For the descendents of Richard Dearie and his son John Russell

Documents about the history of Malayan Collieries. 1908-1922

Transcribed by Claire Grey unless otherwise stated.

1908 Coal is discovered in Malaya.

The Malay Mail, Saturday, 26 February 1910

Coal at Rawang. Those who were privileged to visit on Tuesday the coal mine recently discovered near Rawang had an interesting experience. In addition to Mr. F. J.B. Dykes, Senior Warden of Mines, who had arranged the visit, there were Messrs. W. Trump Director of Public Works, W. Eyre Kenny who is to act for Mr. Dykes, when the latter goes on leave, M.A.V. Allen, Assistant Warden of Mines, R. G. Evans, A.R. Mynott, H.P. Clodd and A.E. Bailey. Mr. S.P. George is resident on the coalfield. The Government authorities were informed by a Malay some months ago that some black looking chunks like coal were lying about the jungle, and enquiries were at once made, with the result that operations have now been in force for the past few months. The route to the mine is via the Kuala Selangor Road from Rawang. About 8 miles from Rawang a track strikes off to the left of the road through the jungle, and a walk of about three miles through this jungle brings us to the head of the mine. Shafting and tunnelling has already commenced. The members of the party descended the shaft about 10 feet down and proceeded through the tunnelling, when a fine seam of coal was seen. The tunnel continues for some 50 yards and pits have already been sunk in various directions. The surface coal is somewhat light and possesses a good deal of shale, but the lower appears to be pure coal, being quite black and fairy hard. It contains we understand about 46 per cent of fixed carbon. Experiments have been made with it up in Perak. In one case an engine was started with wood fire, and on the coal being substituted the pressure rose from 60lbs to 75lbs. It is thought that it may be useful for working a suction gas plant. We understand some 20 acres have already been proved and this represents a quantity of some 600,000 tons. Further pits have been sunk in extended directions and these also give indications of coal. It is quite possible that there may be a million tons within a comparatively small area. The commercial quality of the coal has yet to be proved, although tests have already been made, and the results, we are told, are encouraging. The cost of transporting the coal under present conditions is, of course, very heavy as the coal has to be carried on bags by coolies through the jungle to the Kuala Selangor Road, and then conveyed by bullock cart to Rawang. A proposal is under consideration for a light rail track to be laid, and, if this is done, the coal should be able to compete easily, with imported coals and, provided the quality proves to be really satisfactory in use, a very fine addition to the other valuable products of the F.M.S. will have been recorded.-

Letter November 17th 1908 From Mine’s Office Serendah to Warden of Mines, Kuala Lumpur.

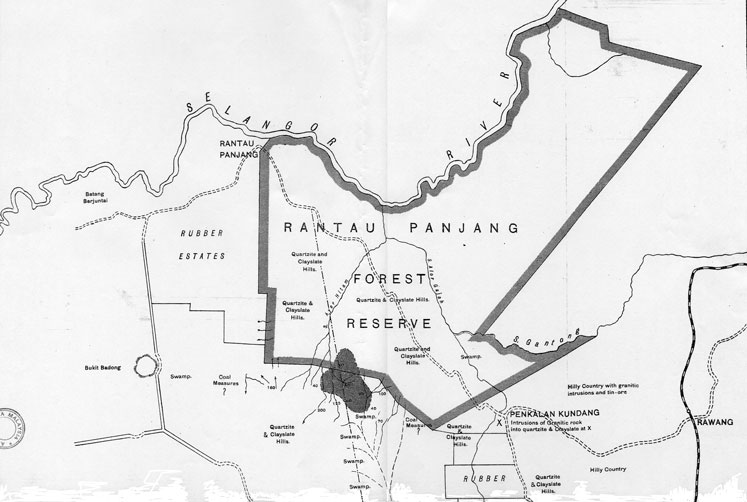

Sir, I have the honour to supply herewith further details regarding the find of supposed coal in the neighbourhood of the Kuala Selangor Road. 2. Last Thursday the 12th I visited the place in company with the finder, an old Malay (75) by name Hadji dul hadji. 3. We left the K. Selangor Road at about the 24 and half mile and following a woodcutter’s track south of the K. Selangor road struck the cleared trace of the Rantan Panjang Forest reserve boundary. This we followed for about 4 – 5 miles, finally bearing south again for about one mile, we reached the spot at which the specimens had been obtained. I attach a sketch map showing the approximate position of the place, which may lie in either the Kuala Selangor district or in that of the Ulu Selangor. 4. The old Malay holds a dulang pass. 5. The place lies in dense jungle and the shallow pits ( 1ft) where the mineral was found lie at the bottom of a gentle slope. The coal was found in 3 or 4 small pits along the bottom of this slope. 6. I extracted several large samples from one of these, which samples I have brought back with me. 7. I could tell nothing of the probabilities of the deposit if any, from the few holes filled with muddy water. A few small prospecting pits would need to be sunk about 10 feet above these holes on the rising ground and a few on the other side of them in order to test the inclination and width of a possible seam. 8. I suggest an analysis of a sample to determine its constituents and calorific properties. Should anything result from this then the pits might be sunk at Government expense. I have etc: Sd: V.L. Aspland. Inspector of Mines, Serendah.

Document in the National Archives of Malaysia 5841 1908

Letter 28th August 1909 . Papan, Perak.

To the Senior Warden of Mines Sir, I have the honour to submit the following short report on the small sample of coal tested today on the Chain Grate Stokers at Siputeh Power House. (1) The coal is very similar in physical aspect to the Brooketon coal supplied by the Sarawak Government. If anything, it is slightly duller on the fracture, possibly due to a higher percentage of moisture either combined or occluded. (2) When put on the grate, the coal caught fire easily and burned with a short flame, quickly giving up all its gaseous constituents. (3) It continued to burn with a red glow, giving out apparently a good heat; in almost an identical manner to the Brooketon Coal. (4) It appears to burn away almost completely to a fine ash leaving no clinker and but very little residue. (5) The coal probably requires a good draught and close fire bars – so as to prevent the finer half burst portions from dropping through – as it has no tendency to clinker or cohere at all, each particle remains separate and would unless the fire bars were close probably drop through in half burst condition. (6) Tried in a blacksmith’s forge the coal burnt freely and gave out a good deal of heat. Its non clinkering properties make it useful in this direction. I should be very glad to give the coal a proper trial at the Power House and submit you a report on the same, as to its steaming qualities. I do not however anticipate that it will quite equal Brooketon Coal. For this please let me have as large a parcel as possible- so that the test may be over a fairly long period to give the coal a proper trial- 10 tons would be sufficient for 1 day- 1and half days. I have etc. sd W.M. Currie, General Manager.

Document in the National Archives of Malaysia 5841 1908

1909 The Government tests the coal.

Letter 15 January 1910 From Geological Department to Secretary of Resident, Selangor. Geological department Kuala Lumpur. Batu Gajah. Lignite near Rantau Panjang

Sir:- I have the honour to submit the following remarks in connection with a recent conversation with the British Resident on the subject of the lignite now being prospected by the Mines Department near Rantau Panjang. 2. I visited the locality on January 10th 1910 and concluded from what I saw that even if the seam being opened up now proves to be of too poor quality to use, the neighbourhood should be thoroughly examined, for it is possible that seams of “coal” as good as the Sarawak “coal”, and oil may occur. 3. I learned from Mr. Aspland, of the Mines Department that it was proposed to bore through the present seam, with a hand boring plant, and I told the British Resident that if any boring were to be done the big steam boring plant belonging to the Mines Department and now in Kuala Lumpur, would, if employed, give very valuable information, a result that can hardly be expected from a hand boring plant, seeing the nature of the rocks to be pierced. The steam boring plant is, I believe, capable of boring 1,000 feet, and I should be inclined to put a bore as far below the exposed seam of lignite as possible, in search of better seams of lignite or of coal, and of deposits of oil. 4. I propose to explore the neighbourhood myself this year, and in the event of a deep bore being put down, would wish to be present during the operations in order to prepare a record of the rocks passed through. I have the honour to be Sir, your obedient servant. J. B. Scrivenor Geologist F.M.S.

