14 July 1924, Page 2

Letter to the Secretary to the Resident, Selangor, Kuala Lumpur from Malayan Collieries Limited, Hongkong and Shanghai Bank Buildings, Kuala Lumpur 24th April 1922. Your No. 2 in 1525/22 -11-4-22 Sir, We have the honour to inform you that we have this day paid the State Treasury, Selangor the sum of dollars Eighteen thousand and seventy –seven, cents twelve, ($18,077.12) being Royalty at 25 cents per ton on Coal- for the first quarter ending March 31st., of the year 1922, as per statement enclosed. We have the honour to be, Sir, Your obedient servants, Malayan Collieries J. A. Russell and Co. Signed ? Robins? Manager, Agents and Secretaries. Document in the National Archives of Malaysia. Se Sect. 1525/1922

Royalty Return for the first Quarter Ending 31st March 1922

Month |

Coal raised |

Total raised |

Coal Sold |

Total sold |

Average selling price on all grades |

|||

1922

January |

For sale |

Slack for Boilers |

|

Screened |

Unscreened |

Slack |

|

|

Tons c qr 29372-1-3 |

Tons c qr 1563-3-2 |

Tons c qr 30735-5-1 |

Tons c qr |

Tons c qr 3124-18-0 |

Tons c qr 2961-18-1 |

Tons c qr 29372-1-3 |

$8.12 per ton |

|

20270-5-3 |

1461-12-3 |

21731-18-2 |

14205-10-2 |

1368-5-2 |

4696-9-3 |

20270-5-3 |

||

22666-2-2 |

1539-12-3 |

24205-15-1 |

15032-10-2 |

2496-14-1 |

5136-17-3 |

22666-2-2 |

||

|

72308-10-0 |

4364-9-0 |

76672-19-0 |

48533-6-2 |

6839-17-3 |

12795-5-3 |

72308-10-0 |

|

Royalty Return for the second Quarter Ending 30 June 1922

Month |

Coal raised |

Total raised |

Coal Sold |

Total sold |

Average selling price on all grades |

|||

1922

April |

For sale |

Slack for Boilers |

|

Screened |

Unscreened |

Smalls |

|

|

Tons c qr 24013=17-3 |

Tons c qr 1370-19-2 |

Tons c qr 25384-17-1 |

Tons c qr |

Tons c qr 1904-8-3 |

Tons c qr 5900-14-1 |

Tons c qr 24013-17-3 |

$8.22 per ton |

|

21997-11-2 |

1263-1-3 |

23260-13-1 |

14745-2-1 |

3007-13-1 |

4244-16-0 |

21997-11-2 |

||

18909-8-3 |

1230-3-1 |

20139-3-1 |

13022-12-3 |

2213-5-0 |

3673-11-0 |

18909-8-3 |

||

|

64920-18-0 |

3864-4-2 |

68785-2-2 |

43976-9-3 |

7125-7-0 |

13619-1-1 |

64920-18-0 |

|

Royalty on Tons 64920-18-0 @ 25 cts per ton = $16,230.22

Royalty Return for the third Quarter Ending 30 Sept 1922

Month |

Coal raised |

Total raised |

Coal Sold |

Total sold |

Average selling price on all grades |

|||

1922

July |

For sale |

Slack for Boilers |

|

Screened |

Unscreened |

Smalls |

|

|

Tons c qr 21010-9-3 |

Tons c qr 1293-2-2 |

Tons c qr 22303-12-1 |

Tons c qr |

Tons c qr 2554-16-1 |

Tons c qr 3639-7-1 |

Tons c qr 21010-9-3 |

$8./- per ton |

|

21775-7-3 |

1219-8-2 |

22994-16-1 |

15337-13-0 |

2769-18-0 |

3667-16-3 |

21775-7-3 |

||

20849-9-3 |

1348-8-1 |

22197-18-0 |

15821-17-2 |

2467-5-0 |

2560-7-1 |

20849-9-3 |

||

|

636?5_7-1 |

3860-19-1 |

67496-6-2 |

45975-16-3 |

7791-19-1 |

9867-11-1 |

63635-7-1 |

|

Royalty on Tons 63635-7-1 @ 25 cts per ton = $15,908.84

Royalty Return for the fourth Quarter Ending 31st Decr: 1922

Month |

Coal raised |

Total raised |

Coal Sold |

Total sold |

Average selling price on all grades |

|||

1922

October |

For sale |

Slack for Boilers |

|

Screened |

Unscreened |

Smalls |

|

|

Tons c qr 22672-3-1 |

Tons c qr 1400-0-1 |

Tons c qr 24072-3-2 |

Tons c qr |

Tons c qr 2612-3-2 |

Tons c qr 3099-10-3 |

Tons c qr 22627-3-1 |

$8.01per ton |

|

20194-13-3 |

1487-2-0 |

21681-15-3 |

15283-10-3 |

2385-2-3 |

2526-0-1 |

20194-13-3 |

||

22617-14-3 |

1402-2-3 |

24019-17-2 |

16677-12-3 |

2830-12-3 |

3109-9-1 |

22617-14-3 |

||

|

65484-11-3 |

4289-5-0 |

69773-16-3 |

48921-12-2 |

7827-19-0 |

8735-0-1 |

65484-11-3 |

|

Royalty on Tons 65484-11-3 @ 25 cts per ton = $16,371. Document in the National Archives of Malaysia. Se Sect. 1525/1922 Quarterly Return of Royalty on Coal sales for 1922

