For the descendents of Richard Dearie and his son John Russell

The Straits Times, 8 January 1926, Page 8 SOCIAL AND PERSONAL. Mr. J. A. Russell is expected in Kuala Lumpur about March

The Straits Times, 25 January 1926, Page 8 The report in the Ipoh paper that a serious fire has occurred at the Malayan Collieries at Batu Arang is officially denied.

The Straits Times, 10 February 1926, Page 11 Minerals in Malaya. Interesting Article by Federal Geologist. (Contains some information about type of coal at Batu Arang and the amount mined.) (1214 words)

The Straits Times, 23 February 1926, Page 3 , The Straits Times, 25 February 1926, Page 12 , The Singapore Free Press, 26 February 1926, Page 6 , The Singapore Free Press and Mercantile Advertiser 26 February 1926, Page 6 , The Straits Times, 27 February 1926, Page 12 , The Singapore Free Press and Mercantile Advertiser, 1 March 1926, Page 14 and The Singapore Free Press and Mercantile Advertiser, 1 March 1926, Page 14. NOTICES. Pontianak Gold Dredging Concessions, Ltd. (Incorporated in Singapore under The Companies Ordinance, 1928). Capital $2,000,000 Divided into 2.000,000 shares of $1 each. Notice is hereby given that the above-named Company is issuing a Prospectus, dated Feb. 17th, 1926, a copy of which has been filed with the Registrar. etc (Summary: Share details. Directors Hugh Norman Ferrers, M.A. Kuala Lumpur, Barrister-at-law, Chairman of Directors of Malayan Collieries. Other directors, engineer, bankers auditors, registered office Singapore, land in Borneo, from Sultan of Pontianak, licences, reports, situation and transport, description of ground, vendor.)

The Straits Times, 24 February 1926, Page 9 Goenoeng Batu Besar. More Litigation in Supreme Court. The train of litigation which originated, directly or indirectly, from the sale of the Goenoeng Batu Besar coal mine in Dutch Borneo, including the Malayan Collieries case, the suit of the Eastern Mining Company against Poey Keng Seng, and the bankruptcy of Poey Keng Seng, will be continued in the Supreme Court next month, when certain shareholders in the Eastern Mining Company will sue certain directors in the Eastern Mining Company, the allegation being that the action against Poey Keng Seng was fraudulently brought. In the Supreme Court this morning the evidence of Mr. G. S. Carver in connection with the case was taken before Chief Justice (Sir. William Murison), Mr. Carver being due to leave for home before the action commences. Mr. F. G. Stevems appeared for the defence, and Mr. Roland Braddell for the plaintiffs.(147 words)

THE MALAY MAIL, WEDNESDAY, FEBRUARY 24, 1926 EASTERN TUNGSTEN COMPANY LIMITED. (In Voluntary Liquidation) Notice is hereby given that a meeting of shareholders will be held at the Liquidator’s Office 1, Old Market Square, Kuala Lumpur, on Tuesday 2nd March 1926 to receive the report of the position and progress of liquidation generally. A. A. HENGGELER Liquidator Kuala Lumpur, 20th February, 1926. 22-2 24-2

The Singapore Free Press, 25 February 1926, Page 16 SHAREHOLDERS' ACTION. SEQUEL TO EASTERN MINING CASE. Position of Keng Seng's Co-Directors. A peep behind the scenes during the inception of the action against Poey Keng Seng, formerly managing director of Eastern Mining and Rubber Company, in connection with the sale to the Company of the Goenong Batoe Besar coal concession. (Summary: Action by shareholders against Dr. Birnie. Very detailed description by Dr. Birnie about how the mine was sold to Eastern Mining and Rubber Co.) (2986 words)

The Straits Times, 5 March 1926, Page 10. Malayan Matches, Limited. The following circular, says yesterday's Malay Mail, has to-day been received from the offices of Malayan Matches, Ltd., in Kuala Lumpur “Dear Sirs, I beg to inform you that, under powers contained in the Debentures of the above Company, I have been appointed Receiver for the Debenture holders and entered into possession of the Company’s assets upon March 1, 1926. As from that date no orders placed by the Company should be executed unless countersigned by me in my capacity as Receiver for Debenture Holders. Yours faithfully, J. W. Fuller”. Malayan Matches Ltd., was floated in 1919 with an authorized capital of one million dollars, of which 525,000 one dollar shares were issued. The Company erected a factory at Rawang near Malayan Collieries, and started manufacturing matches. Its activities were, however, frequently interrupted by machinery and other troubles, and attempts to reconstruct the company failed. Government was induced to impose a protective duty on matches to foster the local industry. Messrs. J. A. Russell and Co., were the Managing Agents and Secretaries of the company. (179 words)

The Straits Times 8 March 1926 page 10 and The Malay Mail 6th March 1926, page 9 MALAYAN MATCHES Directors’ Explanatory Circular to Shareholders The following circular has been issued by the Directors of Malayan Matches, Ltd., to the shareholders, reports the Malay Mail:- We regret to have to inform you of the action taken by the debenture holders of the company, who have given notice calling in the principal moneys due to them; and have also appointed a receiver to protect their interests. It has been made very clear in the last two reports circulated to shareholders that the company was carrying on under great financial embarrassment and only been able to continue trading owing to the financial assistance from time to time rendered by Mr. J. A. Russell and his firm. The recent prosperity throughout the F.M.S. has led to substantial increases in wages being demanded by all classes of workers, but no corresponding advance in the price of our product has been obtainable, owing to the keen competition from imported matches which has to be met. The consequence is that the company has been unable to meet the increased demands of labour, and a steady migration of the company’s skilled labour force has resulted in the factory’s capacity for production being seriously curtailed. The greater outputs which it was hoped would be achieved to enable the company to pay its way have subsequently not materialised, and further heavy trading losses are being incurred today. The position was reported to the trustees for the debenture holders, resulting in the appointment of a receiver, who has assumed possession of the whole of the company’s assets. Mr. J. A. Russell and his firm advanced the company some $115,000 in cash of which some $48,000 has been loaned without security of interest. Every effort will be made by the board (on which Mr. J. A. Russell and Co. are represented) to co-operate with the receiver for the debenture holders with a view to realizing the company’s assets to the best advantage.

The Singapore Free Press and Mercantile Advertiser , 9 March 1926, Page 8 Malayan Matches has gone into the hands of a receiver on the action of the debenture holders. Messrs. J. A. Russell has loaned some $115,000 in cash, $48 without security and free of interest. The company was carrying on under a great financial embarrassment and recently had been faced with the demand for substantial increase of wages, with no corresponding increase in the price obtainable for their wares. Perhaps the import tax placed on matches, one of those irritating little things which annoy traders, will now be removed, as it was imposed for the protection of the native industry.

The Straits Times, 11 March 1926, Page 10 Serendah Hydraulic Tin. The report of the Serendah Hydraulic Tin Co., for the year ended December, 1925, states that the profit for that period including interest on investments, is $11,199.24 which, with the balance of $7,914.73 brought forward from the previous year makes a total of $19,113.97 available. The directors recommend that a dividend of 10 per cent be paid absorbing $17,000 and that the balance of $2,113,97 be carried forward to a new account. The mines, as hitherto, have continued under the management of Messrs. J. A .Russell and Company whose report on the year's working shows that output from all sources was pcls 181.58 1/2 which realised on sale $13,553.55 or an average price of $74.64 per picul. The figures for the year under review are disappointing, in that they maintain a steady decline in output. M.L. 3437 recently acquired was bored during the year and at the time of writing, arrangements have been concluded for the working of the area. If the outputs anticipated by this new tributor are realised the results of the present year’s working should show an improvement on the average of the past three or four years. The company’s property continued to be worked on the tribute system. The total tribute received from all sources was $10,228.40. Of this amount $5,092.85 was derived from the sale of ore as above and the balance of $5,135.55 from the sale of a part of the company’s water supply for use on an adjoining block. The tribute on the ore represented a return of $27.34 per picul or an average tribute rate of 36.6 per cent.