Document in the National Archives of Malaysia 5841 08

To Senior Warden of Mines from Mungo Park.

Sir, In accordance with your instructions I have the honour to submit herewith my report upon the recent coal discovery at Rawang:- 2. I paid a visit to the prospecting pits on the 9th of March and took a number of samples from that portion of the outcrop, which has been exposed in the adit driven across the southern portion of the latter. On my return with the aid of a calorimeter made at the Kuala Lumpur factory, Mr. Eaton and myself tested the evaporative value of the samples thus taken for comparison with the coals of local use; the latter coals were also tested under similar conditions. In my opinion such a series of tests being the most comprehensive way of showing the value of the coal recently discovered. 3. Mr. S. G. George has also kindly allowed me to use a prismatic survey of his showing the location of boring pits sunk through the surface alluvium, indicating the nature of the bed rock struck in these bores. I am also indebted to Mr. George for information regarding the topographical features of those parts of the neighbourhood which I was unable to inspect during my necessarily short visit to the property. 4. The information at present being limited, my opinions must be taken as merely opinions, and not as proved conclusions. However all the minor indications observed by me corroborate each other so exactly, that I have good reason for believing that my views as to the nature of the deposit will ultimately be found to be correct, notwithstanding the fact that my deductions are at variance with the opinions of some of those who have previously visited the property. Nature of the occurrence. 5. Some forty bores have been run through the surface alluvial proving the outcrop over an area of about 20 acres. The surface width of the outcropping coal being shown as about 500 feet, and the seam or seams have been exposed for about half a mile along the strike. 6. The formation appears to dip approximately South 15 degrees W at an angle of about 15 degrees, very clear records of dip being shown in the adit. The strike is approximately E 15 degrees S to W. 15 degrees N a direction which if persisted in would carry the outcrop to the neighbourhood of Pengkallen Kundang in the East and would cross the Kuala Selangor Road between Batang Berjuntai and Kam Kuantan in the west. The information at hand at present is however not sufficient to indicate whether such an extended continuity of the outcrop is likely to occur. As far as can be ascertained at present the coal is overlaid conformably by beds of shale. The coal in its turn resting conformably upon shale beds. From the few specimens shown me on the property the footwall shales seemed to be darker and harder than the shales in the roof of the seam. The former shales should form a good floor for mining purposes if they immediately underlie the coal. 7. The outcrop seems to be marked topographically by slight surface depression. The surface of the ground being more or less marshy. From what Mr. George tells me of the topography to the East of the borings it is possible that the seam may be faulted in that direction. Nature of the Coal. 8. Only about one third of the coal across the outcrop has been sufficiently exposed to allow samples to be taken. The third in question representing the upper seam or portion of the seam. I have mentioned seam or seams throughout as the outcrop has not been proved yet to be homogenous in character. The third in question however represents a seam of over thirty feet in thickness with a few bands of shale running through it. The coal is hard and should stand well for mining purposes, though its hardness will probably prevent the use of chain or sawcutters when mining commences. 9. I note that the coal has been termed a lignite by the Government Geologist. It differs very materially from the German lignites or Brauenkchler with which I am acquainted, but in chemical composition it has a greater resemblance to the latter than to the local coals commonly in use in Great Britain. I would describe it less definitely as a Hydrous Coal, the amount of moisture present in a specimen analysed by the Government Chemist being 20%. The chief disadvantage of such coal is that it tends to crumble if stored or stacked. The moisture present also tends to lower evaporative value. The tendency to crumble and the moderate evaporative value of the coal seem to be its only disadvantages. The amount of ash is exceedingly small (as analysed) and the coal seems to be singularly free from sulphur and it should be possible to mine and screen it free from shale and dirt of any description. 10. In a country such as this where coal has to be brought from India, Borneo, and Australia, the discovery is of great economic importance. During the year of 1908 the FMS railways consumed 53,147 tons of bakau firewood at $3.34 per ton and 19,440 tons of coal at $9.60 per ton. On the evaporative value tests the former could be replaced by 24,000 tons and the later by about 26,000 tons of Rawang coal making 50,000 tons in all. The total expenditure on fuel as described above being over $350,000. The Rawang coal would be in a position to compete with the imported coal and bakau if sold at $7 a ton. I believe that during the present year the price of imported coal has been reduced but in my opinion the conditions are such as to make it impossible for foreign coals to compete with Rawang coals wherever the latter are practically adaptable for steam raising in this country. 11. I append below a statement of the comparative values of coal in local use. All the results were obtained by Mr. Eaton and myself in the laboratory at Kuala Lumpur. In noting the evaporative value of 10.6 for Rawang coal I may add that in 1906 I made a very large number of tests upon Transvaal Coal and that the average results obtained by me showed a lower evaporative value than the samples obtained at Rawang. During the year 1906 about 3 million tons of this Transvaal coal were raised and sold at the pits mouth for 5/5 (or slightly over two and half dollars) a ton. Tests of evaporative value. Thickness of seam represented by sample. Lbs of water evaporated per lb of coal. Rawang Coal a. 3’ 9.0 b. 4’2” 10.2 c. 6’9” 10.6 d. 4’6” 9.6 e. 8’0” 9.8 f.10’0” 10.6 Total Average 36’5” 10.1 Borneo coal used Electric light station 14.4 Chinese anthracite used at Salak South Mine 12.4 Australian Coal from FMSR 13.4 Indian Coal (present contract) FMSR 13.2 Indian Coal (old contract) FMSR 13.6 The samples of Rawang coal were taken from the outcrop a most unfavourable situation. Moreover the whole outcrop section is not yet available. It is therefore a reasonable assumption that when the whole of the seam is exposed in depth these values can be improved upon. The weathered nature of the outcrop should be born in mind when attempting any tests upon a larger scale. 12. I am indebted to Mr. Forbes of the FMS railway for the information that in practice one ton of coal has an evaporative value equivalent to 3 tons of Bakau firewood. The evaporative value of the bakau may therefore be taken as about 4.5 for comparison with the fuel tests previously mentioned. The last Railway report gives $4.34 as the price of this fuel; a price that is likely to be maintained if not increased. 13. In connection with working coal a few rough facts and figures are of interest to indicate the value of the coal on a commercial scale. The Labuan collieries have a capital of $60,000; therefore $500,000 may be taken as a general figure for colliery equipment. The cost of hewing coal in Great Britain is less than $1 per ton (underground expense only). The total cost of coal winning in American coal fields never exceeds 2.70 a ton (Coal and Metal Miners Pocket book). The sale of Transvaal coal has already been given. From these figures a maximum working cost of $3.00 a ton can be safely assumed, a cost at which coal could be sold for the same price as Bakau with a margin of profit. As the coal has more than twice the heating power of the wood it would probably be readily marketable at $5.00 a ton. With two dollars a ton profit the sale of 50,000 tons to the FMSR would yield $100,000 or 20% on the assumed capital previously taken. This return to the Government would be in addition to any saving that would be effected by using coal at $5 a ton, no outside sales are also taken into consideration in the above figure. These rough facts and figures are not put forward in any authoritative way, they are merely given as indicative of the fact that the government in supporting a future coal industry in this country, will not only give stimulus to manufacturing in this country by fostering a great source of commercial prosperity, but will also receive a substantial return for any money invested. Prospecting. 14. From what I have previously written it is evident that this find is, in my opinion, a valuable one, and it is important that vigorous measures should be adopted with a view to opening up, and developing this deposit. 15. It is an axiom amongst miners that a colliery well prospected is half won. The idea is based upon the fact that whereas in a metal mine the main object is to follow up and extract payable areas from a lode of variable values, in a colliery, the coal is usually more or less of uniform value, and greater attention is paid to laying out the workings, so as to ensure cheap and efficient mining. Thus, colliery shafts are sunk with a certain scheme of working outlined beforehand, and are located with a view to underground drainage and haulage and ventilation. Such scheme can not be outlined unless full details are available for its conception. 16. No attempts to work the property should be made until the ground has been thoroughly prospected. I mention this because a very small amount of irresponsible mining along the outcrop may (the seam dipping as it does) form a reservoir which might have to be subsequently drained. 17. In prospecting I consider the most important step, at first, is to obtain by boring a complete cross section of the formation along the line of the dip. The dip of the formation at the outcrop being about 15 degrees. Each bore hole will prove the ground to the North to the extent of four times the depth of the formation passed through. (In the latter measurement, surface alluvial, lying unconformably on the formation is to be neglected). Thus a bore 123 feet deep passing through alluvial 23 feet, and shale 100 feet will probably indicate a shale outcrop to the north for 400 feet. Very complete notes should be kept of such boring, and samples of all rocks in the formation should be kept for reference. Such samples are certain to be valuable when lateral investigations are made along the line of strike. A complete section having been obtained along the line of dip, lateral investigation may be started and I would suggest that in the first instance investigations should follow the strike eastwards viz. in the direction of the Railway line, as if coal of good quality is found in this direction money may be subsequently saved in Railway sidings. Boreholes in lateral investigation can be placed a considerable distance apart as even if they do not strike coal a good indication of the whereabouts of the seams can be obtained by comparing bore sections with the complete section of the formation as previously described. Where faulting is proved to have taken place the location of the bores must be modified to suit the circumstances of the case. 18. While the section along the line of dip is in progress, work might be carried on as heretofore with the shallow boring set. I would suggest that at every ten chains East along the line of strike three or four bore holes be set transversely across the strike. I would strongly recommend a topographical survey of the neighbourhood being undertaken at once. Such a survey would be useful as an aid in prospecting and will be absolutely necessary later on when sites for shafts, surface plant dumps, and so forth have to be laid out. 19 In this later connection I would depreciate any Public Works of a permanent nature being set out in the neighbourhood of the seam until further investigation has taken place, as the most suitable point for attacking the coal seam is quite likely to be at a some distance from the spot where exploration is at present in progress, (a rough track for the conveyance of boring tools and temporary quarters are of course necessary). The inflammable nature of the colliery dumps also precludes their location in the near neighbourhood of buildings. The topographical map mentioned above should be roughly coloured and show sources of water supply. I have etc. sd. Mungo Park, Certified Colliery Manager (Transvaal) Inspector of Mines F.M.S.