The Malay Mail, Thursday, April 27, 1922 and Malayan Collieries. [Articles] The Straits Times, 28 April 1922, Page 11 Malayan Collieries. The Directors' Report for Last Year. And short summary in Malayan Col[Articles] The Straits Times, 26 April 1922, Page 8 and short version The Singapore Free Press and Mercantile Advertiser (1884-1942), 1 May 1922, Page 11 0. Malayan Collieries, Financial Position, The Underground Workings. The directors’ eighth annual report and statement of accounts of the Malayan Collieries, Ltd. for the eighteen months ended 31st December, 1921 is as follows: - Alteration of the Company’s financial year, - In order to agree with the accounting period of the company’s subsidiary Dutch company, the Mynbouw en Handel Maatschappi Goenoeng Batoe Besar, the end of the company’s financial year was altered from the 30th June to 31st December; so the statement of accounts now submitted covers a period of eighteen months. Shareholders were circularized on 15th November, 1921, regarding this alteration. By a special resolution of shareholders, passed on the 14th November, 1920, the authorised capital of the company was increased from $2,000,000 to $4,000,000. By an extraordinary resolution of shareholders, passed on 30th December, 1920, the capitalisation was authorized at $300,000 of the undivided profits, and 30,000 fully paid bonus shares of $10 each were subsequently issued to shareholders appearing on the register; which distribution was equivalent to a dividend of 29 per cent in shares upon shareholders’ holdings. A further 130,000 shares of $10 each were issued, and subscribed, bringing the issued capital to up to $3,100,000. Of these share 30,000 were issued at a premium of $6 per share, producing $180,000, which sum was transferred to general reserve. With the aid of the new issue of 130,000 shares, the whole of the share capital of f.1,500,000 together with the mining and timber leases of the Mynbouw en Handel Maatschappij Goenoeng Batoe Besar, in Dutch South East Borneo (Pamoekan Bay Colliery), were acquired. The development of this property has been financed from the company’s amortization and general reserve, for which reserve funds it has formed a legitimate investment; being one connected with the company’s trade, but independently of the Batu Arang ( F.M.S.) colliery, from which property the funds derived. The company has now obtained from the Government possession of the remainder of its Batu Arang titles. Application to the Government has been made for a further 100 acres, which area is required in connection with the company’s sand stowage operations. The titles to the Pamoekan Bay property are also in the possession of the Company. All titles are free from mortgage and encumbrances. Mines and Plant - An account of these will be found in the General Manager’s subjoined reports. In order to cope with the extra traffic, due to higher output and to sand stowage operations, the line and sidings at Batu Arang were considerably extended during the period under review. Output. The total output from both mines for the period, amounted to 489,243 tons; of which Batu Arang contributed 472,859 tons and Pamoekan Bay 16,384 tons. At Batu Arang 24,451 tons were consumed for generating power in and about the mine and at Pamoekan Bay 1823 tons were consumed for power and in bunkering the company’s vessels. Coal sales for the period amounted to 462,969 tons - 448,403 tons from Batu Arang, and 14,561 tons from Pamoekan Bay. The health at Batu Arang has been excellent throughout the financial period. By the introduction of hydraulic sand-stowage, not only is the mine being rendered safe from its former greatest danger of internal spontaneous fires, but, by rendering total extraction of coal possible (instead of having to leave half of it behind in the form of pillars to support the roof) the life and value of the mine have been doubled. It will, however, be some time before the whole of the old underground workings have been dealt with by this system. Opencasts. - The economic life of these workings is limited, and it was never intended that they should become permanent. At present while the underground workings are being re-organized for sand stowage, they are producing most of the coal, but eventually they will be entirely superseded by the underground workings. In March 1922, when the crisis in the tin mining industry became so acute that many tin miners were in an exceedingly critical position, and in need of every aid to prevent them from financial collapse, the company gave a special rebate of 15 p.c. to all its mining customers, whether these had contracts or not. This concession on the contracts of those consumers who had entered into definite agreements to take monthly quantities of coal at fixed prices, represented a loss to revenue to the company of $86,148.30. In march 1921 Mr. James Barr, B.E., M.I.Aust. M.M., was appointed General Manager. Pamoekan Bay When this property was acquired the price of bunker coal in Singapore was between $40.00 and $50.00 a ton; and it was anticipated not only that the development work would pay for itself, but that it would even show a profit. Coal prices, however, rapidly fell; and the coal won incidental to development- although rapidly sold for a total sum of $335,888.71- did not go very far towards reducing the total development expenditure. On the expiry of the charter of the s.s. Nanyo Maru, the s.s. Passat was chartered for six months; but at the end of her time, as development work on that particular stage was not producing much coal, it was decided not to charter another vessel, and to stop coal sales in the meantime. The property was taken over in Feb., 1921 but - due to handing over - practically no coal was produced during this month. Owing to labour troubles, underground development and coal production was again suspended from November until the end of the year. Coal was therefore only being won during nine out of the eleven months that the company has owned the property. The same applies to underground development which was temporally suspended principally owing to labour troubles. Development work, entailing coal winning, has, however, now resumed; and the s.s. Hydra having been chartered, coal sales will shortly recommence. A coal storage ground has been leased in Singapore, while arrangements have also been concluded to acquire one in Soerabaya. The company has experienced no difficulty in selling such coal as been produced, and see a ready and wide market for Pamoekan Bay coal in the Straits Settlements and Netherlands East Indies; but until the output reaches the neghbourhood of 10,000 tons a month, charges and development expenditure will be too heavy to admit of the profits made on coal sales showing a surplus sufficient to pay a dividend. Due to the present changed circumstances, Pamoekan Bay Colliery will not be fully developed, and thus earn a fair return on capital expended until near the end of 1922; but the coal won from development work will help materially in equipping the mine, and after a new jetty has been constructed it is not expected that any further considerable amount will require to be expended on capital account. The company has now examined coal from all parts of Borneo, and can confidently state that it has found no Borneo coal equal in quality even to the company’s second grade Pamoekan Bay Coal whilst most Borneo coals are decidedly inferior to it. The Company’s first-grade Pamoekan Bay coal is equal in calorific value to the best Australian bitumous coals; but- as explained by the General Manager’s report- it is not yet advisable to mine this high-grade fuel, and only the second grade is being at present produced and sold. Profits. The profits for the 18 months, subject to the directors’ fees and auditors fees, amount to $1,286,032.14 to which must be added the balance, brought forward from the previous account, of $5,985.44 making 1,292,017.58 which less a final dividend of 10 per cent paid on 16th January of $310,000.00 leaves $892,017.58 .You will be asked to sanction fees to the Directors for the past 18 months of $15,00.00 and the auditors have rendered their account for $2,500.00 which total deducted from the previous one leaves available $964,517.58 which the directors recommend should be dealt with as follows:- Transfer to general reserve, bringing same to $1,000,000, $670,000.00; Write off mine development, Batu Arang $1,000,000.00 write off primia and survey fees on mining leases, Batu Arang $40,609.60. Balance to be carried forward to next Year’s account, $153,907.98, Total $964,517.58. It will be the policy of the directors to endeavour, in future, to pay an interim dividend on each succeeding June 30th; but this year they will pay the same at the end of May, when an interim dividend of five per cent in respect of the financial year 1922 will be distributed. The retiring directors are Mr. Alexander Grant Mackie, and Mr. Robert Peebles Brash, who, being eligible offer themselves for re-election. Messrs. Evatt and Co. retire; but being eligible offer themselves for re-election.