The Straits Times, 31 March 1926, Page 7 and The Straits Times, 3 April 1926, Page 12 MALAYAN COLLIERIES, LTD. NOTICE OF TWELFTH ANNUAL GENERAL MEETING AND CLOSURE OF SHARE REGISTERS. NOTICE is hereby given that the Twelfth Annual General Meeting of the Company will be held at the Registered Offices of the Company, Hongkong and Shanghai Bank Buildings, Kuala Lumpur. F.M.S. on Friday, April 9 at 12 o’clock noon. etc. 0. 0. H. D. Brown, Secretary (N.B. The last notice signed by Brown.)

The Singapore Free Press and Mercantile Advertiser, 7 April 1926, Page 8 COMPANY LITIGATION. DISCONTINANCE OF ACTION Sequel to Directors' Secret Profits. Application was made to the Chief Justice, Sir William Murison, in the Supreme Court yesterday morning for the discontinuance of the action commenced by certain shareholders of the Eastern Mining and Robber Co. Ltd. against Dr. William Birnie. (Summary: Mr. Braddell, acting for plaintiffs Tay Lian Teck and others asking about payment of costs. Dr. Birnie brought the action and didn’t disclose material documents and should pay his own costs. Mr. Braddell refers to sale of Goenoeng Batoe Besar by Eastern Mining and Rubber Co. to Malayan Collieries in which large secret profit was made, during which time Dr. Birnie controlled Company by reason of number of votes he held. F. G. Stevens acting for Dr. Birnie would not go into case as this was an application for discontinuance. Mr. Davies for the company, said company had been unwilling to be party to proceedings. Had to because of allegations of fraud against the directors. People who had returned shares had done so because they didn’t want to be further harassed with this very long litigation. Mr. Braddell said duty of every one who received promoter’s shares as gentleman to return them. His Lordship will deliver his decision this morning.) (948 words)

The Straits Times, 7 April 1926, Page 8 The Malayan Collieries report was issued on March 31, and shows a profit of $1,021 255, being an increase of approximately $20,000. The directors recommend a final dividend of 12% per cent, making 32% per cent, for the year, an improvement of 2% per cent, on the previous year. General reserve is increased by $65,000 odd, bringing it up to $1,100,000.

The Singapore Free Press, 8 April 1926, Page 9 EASTERN MINING CASE. SHAREHOLDER PLAINTIFFS TO PAY COSTS. The Chief Justice, Sir William Murison, delivered his decision yesterday morning upon the application of Mr. Roland Braddell, on behalf of certain shareholders of Eastern Mining and Rubber Company that in ordering the discontinuance of the action they had started against Dr. William Birnie and others, his lordship should order that Dr. Birnie and the Company, who were also defendants should pay their own costs. (303 words)

The Singapore Free Press and Mercantile Advertiser, 10 April 1926, Page 8 MALAYAN COLLIERIES LTD. (From Our Own Correspondent). Kuala Lumpur, Apr. 9. At the annual general meeting of Malayan Collieries, Ltd., Mr. H. N. Ferrers, presiding, called attention to the expansion of the Company's trade and the growing strength of the financial position. Notwithstanding its abnormal share of misfortunes, Pamoekan Bay had now recovered. The chairman expressed optimism in the future, despite the proposed hydro-electric scheme. General trade was improving, so there would be greater demand for coal. A final dividend of 12 and half per cent was declared and Messrs J. Barr and F. Cunningahm were re-elected directors. (98 words)

Malayan Saturday Post, 10 April 1926, Page 11 SPARKLES. “Quiz” Being Smiles of the Week. The idea might also be commended to the boards of directors of the numerous Malayan companies now, making handsome distributions among shareholders. What about a bagatelle of one per cent of profits for charity? Take for instance, that purely local undertaking, Malayan Collieries, Ltd., of which we have read and said so much in recent years. Its annual report, just out, shows a profit of over a million dollars. One per cent of that- $100,000- would be a glad windfall to many a “deserving cause”

The Straits Times, 12 April 1926, Page 8 On Other Pages. Malayan Collieries Meeting Page 10

Malay Mail Saturday April 10, 1926 page 9 and 16 MALAYAN COLLIERIES Final dividend of 12 ½% Per Cent. AN OPTIMISTIC OUTLOOK. The twelfth annual general meeting of Malayan Collieries, Ltd., was held yesterday at the Hongkong and Shanghai Bank Buildings, Kuala Lumpur. Mr. H. N. Ferrers, the chairman of the company presided, and the others present were; - Messrs. R.C. Russell, James Barr, F. Cunningham, W.H. Martin (directors), P. K. Paul, Yap Pow Ching, H. C. Joass, B.J. Joaquim, C. J. Chisholm, H. Hopson Walker and H.D. Brown (secretary) The secretary having read the notice convening the meeting, and the minutes of the last annual meeting being taken as read and confirmed the chairman addressed the meeting.

(Rest as Straits Times, 12 April see below except:” The directors and the General Manager’s reports for 1925 will appear later”. Note: These have not yet been found and transcribed.)