Document in the National Archives of Malaysia.

Letter: 21st March 1910 from Office of Senior Warden of Mines to Fedr Secy F.M.S. Kuala Lumpur.

Subject:- Mr. Mungo Park’s report on the Rawang Coal Deposit. Sir, I have the honour to forward for your information a copy of a report by Mr. Mungo Park on the Rawang Coal Deposit. 2. I agree with Mr. Park regarding comparative tests as mentioned in his paragraph 2. 3. The area now proved is considerably in excess of 20 acres. 4. This coal is undoubtedly a Hydrous Coal, and as such will not stand storage, and would have to be used, as soon as practicable, after being mined. 5. In my opinion the economic value of this coal largely depends on whether it can be used profitably, in Suction Gas Plant; and though no tests have been made, there are no grounds for doubt on this point, as the percentage of sulphur is very low. 6. One to three is a reasonable proportion to take for comparison with Bakau Firewood. 7. It is premature to say more than that, this discovery is a valuable one, and I am not prepared to quote costs, either capital or working, until the extent of the deposit has been proved; but I agree that no attempt to mine should be made until prospecting has been completed. 8. In another letter, I am making recommendations to carry out the work of thoroughly prospecting this find. 9. A topographical survey of the neighbourhood is indispensable, and I would ask that the Survey Department might be instructed to aid in this direction. 10. I agree that no permanent works should be undertaken until the situation is fully defined. 11. Attention is invited to the fact that this find is so far proved that expenditure on defining its extent is warranted, and is urgently required vide my No. 58/10 of 1910. I have the honour to be, Sir, Your obedient servant, sd. W. Eyre Kenny Ag. Senior Warden of Mines ,

F.M.S. Document in the National Archives of Malaysia (155/10)

Letter: 17th June 1910 From London and Malay Syndicate to British Resident applying for prospecting licence for Rawang Coal. (Received 8 July 1910)

London and Malay Syndicate Limited, 16 King William Street, Strand. Sir, I have the honour on behalf of my Syndicate to apply for a prospecting licence to prospect for coal over the area of land near Rawang in Selangor, where I understand that the Government has discovered Coal and Lignite. I have already made this application to the secretary of State for the Colonies, who has informed me that the correct procedure is to apply to you. My Syndicate is prepared to at once commence prospecting operations on a large scale and will when it is ready send out a first class Coal Expert to report on the property. They would require fro the Government the right to select a thousand acres in blocks of not less than 100 acres each, in the event of the Expert’s report proving favourable. I attach herewith a list of our principal shareholder to enable you to see our financial strength and as a guarantee of our position; from which you will understand that in the vent of a favourable report we shall be able at once to form a large Company for the proper working of the field. It is a matter of course understood that any reservation of Imperial Preferential rights or such protection for the local mining industry as may be considered fair would be accepted by my Syndicate. I will send separately Bank draft to cover the fees for the above prospecting licence. I have the honour to be, Sir, Your obedient servant A T Nation Manager. List of Shareholders Lord Grimthorpe, B. de Bertodano Esquire. C. de Bertodano C.E., Platt & Co. Turner Schon & Co., Marshall Sons & Co. Ltd. Britannia Iron Works Gainsborough, Skinner Turner Esquire, A. J. Plowes Esq. (Further names will follow)

Document in the National Archives of Malaysia 2961 10

Letter from the London and Malay Syndicate Limited, 16, King William Street, Strand. London. 19th August 1910 to W. Eyre Kenny. Senior Warden of Mines Kuala Lumpur, F.M.S.