(N.B. No General Manager’s report has yet been found.)

The Straits Times, 5 May 1922, Page 9 . MALAYAN COLLIERIES MEETING. Some Questions by Mr. F. C. Peck. The eighth annual general meeting of the Malayan Collieries, Ltd., was held yesterday (Thursday) at the offices of the company, Kuala Lumpur. Mr. J. A. Russell presided and the others present were Messrs. Grant Mackie, H. A. Henggler (Directors), F. C. Peck, A.S. Bailey, F.P. Harris, E.P. Hargreaves, Col. A. J. Hull, and H. D. Brown (shareholders) the last named also representing the Secretaries. 0. A good proportion of the chairman’s speech was devoted to conditions at the Pameokan Bay Colliery, in which he had as much confidence as in the Batu Arang Colliery in its early development days, when the shares fell to $2.50. Before proposing the adoption of the report and accounts he enquired if any shareholder had any questions to ask. 0. Mr. Peck said he had come from Singapore, and his expenses had been paid by a few shareholders there, to find out the fullest particulars of the purchase of the Dutch property. He gave to the meeting certain information which he had gathered in Singapore and also at the offices of the Register of Companies in Kuala Lumpur, especially with regard to the option over the property and its transfer etc. 0. The chairman replied to most of the questions. 0. Mr. Peck was not satisfied with the information given and moved that the meeting be adjourned for a reasonable time to enable the shareholders to consider new information which he had placed before the meeting. The proposal was seconded by Mr. Hargraves. 0. On being put to the meeting it was lost. 0. The payment of the final dividend was confirmed; a sum of $15.000 was voted as director’s fees for the 18 months under review, Messrs. Grant Mackie and Brash were re elected directors, and Messrs. Evatt and Co. reappointed auditors. 0. The meeting terminated with a vote of thanks to the chair.

The Singapore Free Press and Mercantile Advertiser (1884-1942), 5 May 1922, Page 6 . LOCAL WIRES MALAYAN COLLIERIES FOOC KL May 4th The annual general meeting of Malayan Collieries was held under the chairmanship of Mr J. A. Russell. In a lengthy speech he referred to the Pamoekan Bay property. After some discussion Mr Peck moved the adjournment of the meeting, pending further information. The motion was lost and the report and accounts passed. Messrs. Mackie and Brash were re elected directors and the fees for directors were fixed at $15,000.