The Straits Times, 12 April 1926, Page 10 Malayan Collieries. Another Revenue Record 32 and half PerCent, in Dividends. (From Our Own Correspondent.) Kuala Lumpur, April 9. The annual meeting of Malayan Collieries, Ltd., was held in the company's offices, Hong Kong and Shanghai Bank Building, at noon, to day. The chairman, Mr. H. N. Ferrers, presided. The Chairman addressed the meeting as follows: - He said: Gentlemen, the report and accounts have been in your hands for the required period and I propose, with your consent, that they be taken as read. I do not know that they need much by way of explanation: - They are drawn up in the same form as in the past few years and those of you who are sufficiently interested will, no doubt, have already compared this years figures with those of last year and noted the satisfactory expansion of our trade and the growing strength of our financial position. Financial Result. The financial result of the year’s trading is again the largest on record and the gross revenue shows the substantial expansion of $373,789. Considerable additions have been made to railway sidings, buildings and plant and machinery during the year, but the liberal depreciation provided more than counterbalances the additions, the net result being that these items, though substantially added to, stand in the balance sheet at some $15.000 less than the figure brought in from the previous year. Additions, less depreciation of wharf, result in this asset standing at around $100,000. This completes the construction work and the wharf, with its mechanical loading appliances is capable of handling 2,000 tons daily, which will meet our requirements for some time to come. One of our sea going steam launches showed defects of the hull and had to be thoroughly reconditioned at the cost as shown. These launches have to weather severe seasonal conditions each year and there must be no doubt about their sea worthiness. Both of them are now in thoroughly sea going condition and are covered by the underwriters of Lloyd’s for marine insurance. They earn a substantial contribution to their running expenses by carrying local passengers. Stores, coal stock and sundry debtors, are all normal and compatible with the exigencies of our trade expansion. The sundry debtors reserve of $75,000 is ample provision to meet all contingencies. The expenditure on development account is confined to the cost of extensive underground development, in driving the new tunnel referred to in my speech of last year, in opening out the workings generally to cope in an economical manner with the greater outputs expected, and to win the superior coal of the bottom seam. It is recommended that this item be written down to a round $275,000. Litigation Suspense Account. The closing of the litigation suspense account and the consequent effect on the share capital account and investment account is clearly shown by the accounts and needs no further comment from me except that the unappropriated balance of $34,522.59 has been added to our general reserve. This course was decided on in preference to carrying the item into profit so as not to disturb the normal and real trading profits of the company. An appropriation to general reserve from profits, you will notice, is recommended of $65,477.41, the two items together making an addition to general reserve of a round $100,000. In last year’s speech I referred to the effect of the cloud-burst at Pamoekan Bay and its possible effects on production. The normal production was interfered with to the extent that it was decided to sub charter our large collier for two short trips from Saigon to Hong Kong to enable coal stocks to accumulate to normal levels at the mine. Unfortunately on the second of these two trips she was caught in the Hong Kong shipping strike, or more correctly political agitation and boycott, and delayed there for nearly a month. The question of her demurrage while at Hong Kong has yet to be settled by arbitration, the possible result of which has been fully provided for in the accounts. Misfortune at Pamoekan. Our next misfortune at Pamoekan Bay was an underground fire which occurred just a day or two before the close of the year. This matter has been dealt with in the general manager’s report and, I am pleased to be able to tell you, not withstanding the disorganisation that must ensue from such an occurrence, situated as the trouble was adjacent to the main underground transport road, that production was resumed within a fortnight and steadily improved till normal production was reached within a few weeks. Incidents such as the two just mentioned must be regarded as the normal risks of mining and trading but our share of them does seem to have been abnormal. We seem, however to profit in a way by these incidents. Steps are taken to prevent and cope with a recurrence of such troubles and the same type of trouble has not so far repeated itself or rather perhaps the experience we gain has prevented a repetition. Perak Hydro-electric Scheme. The Perak hydro-electric scheme has now taken definite shape. The local Government has granted a concession to Sir. W. G. Armstrong Whitworth and Company Limited, for the supply and distribution of electric energy in the State of Perak, but the said concession is not a monopoly. We, as well as other suppliers of power, are not shut out from Perak, and this being so we are optimistic enough to believe that even if the hydro-electric scheme becomes an accomplished fact it will have little effect on the prosperity of this company. The general trade position at the moment appears to be particularly healthy. As a result of this satisfactory condition of trade throughout the peninsula the railways are called upon to haul more goods and this means that more coal is required. In addition the growing inaccessibility of firewood and its accompanying higher price are causing many power users to turn to us for coal. With the help of the railways we hope to be able to give supplies to all who ask for them and while on this subject I should like to express the company’s appreciation of the efforts which the F.M.S. Railway officials have made to deal promptly and satisfactorily with largely increased traffic. No questions being asked, the formal business of the meeting was proceeded with. A final dividend of 12 and half percent was passed, making a total distribution of 32 and half percent for the year. Messrs. James Barr and F. Cunningham, the retiring directors were re-elected as were also Messrs. Evatt and Co., the auditors. A sum of $12,000, as in previous years was voted as directors’ fees for 1925. The meeting concluded with a vote of thanks to the chair.

THE MALAY MAIL, TUESDAY APRIL 13TH, 1926. REACTIONARY CONDITIONS The “Mining Journal” stated in mail week: - Tin, though subject to reactionary conditions early in the week, soon shook itself free from depression and became very firm as the week proceeded, and cash prices have improved on balance since our last by 50s. and three months by 67s 6d., so that the back-wardation has further declined and is now between £9 and £9 10s. The United States has done a large business for nearby and April dates; Wales has again been quiet, and Germany and France though doing a steady business, have taken smaller quantities. The Straits have been selling only small quantities, and in some cases a premium is asked for prompt shipment. Batavia has sold moderate quantities, but only spasmodically; rather more business has been doing with China, probably owing to the low price of silver. The strength of tin just now is due particularly to apprehension of a tightness in supply during April and May. It has been estimated that the Straits’ shipments for March and April will not be more than 9,000 tons and there is no indication at present that deliveries are going to be lower. Straits’ shipments in March and April last year were respectively 4,035 tons and 6, 356 tons, or a total of 10,391 tons in all. There is no change to note in the estimates at the end of the present month. American deliveries being still estimated at 7,000 tons.

Malayan Saturday Post, 17 April 1926, Page 11 SPARKLES. By "Quiz" Being smiles of the Week. It will be noted with gratification- especially by shareholders- that Malayan Collieries, Ltd., has given up its hobby of litigation and settled down to profit-making- a cool million and more last year looks like quite good business. Mr. Ferrers, however, despite valiant protestations, is plainly upset about the Perak hydro-electric scheme, which is going to “crimp” some of M.C.’s customers. Unfortunate perhaps- but then no-one would have listened to the cry of the gharry men to ban the introduction of motor cars into Malaya.

NB April 1926 Mr Still retires as Editor of the Straits Times

The Straits Times, 26 April 1926, Page 15 UTAN SIMPAN RUBBER. Position of the Company's Finances. . The following report is officially supplied: - The sixteenth annual general meeting of Utan Simpan Rubber Company, Ltd., was held at the registered office of the company, 1 Embankment, Kuala Lumpur, 1 on April 22, with Mr. D. H. Hampshire in the chair. Notice convening the meeting having been read by a representative of the secretaries Boustead and Co., Ltd., the chairman addressed the meeting as follows:- (Summary: report and accounts...capital now issued in full...balance used to open up further area of approx 188 acres… estimated costs clearing land..investments..reserves.. satisfactory profit of $153,546.09…interim dividends 40% paid… 55 % for year… costs of production higher due to increases in salaries expenditure on recruiting Tamil labour and medical expenses expenditure on wash prevention which was restricted during recent bad times.. effort to introduce Tamil labour force.. 180 Tamils compared with 89 at end of 1924. Mr. Kelso resigned from board…. no questions Mr. R. C. Russell seconded report and accounts adoption…” Retiring directors Messrs. D. H. Hampshire and J. A. Russell were re elected and Mr. D. S. Gardner .. to fill vacancy caused by resignation of Mr. Utterson Kelso.. Neill and Bell re appointed auditors..Vote of thanks to staff and chair..)