Sir, I have the honour to acknowledge the receipt of your letter No 337/10 of July 12th 1910. 2. My company would be perfectly prepared to abide by the conditions contained in paragraph 2 of your letter under reply in the event of the lease being applied for and issued to the company. 3. Since last writing to you we have had some correspondence and an interview with Mr Dykes. What we desire is a licence to prospect over a considerable area of land, with the immediate right to take up, if prospecting is satisfactory, a large area of state land, with the further right to be allowed to take up an equivalent right of state land if we observe the conditions of the lease to the satisfaction of the Government. In short what we ask for is a definite promise of Land if prospecting operations are satisfactory and a definite reserve of State Land adjoining for further prospecting with a definite promise of a lease of such area if the further results of the prospecting are satisfactory. 4. I note that no export duty will be charged. “Pit Head Royalty” is mentioned. I am unable to say now definitely what Royalty we should be prepared to give in consideration of an issue of Lease or Leases under the Mining Enactment of 1904. It is a point to be agreed upon after we have prospected the land and found out the extent and value of the deposit, but we feel certain that the Government would not contemplate exacting from us a Royalty that would be irksome to our enterprise. 5. In paragraph 3 of your letter you ask for information as to (a) capital expended and (b) The name of our proposed advisor. We are prepared at once to expend anything up to £10,000 in prospecting the land and proving the extent and value of the deposit, and we are prepared to despatch at once a Mining Engineer to prospect on our behalf. With regard to a Professional advisor we have consulted Mr. Dykes. His opinion is, and we are of the same opinion also that the first operation is to prospect the land thoroughly by shafts and with a diamond drill to find out the area and extent of the deposit, and from samples of the coal sent home, to then gauge the value for raising steam. When once we are in possession of these facts we shall employ the best professional advice we can obtain, and we are now in a position to do so, but at present do not see that such a course is necessary. 6. The Shareholders of our company are influential men who are prepared to work the land on such reasonable conditions as the Government may think fit to enforce and should after prospection the results seem unfavourable we should then determine our negotiations. On the other hand if prospecting is satisfactory then it would be our intention to immediately exploit and develop the land. 7. Mr. Dykes has given us to understand that to enable us to place coal on the market, a cart road, or a light Railway will have to be made to the most convenient point on the Railway, and we have no doubt that facilities on terms to be agreed upon would be given us by the Government to make a road or Railway on state land and also facilities for making sidings to connect with the Main Line in the F.M.S. Railway. 8. I herewith enclose an application form for the land we require so that there may be no doubt about this matter we ask for (a) The right to prospect over the area mentioned in Notification No. 22 (b) The right to apply for the lease over the total area held under prospecting licence or such less area as we may select and (c) A reserve to be held for us of an equivalent area, lease for which is to be issued if work satisfactory to the Government is carried out on the first lease or leases issued or (d) Such modifications of the request above mentioned as may seem suitable to the Government. 9. We are dispatching this day cable to the following effect “ have consulted Dykes letter despatch asking for prospecting Licence over coal area please wait and cable us acceptance “ offer or not”. I have etc, Sd. A. T. Nation, Manager, London and Malay Syndicate Limited.

Document in the National Archives of Malaysia 4022 1910

Letter from the London and Malay Syndicate Limited, 16, King William Street, Strand. London.W.C. 12th August 1910 to W. Eyre Kenny. Ag. Senior Warden of Mines Kuala Lumpur, F.M.S.

Coal Concession Sir, I beg to acknowledge receipt of your letter of the 12th ultimo and to thank you for the information enclosed therewith, as you have suggested I have communicated with Mr. Dykes requested an interview. You are no doubt aware that at this period of the year most people of importance are away from London for the holidays this will cause some little delay in furnishing the name of our professional adviser and other information in respect of capital which you have asked for but will probably follow by next mail, meantime I am instructed by my Directors to say that there will be no unnecessary delay on their part- that they are prepared to spend at least £5,000 in preliminary explorations, and they anticipate no difficulty whatever if their investigations are satisfactory in finding whatever capital may be required for working the whole field. As proof of their ability to do this I append at the foot hereof the names of our principal shareholders. I delay forwarding the application for which you sent me until I have had an interview with Mr. Dykes and our coal expert when I hope to write to you fully with the details as to methods of working and transport which you require. Thanking you for your kind courtesy and the full information with which you have supplied us. I have the honour to be Your obedient servant, sd. A. T. Nation, Manager. London and Malay Syndicate Limited. The Earl Dysart Lord Grimthorpe Sir. R. L. Lucas- Tooth, Bart. Sir William Covey, Bart. B. de Bertodare Esq. ( The Court marales) John H. Platt ( Platt Bros: Oldham Cotton Engineers) G. H. & A. M. Jay, Stockbrokers L. H. Keeling, Barrister at law.

Document in the National Archives of Malaysia

Letter 8th September 1910 From Senior Wardens office Kuala Lumpur to Secretary to Resident Selangor. Subject: Applications for prospecting rights over the Rawang Coal Area

Sir, I have the honour to report on applications for prospecting rights over the Rawang Coal Area as follows, 2. Applications in fairly definite form have been received from the following firms, (a) Messrs. Boustead Hampshire and Co. (b) Messrs. Patterson and Simons (c) The London Malay Syndicate. And an inquiry has been made by the manager of Pusing Pharu Limited. 3. Firms a and b are I believe, still in communication with their London Agencies regarding some details which I asked for. 4. The copy of the latest communication from the London Malay Syndicate is attached- their first letter is your No. 2931/1C. 5. It is a difficult matter to judge between two firms such as Messrs. Boustead Hampshire and Company and Messrs. Paterson and Simons, both of whom could certainly command sufficient capital, and would have sufficient business aptitude to employ trained and experienced men on prospecting and development. 6. If Government desire to give the licence to local firms, I could suggest that the two above mentioned concerns should be invited to join hands and form one syndicate. 7. The London and Malay Syndicate have a number of good names on their Roll, and I also learn in a private letter from their Manager that their association is known to Sir. Francis Hopwood K.C.B.- K.C.M.G., Permanent Under Secretary of State for the Colonies. 8 As it appears desirable to reach a settlement without further lapse of time, I would advise that Government either request the Local Firms to form a Syndicate or grant the Licence to the London Malay Syndicate. 9. With regard to the latter recommendation, I believe that the London and Malay Syndicate have not as yet filed their formal application with the District Officer, Ulu Selangor; but I don’t think that this should be allowed to prejudice them. I have the honour to be, Sir, Your obedient servant. Ag Senior warden of Mines. FMS.

Document in the National Archives of Malaysia 4022 1910

Hand written letter from The London and Malay Syndicate, Limited. 4, London Wall Buildings, London E.C. 14th December, 1910 to W. Eyre Kenny, Esq., Acting Senior Warden of Mines, Kuala Lumpur FMS.

Dear Sir, Referring to our previous correspondence and to our cable to you reading as follows: - “Can you give prompt despatch- Coal Licence- please issue in the name of Rawang F.M.S. Coal Syndicate Ltd. We receipt by telegraph ?£10 cost licence etc. Prospector and machinery will be despatched immediately if we receive cable that licence issued. LonemaCo.” The position leading up to and the reason for this letter are as follows: - Immediately upon receipt of your esteemed favour of the 27th September last we set about forming a Company with a sufficient available working Capital to adequately deal with the Concessions referred to in your said letter as we realised that the moneys required for this purpose might be more than this syndicate as then constituted would have power to provide, and we were anxious that no difficulties should arise when matters were once in hand through any want of necessary cash. We have accordingly promoted and registered a company called “The Rawang (F.M.S.) Coal Syndicate Limited” This company is registered with a Capital of £25,000, and we have made arrangements whereby it has an actual cash working capital of an amount which we believe is amply sufficient to deal with the concessions above referred to, in an expeditious and thorough manner. This new Company having already been registered, we thought it better that the License should be granted direct to it rather than to the existing Company, as if this latter course was adopted we should immediately, in receipt of the licence, have to apply to you for a transfer thereof, or the issue to the new company of a fresh Licence in substitution therefore. All arrangements have been made by the new Company whereby, immediately we receive from you notice that the Licence has been granted, competent prospectors together with the necessary machinery will forthwith be despatched, and the work of prospecting energetically proceeded with. I have etc. Sd. T. Nation, Manager London & Malay Syndicate Ltd. P.S. Please note the change of this company’s address. A new Secretary has been appointed, and the further correspondence will be carried on by him. The office of the new Company (The Rawang (F.M.S.) Coal Syndicate Limited) is in the same building, and the Secretary of that Company is the same gentleman as is the Secretary of this Company. Sd. a T. Nation.

Document in the National Archives of Malaysia 4022 1910

From the Annual Departmental report F.M.S. by W Eyre Kenny, Senior Warden of Mines for 1910.

“ Further preliminary prospecting was carried out departmentally on Rawang coal area, and a company has been registered in London as the Rawang F.M.S. Coal Syndicate Ltd., to prospect and work it with a capital of £25,000. His Excellency the High Commissioner accompanied by the Residents of Selangor and Pahang paid a visit to the site on 5th May 1910, and examined the adit which had been opened. This mineral has been identified as hydrous coal, laboratory tests have been made, the results of which agreed with a trial made by F.M.S. Railways; but as the samples were of the outcrop near the surface, results cannot be regarded as more than experimental. On the railway this coal steamed well; but the consumption was higher than that experienced with the coals in general use. A local trail in a suction gas plant showed the coal to be unsuitable for such a purpose, a result which, I am informed, was corroborated by a trail made by Messrs. Hornby & Company in England.”

Document in the National Archives of Malaysia

Report on Rantau Panjang Coal Measures by the Government Geologist Paper No. 4 of 1911 F.M.S. to be laid before the Federal Council by Command of his Excellency the High Commissioner. Geologists Office, Batu Gajah, 17th January 1911.

(Report prepared according to instructions in letter of 10th September 1910. Includes a map compiled from several sources “which will be found to differ from the State map published in 1904”. Sir, - During 1908, a Malay named Haji Abdul Hadi, while prospecting for tin ore in the dense jungle that lies to the south of the Rantau Panjang Forest Reserve and west of the Kuang Pengkalan Kundang cart-road, found in the swampy bed of a small stream pieces of black coal, some of which were sent to the office of the inspector of Mines, Kuala Kabu. In September some fragments, weighing about 10 grams, were sent to my office by the Warden of Mines, Selangor. In November, at my request, a larger specimen was sent to me and meanwhile the Mines Department had examined the locality, and steps were taken for prospecting, which continued throughout 1909 and until May 1910, when it was suggested that I should take over the work and utilise the steam- boring plant belonging to the Mines Department, but a decision to leave all further prospecting to private enterprise put an end to the operations and the locality has been practically deserted ever since. 2. In September, 1910. I was instructed to examine the surroundings of the coal with a view to” ascertaining the probability of the extension and occurrence of coal bearing country in areas outside the proposed prospecting licence, and to advise as to tracing the coal to a workable point as close to the railway as possible.” In order to carry out these instructions, the greater part of November and December 1910 were spent in the vicinity of Rantau Panjang, and I now submit the conclusions at which I have arrived. 3. Situation and extent of coal.. 4. Operations by Mines department..5. type of coal..6. classification of coals.. 7. Analysis of coal.. (with table) 8 evaporative value..9. moisture content..10. steam tests.. 11. Price..12. Topography of neighbourhood and seam “whole of this part of Selangor is covered with virgin jungle” 13. View from top of Bukit Panjam.. 14. Rolling hills... 15.. roads..16. jungle drainage.. 17..geology of neighbourhood.. quartzite, clay-slate, 18.quartizite 19. Clay slates..20. shales above coal seam 21. Coal measures soil orange.. Quartzite yellow or reddish..22. relations of coal measures to quartzite and clay slate age of rocks.. 23 coal measures younger than granite..24.. coal measures tertiary.. fossil plants 25. Flora different if coal measures same age as quartzite..26. fossil plants latin names..27. coal made of thin reed like plant.. 28. More fossil plants will identify age.. 29. Conclusion Sketch map shows boundary, best way for railway would be along Klang River and then up unnamed left tributary. 30. Places where more coal may be found marked on map.. 31. May be other patches, patch one square mile is on a watershed which explains its preservation… 32. Searches on other low watersheds… 33. Unlikely to be more on higher granite hills.. 34.thanks to Mr. H. N. Ridley for examining fossils, Mr. A. M. Burn Murdoch conservator of forests, Mr. Mungo Park for help in obtaining coolies. J. B. Scrivenor. Geologist, F.M.S. (Map attached.)

Document in the National Archives of Malaysia 2505/1911

Letter from The Rawang F.M.S. Coal Syndicate Ltd., 4, London Wall Buildings, London E.C. 17, February, 1911 to Ag. Senior Warden of Mines, Kuala Lumpur.

Dear Sir, I beg to acknowledge receipt of your cable dated the 4th instant, reading: -“Do not delay qualified prospector” to which we replied on the 6th inst: - “ We have appointed Osborne Chappel Managers; operations beginning immediately. Have not yet received Licence” which, however crossed your letter of the 16th January (received on the 7th instant) informing us that the Licence would be handed over to our Representative at Kuala Lumpur on production of the necessary authority. On receipt of this letter, we replied on 8th inst: - “Referring to your letter of 16th day of January will you give licence to Osborne Chappel” On the 15th inst: your answer came to hand as reading:- “ may proceed” I am instructed by my Directors to express to you their appreciation of the help which you have rendered this Company in forwarding its interests, and to assure that no time will be lost in pushing on prospecting operations. Mr. Osborne of Messrs. Osborne & Chappel, is at present in this country, and has cabled his firm asking them to commence prospecting immediately. I am, dear Sir, Yours faithfully, Sd. C. Leslie, secretary.

Document in the National Archives of Malaysia

Letter from Osborne and Chapel, Ipoh, Perak, 20th October, 1911, to Senior Warden of Mines, F.M.S., Kuala Lumpur.

Sir, We have the honour to acknowledge receipt of your letter of the 18th of October, No 526/11, covering a copy of a letter from the General Manager of the F.M.S. Railway in reference to the Coal tests which they propose carrying out with Rawang Coal. As soon as sufficient quantity of Coal has been collected and carted to Rawang we will take the necessary action laid-out in the General Manager’s letter at the same time, we will inform him of what we are doing. Since last writing to you in reference to the Prospecting which has been done on the property, we would like to take this opportunity of informing you that we have proved an area of 150 acres to up to date, exclusive of the area composed of the outcrop, which gives, on a conservative basis, a tonnage of Marketable Coal of over 3,000,000 tons. In view of our conversation with you to-day and the above figures for the tonnage which we now furnish we would like, if possible, to make arrangements at an early date for Mr. Lucas to inspect the property with our representative so that we know exactly what is considered necessary in the way of confirmatory work by your department. We have the honour to be, Sir, Your obedient servants, Sd. Osborne & Chapel.

Document in the National Archives of Malaysia 4022/1910

Page 2 of Letter from Senior Warden of Mines to ? ( page 1 missing)

of Mr. G. D. Lucas for this duty, I propose to ask the British Resident, Perak, to allow him to come here for a week or ten days as soon as possible. 5. Prospecting operations have progressed more rapidly than heretofore, and it may become advisable to commence the construction of the Railway connection next year and to order the necessary Rolling Stock; but I am not prepared to make a final recommendation until Mr. Lucas has verified the prospecting results and sampling has shown that the coal is of a marketable quality. I have the honour to be Sir, Your obedient servant, Senior Warden of Mines, F.M.S.