THE MALAY MAIL. WEDNESDAY MAY 12TH 1926 PORT SWETTENHAM MATCH FACTORY Proprietor Sued by Ex-Manager HALF PROFITS CLAIMED Before Mr. Justice Farrer-Manby, the acting Chief Justice, was begun yesterday, in the Kuala Lumpur Supreme Court, an action by Mr. J.D. Simons, formerly manager of the Elkayes Match Manufactory at Port Swettenham, against Mr. Lee Kim Soo, of Singapore, the proprietor, for the recovery of a half share of the profits made during the period that the plaintiff was in the defendant’s employ at Port Swettenham. Mr. Hopson Walker appeared for the plaintiff, and Mr. V. D. Knowles, with Mr. Hastings, for the defendant. A bundle of correspondence which had passed between the plaintiff and his solicitors, and the defendant’s solicitors, leading up to the filing of the action, was put in by consent. Mr. Hopson Walker opened the case by reading the pleadings and the correspondence, and briefly outlined the nature of the relations which had existed between the parties until the plaintiff was practically dismissed by the defendants by tendering to him a month’s salary in lieu of notice. The Plaintiff’s Story Mr. D.J. Simons, the plaintiff, said that he was an expert in match making, and was in the service of well-known manufacturers in South Africa before the Boer War. During the Great War he went to England in 1916 and offered his services to the Imperial Government. He was directed to the Woolwich Arsenal where he was employed in making gauges for shells. He had been connected with the manufacturing business since he was 15 years old. In 1921 he accepted a position with Malayan Matches, Ltd., who gave him three months’ notice in May, 1923, but he left them before the expiry of that notice, by arrangement, with the idea of starting match manufacturing on his own. He produced the letter of Malayan Matches, Ltd., in which he was given notice, and in which the company referred to certain tools which he had brought with him. Mr. Knowles objected to the letter being put in unless the writer was called. His lordship over-ruled the objection. Continuing, the witness said that these tools were his private property, and he had used them in connection with the operation of the defendant’s factory at Port Swettenham. He claimed to know a formula for making match-heads. He had acquired that knowledge during his long acquaintance with the match industry, and also by experimenting. He admitted that a certain formula could be obtained from the manufacturers of chemicals, but it would take a good deal of experimenting to find out one which would suit the climatic conditions in this country. By analysing the composition it was impossible to secure a formula. It was agreed between him and the defendant that the witness should use his formula in the manufacture of matches in the defendant’s Singapore factory. The defendant was satisfied with the formula and said so. Nobody else but the witness knew his formula, because he guarded it carefully. The defendant asked him for the formula but he did not get it. The defendant also tried to ascertain it by other means. On one occasion he was sick and had to go to Singapore and when he returned his clerk told him- Mr Knowles objected to the evidence. Mr Hopson Walker told the witness not to repeat what the clerk told him as he was not going to call the clerk. For Friendship’s Sake Continuing, the witness said that the defendant also asked him to send to him a statement of the exact amount of chemicals, etc., which he bought. He sent to the defendant an account of the things which he had to pay for but he did not send him an invoice from day to day. On Aug. 22, 1925, the defendant stepped into his office with some Chinese and wanted him to go to Singapore immediately. He enquired the reason for his sudden decision and the defendant told him not to ask questions but to go to Singapore as he was doing it for the sake of friendship. The defendant also said that owing to the noise of the machinery he could not speak in the factory and wanted the plaintiff to accompany him to the boat to talk matters over. The defendant also told him that he had brought back a man from China who would take charge of the Port Swettenham factory and if the witness did not want to go to Singapore he could consider himself dismissed. If the formula had been in the factory the witness would not then have been able to take it with him. Witness continuing said that he first met defendant in the Malayan Matches factory which he was then visiting. The defendant there extended to witness a pressing invitation to go and see his factory in Singapore. When witness left Malayan Matches Ltd., he went to Singapore and saw defendant and discussed with him a proposal to start a match factory in the F.M.S. The defendant was then arranging to visit China and the matter was left in abeyance. When he returned from China witness saw him in Singapore and discussed the matter thoroughly. Later on defendant himself came to Kuala Lumpur and on going more fully into the question it was found that defendant had sufficient equipment in his factory at Singapore to spare for the proposed new factory. They inspected several sites for the factory one of which was in Padu. It was found to be unsuitable. After the terms had been settled witness went to Singapore on Oct. 10, 1923, which he remembered because it was a Chinese festival day. He was met at the station by the defendant and they went together to the defendant’s office. There defendant told him that he had dismissed the manager of the Singapore factory and wanted witness to take temporary charge of the factory. Witness asked him what was to happen to the F.M.S. project and defendant assured him that it would be all right. He was on temporary engagement in Singapore on $300 a month until the case brought by defendant’s former manager was over. That was finished in March, 1924. After that witness began to sort out the machinery and send it on to the F.M.S. Defendant’s Profits Witness then went on to speak about the profits made by the Port Swettenham factory, and said that he was once shown a draft balance sheet drawn up in pencil on a sheet of foolscap paper. Mr. Hopson Walker wanted this balance sheet produced. Mr. Knowles said that the balance sheet need not be produced unless an accounting was found to be necessary. At that stage of the case he submitted it was no evidence of fact. His lordship enquired whether the defendant admitted showing the plaintiff any balance sheet. Mr. Knowles said he denied it entirely. His lordship asked Mr. Hopson Walker to go on with the examination. Witness said that a balance sheet was shown him. He remembered that one item in it was $6,000 which was put down as a loss in respect of the Singapore factory. Witness pointed out then to the defendant that the Singapore factory had nothing to do with the Port Swettenham factory and that the loss should not be included in the Port Swettenham accounts. There was another item admitted from the balance sheet referring to a profit made on the sale of a lorry, which too he pointed out to the defendant. The latter promised to correct the balance sheet, put it in his bag and carried it away and since then he had not seen it. He supplied to the factory at Port Swettenham certain spare parts which he himself had made and the prices charged for these were reasonable. When he left Malayan Matches Ltd., he was given a passage to England and he had actually received the tickets which he did not use because of the better prospects which he then appeared to have. A Verbal Agreement Replying to Mr. Knowles in cross-examination, witness said that he did not insist on having this agreement regarding the 50 per cent. profit in writing because he trusted the defendant. He admitted that when he took over temporarily the management of the Singapore factory he exchanged letters with the defendant with regard to terms. The reason why the terms regarding the Port Swettenham factory were not put into writing was because the defendant told him, that the plaintiff’s agreement with Malayan Matches Ltd., did not turn out to be quite a success but that he could take his word as his bond. Witness admitted giving evidence in the case which was brought by Mr. Evans against the defendant, which Mr. Evans lost. It was not true that as a result of that case the plaintiff suggested writing down the terms of service. The reason why witness left Malayan Matches was because he asked for a Sunday off to play a game of cricket. He got his Sunday off and went away taking with him the keys of the box in which his tools were kept. While he was away the automatic machine broke down, and when he returned he was told that the machine had been held up the whole of Sunday afternoon owing to the want of tools. Mr. Robins and he had some words over this as a result of which Mr. Robins went to Kuala Lumpur and sent him the notice. Malayan Matches asked him to accept one month’s salary in lieu of three months’ notice which he refused. Eventually he was paid three months’ salary and left in two months. Mr. Knowles: Why did you not sue Mr. Kim Soo for wrongful dismissal, as Mr. Evans? Witness: Because the terms are entirely different. In this case we entered into a verbal agreement to divide the profits on a 50 per cent basis. It was also understood that he could dispense with my services at any moment, and that I could leave his service in similar circumstances. Mr. Knowles: Then why did you claim salary up to Dec. 31? Witness: Because the balance sheet would carry on till that date. Witness, continuing, said that he was now staying with Commander Mills. He knew Mr. E.L. Watson who came to see him in the factory, and he showed him round the factory. Commander Mills and he were starting a match factory and that was a project he had in mind when he left Malayan Matches Ltd. He was in communication with a Australian firm which manufactured plant for match making. The defendant knew he was trying to secure certain agencies, any profits made by which would have gone into the profits of the defendant’s Port Swettenham factory. The defendant knew that plaintiff was attempting to start another match factory. Mr. Knowles: Do you mean to suggest that Mr. Kim Soo paid you $300 a month, found you accommodation and was prepared to give you 50 per cent. of the profits knowing that you were going to start a rival factory? Witness: Yes. Mr Knowles: I put it to you that you made every effort to wreck Mr. Kim Soo’s business with the object of starting your own business with Commander Mills? ---No. Witness continuing said that he had not passed either a chemical examination or an engineering examination. His knowledge had been acquired in various factories. The mixture which he had prepared, which was described as his formula, might be slightly better or slightly worse than any other similar mixture. Mr. Knowles: Can you explain to me what is meant by chemical reaction. Witness: It is good or bad effect caused by chemicals. I do not want to go into details. Mr Knowles: I say you are no more a machinery expert than any other man who had worked at Bryant and May’s. Witness: I claim to be above the average. Witness admitted ordering his own letter heads from a printing office in Klang before he left the employ of the defendant. His object in doing that was to use his own notepaper in writing to firms abroad whose agencies he was trying to get. If he got the agencies he would have obtained all the machinery which the defendant wanted at very low prices. He did not write to the Australian firm whose agency he had secured that he was manager of the defendant’s match factory because it would not have mattered very much to them. His lordship: By getting these agencies you were trying to sell this match making machinery in Malaya. Were you not throwing away means for the shadow? If you destroyed your own business where would your 50 per cent. of the profits be? Witness replied that he was in fact trying to help his business by getting machinery cheaply. Mr. Knowles here put before the plaintiff a whole bundle of letters which had passed between him and the defendant, and asked him whether he could point to one letter in which the arrangement regarding 50 per cent. of the profits was mentioned. Witness said that the matter was a private one and the defendant did not include it in any of the letters. Action Dismissed After reviewing the circumstances of the case, his lordship to-day delivered a lengthy judgement in favour of the defendant, with costs. He, however, allowed the plaintiff a sum of $464, being one month’s salary and costs of material supplied, and costs up to the date on which the defendant paid this sum into court.

The Straits Times, 12 May 1926, Page 10 Matchmakers' Secrets. Factory Manager's Claim Against a Proprietor. (From Our Own Correspondent.) Kuala Lumpur, May 11. An action was begun in the Supreme Court this morning before the acting Chief Justice (Mr. Justice Farrer-Manby) in which Mr. Daniel John Symons, formerly engineer of Malayan Matches, Ltd., and until recently manager of Mr. Lee Kim Soo’s match factory at Port Swettenham, is suing Mr. Lee Kim Soo for alleged breach of contract. (1066 words) (The same case as above)

The Straits Times, 22 May 1926, Page 8 The output from the Malayan Collieries Rawang, last year totalled 407,734 tons, an increase of 34,939 tons. Since it was first started, the colliery has produced over two-and-a-half million tons of coal.

The Straits Times, 7 June 1926, Page 7 , The Straits Times, 8 June 1926, Page 16 , The Straits Times, 9 June 1926, Page 16 LATEST ADVERTISEMENTS MALAYAN COLLIERIES LIMITED, require for their Borneo mine office a young English-speaking Chinese clerk. Applicants must possess a sound knowledge of bookkeeping and general accountancy and should be able to speak Cantonese, Hakka and Malay fluently. Knowledge of type writing is essential. Excellent prospects and a permanency for an intelligent and capable young man. Free quarters are provided. Written applications only, in the first instance, stating salary required, age and previous employment and enclosing copies of testimonials (original testimonials should not be forwarded but will be required if applicant is interviewed) should be addressed to the Secretary, Malayan Collieries Ltd., Kuala Lumpur.

The Straits Times, 15 June 1926, Page 7 The Straits Times, 17 June 1926, Page 14 . The Straits Times, 19 June 1926, Page 3 . MALAYAN COLLIERIES, LTD. NOTICE OF DECLARATION OF DIVIDEND No. 22 CLOSURE OF SHARE REGISTERS. 7 ½%. Etc. By order of the Board J. W. Fuller, Secretary.

The Straits Times, 21 June 1926, Page 3 Malayan Minerals. Alluvial Gold Found in Small Quantities. In his annual report to the F.M.S., the Chief Secretary states that the export of tin-ore, reduced to a metallic basis, and of block tin during the year was 45,926 tons compared with 44,043 tons in 1924 and 37,490 tons in 1923…. (Summary: gold from Raub Gold Mines (the only gold mine now working in Malaya) The production of coal from the Malayan Collieries Limited, Selangor, was 407,734 tons, an increase of 34,939 tons on the previous year. The Enggor Coal Syndicate, Limited, Perak, produced 350 tons of coal in 1925, of which 20 tons were given to the F.M.S. Railways for testing purposes, 209 tons were sold to mines and 121 tons were consumed by boilers at the collieries. An output of 40 tons a day is expected…increase in Chinese opening up gravel pump mines.) (231 words)

The Singapore Free Press and Mercantile Advertiser, 24 June 1926, Page 9 A BANKRUPT'S SHARES. EASTERN MINING CO’S DEBT. Official Assignee Seeks Directions. Shares in the Eastern Mining and Rubber Co. standing in the name of Poey Keng Seng, bankrupt, formerly managing director of the Company, were the subject of an application to the Chief Justice (Sir William Murison) yesterday. The Company, petitioning creditors in Poey Keng Seng’s bankruptcy, filed a proof of debt in which they set forth that they hold a lien on 2,263 shares, valuing them at $100 each. The Official Assignee (Mr. E. E. Colman), sought directions in connection with the Company’s proof of debt. 0. In the course of the affidavit of the Official Assignee it was stated that Poey Keng Seng was made bankrupt in February 1925. The Eastern Mining and Rubber Co. Ltd. filed a proof of debt of $588,681, claiming a lien on 2,263 shares registered in the Company’s books in the name of the bankrupt. The proof was based on two judgments obtained against the bankrupt, $413,000 representing 4,130 shares of which it was held that the bankrupt had fraudulently deprived the Company. There were 1,663 shares registered in the name of the bankrupt, and those shares together with 600 shares which had been previously acquired by the bankrupt, constituted the 2,263 shares referred to in the proof. 0. Mr. Colman remarked that the balance sheets showed nothing as to the value of these shares. It all depended, he believed, upon whether a certain coal mine was going to be profitable for sixteen years. 0. The questions before the court ..(Summary: How to value the shares. Tan Cheong Chew believes company should refuse recognition of fraudulent shares. Mr. Colman said Mr. Birnie and Mr. Poey Keng Seng initiated fraud. Mr. Campbell for the Company objected to Mr. Birnie being slated. The Chief Justice tells him he is only one to have a good word for Mr. Birnie. Mr. Campbell submits the valuation of the shares. They had acquired the property in Java by using shares. Increased capital in order to do so. Omitted to disclose commissions that certain persons received by way of fully paid up shares. Company started action against Poey Keng Seng, judgment went against him.) The Chief Justice: Why did they sue him? 0. “Mr. Campbell: Because he was backing Peck against J. A. Russell, who was a director of Eastern Mining Co. at that time. 0. The Chief Justice remarked that it was not the right thing to do since it released the others who had participated. 0. Mr. Campbell said that out of the 4,130 shares Poey Keng Seng got 1,663, part of his holding of 2,263 in the Company; the other 600 shares he had paid for. The Contention of the Official Assignee was that some of these other people were going to hand back some of these shares or pay for them, and that would give the Company another fund against which it could go for its judgment debt. 0. When the Chief Justice asked if this surrender was voluntary Mr. Campbell said it was not, and referred to the action started by Tay Lian Teck, Seah Eng Chan, Seah Eng Lim and other shareholders of the Eastern Mining Co. against Birnie, Yeo Ban Keng, Tan Way An, J. A. Russell, Tan Chong Kee and Tan Cheong Chew, who were directors at the time of the action against Poey Keng Seng, claiming damages for negligence in having sued only one of the joint tort feasors and not having sued the others. 0. The Chief Justice: It is a terrible mess, isn’t it? 0. No Disclosure to New Subscribers. 0. Mr. Campbell said he believed that it was part of Poey Keng Seng’s case that before the Company increased its capital disclosure had been made to then shareholders; not to new subscribers. It all arose out of a technical mistake. 0. The Chief Justice: More than that. The new subscribers are the people that you want to tell. 0. Mr. Campbell: They went the wrong way about it. Because of that you have “ dirty disgusting business”, fraudulent shares” and “stolen property” handed out ever since whenever this matter is dealt with in Court. 0. The persons who actually received the 4,130 shares were set out in the statement of claim filed in the shareholders action as follows: 1,030 to Poey Keng Seng; 350 to Birnie, 350 intended for Tan Wan Liat and transferred to him but the transfer not yet registered; 200 to Birnie subsequently transferred to Tan Chong Kee for no valuable consideration; 500 to Tan Wan Liat; 50 to Birnie, subsequently transferred to Tan Cheong Chew for no valuable consideration (which was not admitted); 133 to Birnie subsequently transferred to Poey Keng Seng; 100 to Birnie subsequently transferred to J. A. Russell; 0. 217 to Birnie. 500 to Tan Way An, 200 to Yeo Ban Keng, 100 subsequently transferred to Kim Hoe and Co.; and 500 to Poey Keng Seng, really intended for Lim Boon Keng. 0. (Summary: of total shares issued 18,852, the defendants controlled 11,902. The plaintiffs owned 4,385. Defendants could control any general meeting of company, so impossible for plaintiffs to get Company to sue defendants. Suggestion that shares were surrendered, not everyone agreed. They went on trial against Birnie, the only man who would not give in, and they were allowed to discontinue. Solutions discussed as to what creditor should get. His Lordship reserved his decision.) (1953 words)