Document in the National Archives of Malaysia

F.M.S. Annual Departmental Report 1911 (J. B. Scrivenor. Geologist, F.M.S) The Rantau Panjang Coal Measures 17.

During the year prospecting work by diamond drill, hand-boring tools and pits, has been carried out by Messrs. Osborne & Chapel, with Mr. Mungo Park as Resident Manager, on behalf of the Rawang Federated Malay States Coal Syndicate, Limited of London. This has been followed with great interest in connection with my report on the coal- measures as a check on the accuracy of the limits mapped by means of the soil derived from the coal measures, and its difference from the soil formed from older rocks. As far as can be judged at present, it appears that the area was too restricted, since the soil from the older rocks, which form hilly ground overlaps that of the coal measures. This may be entirely due to soil creep. In para. 29 of my report I remarked that in the map the boundary- line of the coal measures had not been closed on the south because the coal- measures might extend into the swampy ground beyond. Mr. Mungo Park has now proved by boring that the coal measures extend into this swamp nearly as far as the three-mile radius from the adit. As yet no prospecting has been done at localities indicated in the map where more coal may exist. (18. Notes on more fossil leaves identified by Mr Ridley).

Document in the National Archives of Malaysia

F.M.S. Annual Departmental Report 1912 p.7

Rawang Coal Area 32. The Rawang Coal Syndicate, Limited completed their prospecting operations and a quantity of coal amply sufficient to justify working on a large scale has been proved; the Government have decided to connect the field with the railway system and the survey of a branch line from Kuang Station was in hand at the end of the year. A considerable deposit of oil shale was discovered in the course of prospecting, but its oil content was too low for commercial purposes. The clay on this field was tried for making tiles and pipes and proved to be suitable. No deep boring was done, the greatest depth investigated being 306 feet, so that there is still a possibility of further discoveries being made in the future. It is regrettable that experiments have not been conducted by the Syndicate on briquetting this coal, and on its use in Dowson double action suction producers. Further trials were conducted by the railway authorities which tended to confirm the results previously attained.

Document in the National Archives of Malaysia

The Malay Daily Chronicle, Wednesday , October 23, 1912. Extracts from report of Chief Secretary, Mr. E. L. Brockman C.M.G. on the Federated Malay States for the year 1911:

“Coal. Progress was made with the prospecting operations in the coal area at Rawang, or rather Rantau Panjang, as it should be called. A sufficient quantity of coal has already been located, and experiments have been made with a view to testing the quality. It is proved that the coal has a commercial value, and the promoters of the undertaking hope that it will find a sale among the mining community. It will be a valuable asset to the country if it can be produced at such a price as to compete with firewood, and thus save the forests of the Federated Malay States from the destruction with which they are threatened. Fuel is becoming a serious question for the mines, and a cheap coal will benefit the industry very greatly.”

Copy of Letter: October 25, 1912. From Rawang F.M.S. Coal Syndicate Ltd., London, to Messrs. Osborne and Chappel, Ipoh 25/10/12

Dear Sirs, I am instructed by my Directors to inform you that Mr. J.A. Russell, by the terms of an agreement, dated October 22nd, is financially associating himself with this Company. My Directors have also been advised, that in the interests of the Company, they should endeavour, as far as possible, to obtain the co-operation of the Chinese and the big consumers of fuel in the F.M.S. and allow of their becoming financially interested in the future of the coalfield. The time appears to be now ripe for this action. There seemed to be difficulties in bringing any such scheme to maturity, without enlisting the services of someone thoroughly conversant with the Chinese and their language, and to obviate these difficulties, the Directors have entered into the agreement above referred to. To enable him, to negotiate on these lines, Mr. J. A. Russell is proceeding to the Federated Malay States at once, and will at an early date, either call or correspond with you. My Directors request that you will consider him as an emissary from the Board, whose interests are largely identical with those of the Company, and therefore that you will give him at all times such particulars of the past and present prospecting operations as he may request, and give him full access to all plans. My Directors would also be obliged, if you would at any interviews with Officials of the Government, when his attendance might be beneficial to the interests of the Company, request him to be present with your representative, notifying the Official or Officials concerned, that Mr. J. A. Russell, is associated with the Company, and therefore in that capacity, that his interests being identical with the Company’s, due attention to his requests may be given by the Government and yourselves. It is quite likely that he may see no good arising from his being present at any interviews, but should such an opposite policy seem desirable, then I would suggest that you should before any such meetings request Mr. J. A. Russell to meet your representative and arrange as to the line of policy pursued. Should any question arise as to his locus standi, then would you please present a copy of this letter to the Official or Officials, showing that he is authorised to do so on behalf of this Company. Mr. J. A. Russell has also been given an authenticated copy of this letter. Would you please also instruct Mr. Mungo Park to give Mr. Russell access to all portions of the land, and to all plans and results of prospecting operations, and also to afford him verbally all such information as he may require. My Directors wish to make it quite clear that Mr. J. A. Russell’s position as an emissary of this Company, in no way supersedes in any respect your legal position as our present Agents and Consulting Engineers. Our agreement with Mr. J. A. Russell specifically mentions that we shall endeavour to obtain the renewal of our prospecting licence, and to apply for all land likely to be coal bearing. We have already requested you to further these objects. Any fees required over and above those necessary in connection with the application you made for the 1,200 acres, will be defrayed by Mr. J. A. Russell. Should Mr. J. A. Russell desire to be supplied with coal for trials, I should be obliged if you would comply with any request made by him. He will defray all expenses in connection with the getting of such coal. Should there be any conflict of opinion between you and Mr. Russell regarding any request he may make to you, would you then refer such matter to me by cable for the decision of my Directors. I am, Dear Sirs, Yours faithfully, (Sgn) C. Leslie. Secretary.

Document in the National Archives of Malaysia SEC. SERL 999/1913

Document: U. S. 544/10, No. 5239, Government of Selangor P.L. No. 15/12 Schedule Under Section 46 of “The Mining Enactment, 1904” Prospecting Licence

This licence authorises the Rawang, F.M.S. Coal Syndicate Ltd. of London (a) To prospect for the following metal or mineral- namely Coal and oil for the period of 18 months commencing from the 13th day of January 1912, within the area hereunder described, subject to the conditions and limitations contained in part III of the “Mining Enactment, 1904” (b) To select and receive a lease for the whole or any part of State Land within the area hereunder described on proof to the satisfaction of the Resident that the licensee has done a sufficient amount of prospecting work to entitle him to such a lease. Note. - This licence is liable to cancellation by the Resident if the licensee shall cease altogether to work within the area hereunder described for a period of 6 months. Description of Prospecting Area. The available area within a radius of 3 miles from the adit of the Selangor Coal Field near the 26th mile Rawang- Kuala Selangor Road and also such part of the additional area as lies within the Ulu Selangor district together with such part of the additional area as lies within 80 chains of the District boundary. Dated this 25th day of October, 1912. Fee paid $25/- Sd. Re E. Gordon- Walker, Collector. Rt. 6441/12 Special Conditions (Endorsed on back of License) The licensees shall prospect on the express understanding that no lease will be granted without a proviso to the effect that the Government shall always have the right of entering upon the land for the purpose of mining and taking mineral oil for the ships of H.B.M.’s Navy or for other purposes of H.B.M.’s Admiralty and further subject to such other conditions as may be settled hereafter. The issue of the lease will also be subject to the approval of the Secretary of State for the colonies. Sd. R. E. Gordon- Walker, Collector of land Revenue, Ulu Selangor.