The Singapore Free Press and Mercantile Advertiser, 3 July 1926, Page 8 SINGAPORE FREE PRESS. SATURDAY, JULY 3, 1926. (Editorial.) Developing Malaya. When we were dealing with the question of the Malay Rulers finding some more satisfactory expression of their gratitude to the Imperial Government than voting two million pounds towards the expenses of the naval base, we said that, leaving the principal of the gift aside for the moment, there were many objects upon which money could be expended which would be Imperial and even international in scope, and would be fitting vehicles for such gratitude. (Summary: Paper suggests need for college of tropical agriculture and tropical medicine. Malaya relying on tin and rubber, small sugar industry has died, copra has dwindled, Sir John Anderson most capable Governor since Swetteham urged planting community to develop other projects. Arghan fibre tried. Nipa palm, oil palms, tentative and spasmodic. Government efforts never on large scale. College of agriculture could provide training and could discover new useful plants and fibres. Malaya’s prosperity needs third leg. Rubber will meet with competition from Dutch. Sales will decrease. Americans will grow their own. Japanese … iron ore. Malayan Collieries have shown the same as regards coal, manganese in Trengganu. Government has to recognise revenues depend on natural outputs. Malay Rulers should insist on attention being paid to develop countries’ resources and encourage Malay people to participate. )(871 words)

The Straits Times, 3 July 1926, Page 16 CASSIFIED ADMTISEMENTS Wanted an intelligent young English speaking Chinese clerk who should be able to speak Hakka and Cantonese. Typewriting essential and knowledge of shorthand will be a preference. Good prospects and permanency for a young man of intelligence who would be given every opportunity to train and adapt himself to duties expected. Written application only, stating age and employment over last 4-5 years (original testimonials should not be enclosed but will be asked for if interviewed) Apply to the secretary, Malayan Collieries ltd., Kuala Lumpur.

The Straits Times, 13 August 1926, Page 7 , The Straits Times, 14 August 1926, Page 3 and The Straits Times, 17 August 1926, Page 3 THE MALAYAN COLLIERIES, LIMITED CANCELLATION OF LOST SHARE CERTIFICATES Nos. 59 and 1724. WHEREAS a Statutory Declaration has been made that the original of Share Certificates No. 69 and 1724, dated August 20, 1913 and January 14, 1921, in the name of Tan Poon Choh, Kuala Lumpur for 12 shares numbered 26328-26337 and 156093/156094 inclusive have been mislaid, lost or destroyed. Etc. J. W. Fuller Secretary.

The Straits Times, 14 September 1926, Page 7 , The Straits Times, 16 September 1926, Page 3 , and The Straits Times, 18 September 1926, Page 3 MALAYAN COLLIERIES, LTD. NOTICE is hereby given that the Directors have to-day declared a Second Interim Dividend of 7 1/2 per cent, (making 15 per cent. Interim distribution) in respect of the year ending December 31, 1926, payable on September 30, 1926. Dividend Warrants will be posted on the… etc. (739 words)

The Singapore Free Press and Mercantile Advertiser, 22 September 1926, Page 9 EASTERN MINING SHARES. Director's Claim Against Company. COUNSEL'S CRITICISM OF BIG LOANS. Further litigation relating to shares in Eastern Mining and Rubber Company commenced in the Supreme Court yesterday afternoon before Mr. Justice Deane. The Company is sued by Mr. Tan Wan Liat, a director of the Company, who seeks to have certain shares registered. 0. (Summary: Tan Wan Liat, wants to register his and his father’s shares. He has been director since 1920. Defence say his father was a Dutch subject and under Dutch East Indies law not his father’s executor. That other shares belong to Telok Pamoekan Company. Details of correspondence. Mr. Tan Wan Liat claims that his father was one of principal promoters in sale of Goeneng Batoe Besar to Company.) “In the course of his argument Mr. Page referred to a case which came before the late Chief Justice, Sir William Hyndman Jones. Mr. F. C. Peck wanted to be registered as a shareholder of Kempas Company. The directors made it a stipulation that he should not indulge in obstructive criticism and they refused to register him. Mr. Peck applied to the Chief Justice at Malacca Assizes to compel the Company to register him and the Chief Justice granted the order. Counsel submitted here that of the Company had refused registration for an improper purpose the Court would order registration.” (Summary Mr. Page argues that the Company’s refusal to register the shares is because they do want him to have a vote. Mr. Tan Wan Liat had opposed everything the directors had done. The balance sheet for 1924 showed loans to director and their interests. “ Tan An Way owed $30,000 to the Company, Yeo Bang Keng $35,000; Kim Hoe and Co. (which he said was simply a nominee of Yeo Ban Kheng, who was its managing director) also owed a considerable amount; J. A. Russell owed $40,000; and the Telok Pamoekan Co. $98,000. Mr. Page said that he did not think it would be disputed that Telok Pamoekan Co. really meant Dr. William Birnie. The Commercial Rubber Co. of which Yeo Ban Kheng was one of the directors, owed $86,000; and Poey Keng Seng the former chairman of the defendant company, was a debtor for $559,000. The Teweh Company, which counsel suggested was also Dr. Binie, was also among them. Among the investments was the Menoehan Coal Mines, a company which had an issued capital of $1,500,000, of which Tehweh owned $79,000, Tan Way An 79,000, Telok Pamoekan 23,800 and Eastern Mining 47,200. Menoehan, counsel suggested, was another name for the little ring of these directors who wished to keep Mr. Tan Wan Liat, off the Board. Counsel remarked that part of the Company’s business seemed to be to lend money to the directors…. Quoting from the 1925 balance sheet of the Company Mr. Page pointed out that Tehweh had increased its debt from $98,000 to $227,000. “ If you take this balance sheet you will see that the Company has an issued capital of $1,544,000, and if you add up the loans to directors and their interests- the Commercial Rubber Co., J. A. Russell, Poey Keng Seng and Menoehan Coal Mines -(a creature of these directors)- you will find that $1,600,000 or more has been invested in their pockets. It is clear that these directors do not want to be interfered with and the power to lend money to each other taken out of their control” 0. Before concluding his address Mr. Page handed in an underwriting agreement between Meoehan and Teweh, signed by Dr. Birnie, in which the rate of underwriting commission was 25 per cent. To all intents and purposes, he said, that amounted to a present of $250,00 in shares to Dr. Birnie. The hearing was adjourned.” (2195 words)

The Straits Times, 22 September 1926, Page 10 COMPANY SUED. Eastern Mining Company. Mr. Tan Wan Liat Seeks Voting Power. Loans to Eastern Mining Directors. The Eastern Mining and Rubber Company were defendants in an action brought one of their directors, Mr. Tan Wan Liat, in Mr. Justice Deane’s court yesterday afternoon. Mr. R. Page appeared for the plaintiff and Mr. Dudley Parsons for the defence. (1762 words) (Report of same case as above with some slightly different details)

The Straits Times, 4 October 1926, Page 12 Amalgamated Malay Estates. Dividend of 35 Per Cent. For Year. The following report is officially supplied: - The tenth annual general meeting of Amalgamated Malay Estates, Ltd., was held at Kuala Lumpur on Friday, with the Hon. Mr. Choo Kia Peng in the chair. The Chairman said: - The nett profit for the year under review is $339,654,10, as compared with a profit of $114,661.38 in the preceding year. We recommend the payment of a final dividend of 15 per cent., making with the two interim dividends of 10 per cent each already paid, a total of 35 per cent for the year, as against 15 per cent paid in respect of 1924-25. A further $70,000 is to be transferred to reserve for development making this account $200,000 which sum, when deducted from the amount at which the Company’s profits stands in the books, will leave a balance approximately corresponding with the capital issued. This appropriation is necessary as otherwise the large carry forward in profit and loss account does not represent liquid assets and is possibly misleading. With the lessons of the slump behind us, prudence suggests that it is now the primary duty of every planting company to provide for a rainy day. Against the investment of £2,300 in British War loan, it is therefore decided to appropriate to a reserve account the sum of $20,000 which action I trust will meet with your approval. New Area Opened Up.. During the past year we opened up and planted with rubber 273 acres on Serdang Estate, the cost being within the estimate of $17,000 which, considering the condition of the labour market, is an achievement on which our manager deserves congratulation. Since the close of the year, an area of 4 ½ acres situated within the Serdang Estate has been acquired, and with 12 ½ acres of adjoining jungle land owned by the company is being opened up during the current year. The year under review covers the period during which the price of rubber rose steadily to over 4s per lb. From May to July rubber averaged 3s 2d the export allowance being 65 per cent. From August to October the average price was 3s 7d and the export allowance was 75 per cent. For the quarter November to January, 1926, the price averaged 4s 1d, and the export allowance was 85 per cent. For the rest of the financial year the export allowance was 100 per cent during which period the price declined steadily, the year closing with rubber at 1s 8 1/4d. The highest level touched 4s 7d and at that time there was strong agitation in some quarters for the removal of restriction. Benefits of Restriction. Fortunately this agitation was unsuccessful, and I consider that the satisfactory position in which we find ourselves- and the industry as a whole- is due largely to the policy of restriction, without which many producing companies would long ago have ceased to exist financially. Speaking on behalf of the Asiatic planters, I can authoritatively state that what opposition there was to the continuance of control has entirely ceased. I can only express the confident hope that any short-sighted demand at any time for the removal of the present control will be strongly resisted by all parties. The report before you is a very full one and gives summarised details of the working and condition of your properties. Messrs Athorne and Evans, managers of our Jinjang and Serdang Estates respectively, have as usual rendered efficient service, and our thanks are due to them for the very satisfactory results obtained. In like measure our thanks are due to Mr. H. Armstrong, our visiting agent, for the valuable advice and assistance given at all times. No questions being asked, Mr. Hampshire seconded the resolution which was carried unanimously. A final dividend of 15 per cent was declared, making 35 per cent for the year. The retiring directors, Messrs. J. A. Russell and I. H. Armstrong were re- elected, as were the auditors, Messrs. Neill and Bell .(671 words)

The Straits Times, 28 October 1926, Page 10. Malayan Matches. Cessation of Production Reported. (From Our Own Correspondent). Kuala Lumpur, October 27. The annual meeting of Malayan Matches, Ltd., was held at 11 a.m. today in the offices of the Secretaries, Messrs. J. A. Russell and Co., Kuala Lumpur. 0. The Chairman, Mr. R. C. Russell, presided and in moving the adoption of the report and accounts, said:- 0. Gentlemen, the report and accounts have been in your hands for the prescribed period, and with your permission I will take then as read. It is greatly to be regretted a further loss falls to be recorded, the amount being $49,986.26 for eleven months working. 0. Of this amount $13,766.88 is an actual loss incurred in the manufacture and sale of the company’s product, the balance of $36,219.38 being accounted for by depreciation, debenture interest and loss on jelutong workings of $28,913.09, $6.187.50 and $1.118.79 respectively. 0. Match Production. 0. The production of matches during the eleven months, 103, 268 and 8/12 gross, shows a considerable decrease as compared with that during the preceding financial year. The financial position of the company has not permitted of any additions to the existing plant, and for the same reason it has been impossible to carry out the extensive repairs and replacement of parts which were necessary to enable the machinery to produce at its maximum capacity. 0. Further, the rubber boom which occurred during the period under review resulted in a migration of the skilled labour force as a result of the company’s inability to meet the demands for increased wages. 0. Finance. 0. In a circular letter, dated March 5, 1926, the shareholders were informed of the action taken by the debenture holders, who appointed a Receiver, after their demand for repayment of principal monies secured had remained unsatisfied. 0. The Receiver, under powers contained in the debenture deed and in the document making the appointment, carried on the business for seven months, during which time several attempts were made to dispose of same as a going concern, but without success. 0. I regret to report that in September the Receiver informed your directors that, under existing circumstances, the manufacture of the company’s product could not be carried on except at a further loss, and that the supply of raw materials being exhausted, it was his intention to close down the factory and cease manufacture on September 30, 1926. 0. The factory is now closed down and the Receiver has further informed the Board that he has sold the whole of the match making machinery. 0. It is greatly regretted that that it is most improbable that the claims of the debenture holders will be fully satisfied form the company’s assets; if this should be the case, there will be no surplus available with which to satisfy the company’s creditors, or with which to make any return to the shareholders. 0. I think that the Chairman at the last meeting made it quite clear that the scheme for reorganisation having failed to receive the support of the shareholders, the position which has arisen would ultimately be an accomplished fact. 0. As in the past, your managing agents have personally guaranteed payment of all bills of exchange drawn upon the company for supplies of chemicals, etc., and as will be seen from the accounts, have actually advanced free of interest the sum of $46,548.59 and are liable on bills of exchange to the extent of $3,444.50 0. Accounts. 0. The capital accounts have been increased by small additions amounting to $1.083.66 and have been reduced by depreciations amounting to $28,913.09. The decrease in sundry debtors and creditors is accounted for by the decrease in production with the corresponding decrease in sales and local purchase of supplies. 0. There has been a slight alteration in the amounts due to the three principal creditors. 0. Mr. E. Mudispacher continued in charge of the factory, and the directors wish to express their appreciation of his services during the very trying period that has been experienced. Before formally moving the adoption of the report and accounts, I will endeavor to the best of my ability to answer any questions form shareholders. 0. The Chairman formally moved the adoption of the report and accounts. Mr. J. Davidson seconded and the motion was carried. 0. Messrs. Evatt and Co., were reappointed auditors. (708 words)

The Singapore Free Press and Mercantile Advertiser, 26 November 1926, Page 15 MALAYAN MATCHES. This ill-fated undertaking has now finally collapsed, the machinery has been sold, and the factory closed down on September 30th. the loss notified in the report being just under $50,000.

Passenger ships list on findmypast 8 Dec 1926 Port of Departure Liverpool Destination Penang John Archibald Russell aged 44 male, merchant, ship Sarpedon, Blue Funnel Line Going to China. 105 passengers on board.

The Straits Times, 11 December 1926, Page 7 and The Straits Times, 13 December 1926, Page 13 MALAYAN COLLIERIES DECLARATION OF DIVIDEND no 24 & CLOSURE OF SHARE REGISTERS 7 1/2 %. etc. J. W. Fuller, Secretary.

Post card of Sarpedon, Blue Funnel Line. 13 Dec 1926. Port Said. From Archie to Hilda Russell about tea and ginger.