Document in the National Archives of Malaysia 3943/13

Letter: 13 February 1913. From Osborne and Chappel, Mining and Consulting Engineers, Ipoh, Perak to The British Resident, Selangor, Kuala Lumpur.

Sir, Rawang F.M.S. Coal Syndicate, Ltd. We have the honour to inform you that we have been asked by Mr. J. A. Russell to send you a copy of a letter which we received from the Board of the above Syndicate dated October 25th 1912. You will gather from the letter that Mr. Russell by terms of an agreement, is financially associating himself the above Syndicate, and the directors have asked us if in the case of any interviews with Officials of the Government when his attendance would be beneficial to the interests of the Syndicate, that we are to request the Official or Officials concerned that Mr. J. A. Russell be present, and that due attention to his requests may be given by the Government. We have the honour to be, Sir, Your obedient servants, Osborne and Chappel.

Document in the National Archives of Malaysia SEC. SERL 999/1913

The Malay Mail, Supplement, Kuala Lumpur, Wednesday, March 5, 1913.

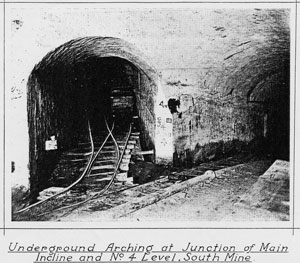

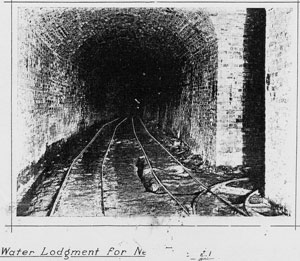

The Rawang Coal Measures. Their Extent and Potentialities. History of the Coalfields. The credit of discovering the Rawang coal measures belongs to one Haji Abdul Hadi bin Abdullah, a Malay who in the latter part of 1908, found beside a stream near the Southern boundary of the Rantau Panjang forest reserve, in about as out of the way place as any in mid Selangor, a piece of dark mineral which appeared to him unfamiliar. He took some specimens to the District Officer, Ulu Selangor, at Kuala Kubu, who handed them over to the mines department. The mineral was examined and found to be a species of coal. Haji Abdul was rewarded with a pension of five dollars a month for life, which, we believe, he subsequently compounded for a lump sum in order to visit Mecca, and so he passes out of the story. An Inspector of Mines visited the place on Nov 17th 1908, and the Mines Department, impressed by the value of the discovery, commenced prospecting, near the scene of Haji Abdul's find, in May 1909. An adit was driven into the side of the sloping ground by the stream and numerous experimental shafts were sunk in the same immediate neighbourhood. The presence of coal in large quantities was soon established, while sample lots were tried in this country with considerable success, it being demonstrated that, though the coal had not a high calorific value as compared with the best Welsh coal, it might well prove useful fuel for local consumption, since, being on the spot, it would be possible to produce it at a very much lower price than that paid for imported fuel, practically all of which is Indian or Japanese mineral, with which the Rawang product has proved to be practical identical in economic value. Moreover, the increasing price of firewood, even three years ago, indicated that the mining industry might well be hampered in the future by the curtailment of the supply of timber readily available. The investigations of the Mines Department had not, however, determined the extent of the measures, nor the probable direction of the seam when the then High Commissioner, Sir John Anderson, visited the workings on May 5th 1910. Towards the end of the same year prospecting was stopped, and the Government decided, apparently, that enough had been done to establish the existence of useable coal in quantities sufficient to induce private enterprise to carry out the task. Negotiations were opened with local capitalists but eventually a prospecting permit over 18,000 acres was given to a London corporation, formed for the purpose, and entitled the Rawang F.M.S. Coal Syndicate. The concession covered the southern portion of the Rantau Panjang Forest reserve and a large area adjoining. The syndicate appointed Messrs. Osborne and Chappel their agents, and the latter engaged Mr. Mungo Park who had till then, been an Inspector of Mines under Government, to carry out the work of further prospecting the area. Mr. Mungo Park had already some knowledge of the measures and was, moreover, one of the few men in Malaya who had any experience of coal mining, he having worked in the coal fields of Natal and the Transvaal before he came to this country. He began prospecting on behalf of the Syndicate in April, 1911, with the object of discovering whether there was enough coal of a marketable quality to enable the syndicate to dispose of its holding to those who would be willing to finance it as a working colliery. There was no intention of developing the measures, except in so much as might be necessary for obtaining coal for experimental purposes, nor was it part of the syndicate’s programme to determine the full extent of the coal field. Towards the end of last year the syndicate found, as a result of its discoveries, that it possessed a marketable proposition and it was enabled to dispose of its rights to a Kuala Lumpur group willing to undertake the capitalisation of the colliery into a going concern. Situation and Extent. We propose to make some account of the discoveries of Mr. Mungo Park, but before doing so it may be of interest to convey an idea of the situation of the district in which the existence of the coal has been established. The portion of the measure so far definitely prospected is an oblong block of about 350 acres running from north of the southern boundary of the forest reserve nearly due south, and is at present approached from the 26th mile of the Kuala Lumpur- Kuala Selangor Road, via Rawang, about 8 miles beyond the last named town. From the milestone a rough track, crossed and re-crossed at frequent intervals by the spoor of wild elephants, leads south west, for two and three quarter miles through dense jungle of the forest reserve, to a small clearing where are the houses of the prospector and the men who have been working for him; other clearings in the jungle near by, mark the site of the Government workings on the scene of the first discovery and the pits sunk later for obtaining coal for experimental purposes. Here in the midst of the virgin forest are heaps of coal, not very large ones, for they consist only of the residue left over when the good coal was removed, but still coal enough to provide a striking contrast with its surroundings. Environment has much to do with the impression left on the mind by any specific scene, and the Englishman’s idea of a coalfield is usually derived from what he is accustomed to in his own country, where the existence of the mineral, means that it has been worked for a period quite long enough to have blackened everything in its neighbourhood, to say nothing of the scarifying effects produced by the allied industries which usually spring up in its immediate surroundings. It is necessary to exercise the imagination, presupposing the possession of such an attribute, to experience any lively sensation of incongruity when standing in a primeval forest and being assured that coal or anything else lies below the ground, but even an unimaginative person cannot escape the sense of the unusual in being confronted with heaps of raw coal lying in the depths of an F.M.S. forest reserve. However there the coal is; it can be seen and touched, so it is worth while considering how it will be approached if it is worked. The present method of approach is obviously unsuitable, for even if the track from the Government road should be metalled it would be a roundabout way of getting to the railway line. Approach from the southern end will undoubtedly be the best, and this has been recognised by Government since the 1913 estimates provide for the spending of $2,000,000 on a branch line from Kuang in the direction of Batang Berjuntai which will, in the first instance, go as far as the Rawang coal fields. In addition the new road from Kepong to Kuala Selangor, which has been under construction so long, but which is now nearly completed, passes within a few miles of the coal field so that this may well prove the best method of approach to Kuala Lumpur for road- borne traffic. The Main Seam. To come to the results of the actual prospecting, and bearing in mind that borings were nowhere sunk below 340 feet, the existence of two seams of coal, besides small minor ones, has been established, the Main Seam and the North Seam. The latter has been little investigated, and leaving it for the present, it may be well to deal with the Main Seam which was the site of the first discoveries. The outcrop, which lies on an average about 20 to 30 feet below the soil, runs from a point a little to the west of the first discovery almost due east and then curves boldly towards the south, running first due south and inclining more to the west as it reaches its termination. It forms, therefore, a rough semi circle, rather like an undrawn bow, bent towards the east, with the top, or northern end more flattened than the bottom or southern end. From the outcrop the seam slopes inwards and downwards, towards the string of the imaginary bow at an angle of 10 degrees; the direction being, beginning at the north end of the seam, first south then south