FROM PROCEEDINGS OF THE FEDERAL COUNCIL OF THE FEDERATED MALAY STATES. VOL 1-1926 Mr. Wong Yick Tong: Sir, I wish to refer to the subject of the import duty on matches. This was a duty which was originally introduced as a war tax. On the termination of the Great War it was kept on for the purpose of helping the local industry, especially the Malayan Matches, Ltd. Although this duty brings into Government a revenue of over $300,000 yearly, yet I think Government should consider its removal. As is well known the primary object of the imposition of this duty has not been achieved. Matches are articles that are consumed by all, rich and poor alike. They are a necessity of life and fall within the category of things which it is the well-established fundamental policy of the British Government to exempt from taxation. Sir, I ask and I hope that Government will withdraw this duty regardless of the fact of the revenue it produces. The President: With regard to Mr. Wong Yick Tong’s remarks on the duty on matches, I have to go further into that matter with the Customs. He did not state that any hardship had resulted or that there had been any increase in the price on that account. The position is that it was not a war proposal. It was a post-war proposal. I think it started in 1919. The result of it has been that, in order to escape the import duty, match manufacturers have opened factories here, but they cannot claim to be entirely a local industry because they import the whole of the wooden timber used to make matches. The object of the notification, which I announced the day before yesterday would be withdrawn, was to meet this. It was on a graded scale so as to give preferential treatment to the genuine local manufacturer. It started with seventy cents per ten thousand cases as against a dollar import duty and came down to 40 and 20 cents according to the proportion of local timber used. That, I think, is a fair basis. But, as I said, I am quite ready to consider the matter further. Mr. F. G. Harvey: With regard to the tax on matches, I wish to do away with any impression that the tax is for the purpose of increasing the profits of a company that has recently been started or any other companies. It was merely asked for as a protection against dumping. I wish to explain that in case a wrong impression might have been formed.

The Straits Times, 23 December 1926, Page 8 The Straits Times THURSDAY, DECEMBER 23. DIRECTORS & THEIR CRITICS. (Editorial) There seems to have been quite a little breeze at the annual meeting of the Malaka Pinda Rubber Company. The persistent shareholder can be a sore trial, and Mr. Peck knows how to be persistent, so it is perhaps not surprising that that Mr. Tan Cheng Lock was somewhat ruffled. Mr. Peck frequently has that effect on chairmen of meetings. We are not concerned for the moment with the merits of the discussion. There may be a good deal in Mr. Peck’s contention that the directors are going to undue lengths in acquiring new land; on the other hand the chairman may be right in maintaining that they are merely making a wise provision for the future. It is all a question of point of view. Mr. Tan Cheng Lock, who pointed out that the directors are also shareholders and are spending their own money besides that of other people, was correct in stating that a certain policy of extension has always been held to be a sound one for a rubber company. But shareholders have a right to ask questions, and Mr. Peck has done valuable work for years in seeking to ascertain certain facts than are given in directors’ reports and their chairman’s speeches. The annual meeting is the one occasion of the year when shareholders can meet their directors on an equal footing and find out all there is to know about what is the joint property of all of them. Usually, in Malaya, though the acquiring of shares can almost be described as a national pastime, there is an extraordinary apathy on the part of shareholders. If things are going reasonably well they are content to leave everything to the directors, and annual meetings are little more than mere formalities. The man who wants to know is a rare being, who usually does nothing more than write to the papers, so the fact that Mr. Pecks are not plentiful is an additional reason for giving every consideration to their questions when they do happen to be made. Directors of companies have a good deal of power, and they must expect to be criticised on occasion. They are not in the same position as the committee of an association which has to be elected annually. Vacancies on the board do not occur all at the same time, and once appointed, directors have the control of affairs very much in their own hands. In the case of Mr. Peck, he takes the trouble to inquire into the affairs of a company in which he is interested to an extent quite unusual in an ordinary shareholder, and he is not afraid to state his opinion when the occasion arises. His action in the matter of Malayan Collieries is local history. Though he may be a thorn in the sides of directors he is a useful man to his brother shareholders who are too apathetic or too afraid of the limelight to seek information for themselves, and if he may occasionally err on the side of undue persistency the fault if any, is a good one. These are not over-bright days in the rubber industry, and there was never a time when directors could profitably take shareholders into their confidence and be ready to listen to advice. It is not necessarily the man with the largest holding who is able to see into the future most clearly. While Mr. Tan Cheng Lock and Mr. Peck may both have good grounds for their point of view, it is a matter of common knowledge that there has been a good deal of criticism of policy in the case of Malacca companies and directors would do well to give due consideration to the case for the other side. Nothing is lost by giving a grievance full ventilation and discussing it from every point of view, and the more information given at general meetings the better it is for all concerned. The principal applies to other companies not only those concerned with the cultivation of rubber. While on this subject we do not think we are out of place in again referring to the case of the Pontianak Gold Dredging Concessions, which continues to be a chief topic of discussion in local business circles. The position as it stands at present is that the consulting engineer specially sent down to make check bores on a property which shareholders had been led to think was a very rich goldfield wrote a report in which he said he was positive that salting had occurred. The resident managing director and consulting engineer replied, as was only to be expected, that he did not believe this and he was convinced that the property was as valuable as he ever thought it. The directors have decided to have further bores made. This is, of course, quite reasonable as far as it goes, but it was generally expected that a general meeting would be called when the position would be put fully before the shareholders and they would have the opportunity of asking questions. The managing director himself said he expected that this would be done. It is evident now that no such meeting is to be called, and it is not surprising that some shareholders are expressing dissatisfaction with the attitude taken. A general meeting would have cleared the air, and would not have disturbed the gold which we all hope is to be found on the Pontianak concession. We think the directors would have acted wisely if they had followed the suggestion that an extraordinary general meeting should be called.

1926 News and other sources.

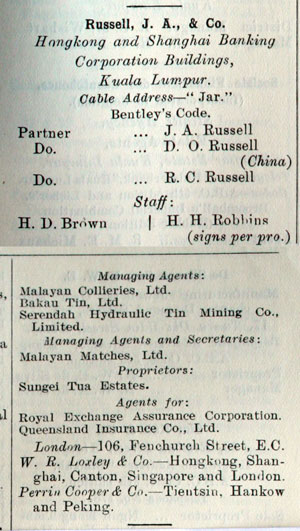

Russell, J. A., & Co.

Hongkong and Shanghai Banking Corporation Buildings, Kuala Lumpur.

Cable Address :-“Jar”

Bentley’s Code.

Partner J. A. Russell

Do. D. O. Russell (China)

Do. R. C. Russell

Staff

H. D. Brown H. Robbins (signs per pro)

Managing Agents:

Malayan Collieries, Ltd.

Bakau Tin, Ltd.

Serendah Hydraulic Tin Mining Co., Ltd.

Managing Agents and Secretaries for

Malayan Matches, Ltd

Proprietors:

Sungei Tua Estates.

Agents for

Royal Exchange Assurance Corporation

Queensland Insurance Co., Ltd.

London—106, Fenchurch Street, E.C.

W. R. Loxley & Co.—Hongkong, Shanghai, Canton, Singapore & London.

Perrin Cooper & Co.—Tientsin, Hankow and Peking

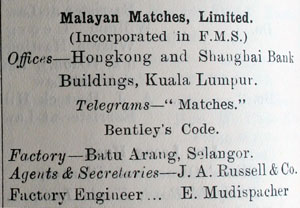

Malayan Matches, Limited.

(Incorporated in F. M. S.)

Offices- Hongkong and Shanghai Bank Buildings, Kuala Lumpur

Telegrams—“Matches”

Bentley’s Code.

Factory—Batu Arang, Selangor.

Agents and Secretaries J. A. Russell & Co

Factory Engineer E. Mudispacher