west, then due west and finally west with a slight tendency to the north. The seam has uniform depth wherever bored at 50 feet, measured at a right angle to its floor, and since it slopes downwards, the further it gets from the outcrop the deeper it lies. The full extent of the seam has not been proved, but at rather over 300 feet, the depth to which the deepest borings were made, the coal still continued wherever tested, so that there is strong presumption that it runs further at a greater depth. The next strata above the seam is oil shale to which we shall refer later, and the next clay, while beyond the clay comes a mass of rock. It was at first believed that this rock, which occurs slightly beyond the deepest borings, was a solid quartzite formation older than the coal, and that in consequence the seam could not continue beneath it. For the purpose of ascertaining the nature of the rock, therefore, a pit was sunk, and carried to a depth of about 46 feet, in a valley the reverse side of the hill in which the rock begins. The stone quarried from this pit, which is still being worked, are boulders of varied kinds of rock, which appear younger than the coal, so that the seam may be of much greater extent than is present known. Setting conjecture aside, however, and taking into consideration only the area actually prospected, it is reckoned that there exists in the main seam about 15 million tons of coal, though for the purposes of estimation not more than seven to ten million tons have been calculated upon. Still, taking even the lowest figure, the Main Seam offers an enormous quantity of coal, at a comparatively shallow depth. The North Seam. Going due north from the scene of the first workings, by the Mines Department the first outcrop is a strata of sandy clay running immediately under the Main Seam, the next outcrop, underlying the clay, is oil shales, and beyond the shales, comes the outcrop of the North Seam, running at the same angle as the Main Seam, but, of course, far below it. This seam, which was discovered by Mr. Mungo Park, has so far been but little prospected. Coal of a quality similar to that of the Main Seam has been won from two pits near the point of discovery, immediately north of the first workings, and experimental bores put down to the east and south- east indicate that the outcrop tends to follow the same outline as that of the Main Seam. But though its existence has been established, its extent has not yet been proved. The very fact of its existence, however, indicates that the capacity of the coal field, as a whole, may possibly be very much greater than was at first believed or has yet been definitely ascertained. Quality of the Coal. It would appear that the presence of coal in large quantities has been ascertained, and that there are indications that further prospecting, if undertaken, may reveal the existence of quantities larger still; but, however large the amount, unless the quality is good, there would be no profit in mining it. The coal has, therefore, been subjected to a variety of practical tests, both by the Government and by the prospecting syndicate, here and in England, the general results of which indicate that, although not a high- quality coal, it may well prove of use here in Malaya, taking into consideration the peculiar conditions which govern the supply of fuel. To go into details, abbreviated though, for in their entirety details of any subject, save to experts or persons vitally interested, are apt to be tedious, the deposits are pitch coal, a variety of lignite ranking between lignite and bitumous coal, of the tertiary period, closely allied to coals found in Sumatra, Borneo and New Zealand, and to the brown coal of Germany, of which latter 49,000,000 tons were produced during the first nine months of 1910 and a slightly larger amount during the twelve months preceding. In England no coal of the same kind is found, and compared with the English minerals, it is a young coal, though this fact, by the way, has no bearing on its fuel value since pressure and local conditions, rather than age, determine its worth or worthlessness. When compared with the valuable deposits in England the Rawang product has but a low calorific value, but when contrasted with Indian coal with which it would have to compete, it appears to more advantage, since, though it has slightly lower calorific value than the Indian mineral, it is a cleaner fuel, having no sulphur and producing much less ash and smoke and practically no clinker. The railway tests give 56lbs. per train mile for the local coal as against 47lbs from the Indian, but it is claimed that better results would have been obtained had the furnace bars on the engine employed in the tests been altered by being put nearer together, since the Rawang coal breaks up easily and requires a grate with narrow bars or even a chain gate. If, however, the railway authorities decide to use the local coal, it could be put upon the railways at the time at a very much lower rate than could Indian, the cost of which is from $11.75 to $12 per ton in Kuala Lumpur. That fuel does not depend entirely upon calorific value is shown by a series of practical test carried out at Kuala Lumpur cement works, near Batu Caves, where we are told that, although no greater amount of Rawang coal than Indian coal was used, the former owing to the qualities mentioned above, gave by far the better results of the two minerals. But wood is still the principal fuel here, both on the railway and on mines, and with wood the new coal should be able to compete, even at present prices, while in the future it ought to be in a position more favourable still. On the railways 123lbs to 140lbs of wood are used per train mile as against 56lbs of Rawang coal, i.e. more than two to one. Moreover, coal occupies less storage space than timber and would on that account be preferable. Further, apart form the railways, which have a permanent supply of wood assured in the big mangrove reserves, harvested in accordance with the rules of forestry, the increase in the cost to other users, the principal of which, are of course, the mines, has recently been so considerable that, in spite of the vast forests which cover the greater art of the peninsula, wood fuel is now costing as much that consumers are eager for a substitute. The forests are receding from the near neighbourhood of the mines and the chief centres of industry so that, though there is almost any quantity of timber to be had, the cost of transport is tending to raise the price beyond that at which so rapidly burning a form of fuel can be used with economy. Further experiments have shown that Rawang coal can be used successfully in the furnaces of mine boilers and, an important point when dealing with so conservative race as the Chinese; mine-owners and managers who have tried the coal are willing to use it instead of wood if the price is satisfactory. We are told that, from trials carried out by Mr. Chong Yoke Choy at Mr. Loke Yew’s mines near Ampang, it was found that a ton of Rawang coal was equal to two and half parsongs of hard wood for which the current market rate was $5.30 a pasong at the time, though now it is higher. In addition to local tests, specimen parcels have been sent to England for trial and Professor Bone has used Rawang coal with success in the Bettington boiler, in which dust coal is fed through a sprayer on to the furnace bars in the manner employed in oil burning furnaces. Another consignment was recently tried at Stockton on Tees where, as we recorded the other day, the municipal power plant, using Rawang coal, successfully completed a trial run of thirty hours. Oil Shales and Clay. Mention was made earlier in this article of the strata of oil shales which overlies both the Main and the North Seams. These shales are somewhat similar to the deposits in the West of Scotland. Oil has been distilled from them, and specimens of the results are to be seen at the coal field. Experiments are being undertaken to ascertain the value of the oil, but results have not yet been received. The proportion of oil in the shale is, perhaps, somewhat too small to enable it to be distilled at a profit with the methods of extraction at present in vogue, although the enormous size of the deposits of oil shale, containing in aggregate millions of gallons of oil, their proximity to the surface and to a supply of cheap fuel invest them with great interest. Should some more economical way of getting oil from the shale be discovered, it is possible that the Rawang shales might be exploited, and, considering the limited area of the known oil fields within the British Empire and the extent to which oil is replacing coal in the British Navy, the future my see them endowed with a significance they do not now possess. The concessionaires now propose boring their property to greater depths in the hope of discovering free oil, and oil rights have been obtained from Government over the whole concession. Above both strata of shales lies sandy clay which has been found by practical tests to be suitable for making bricks and tiles, besides the coarser kind of pottery, so that, whether the shales possess an economic value or not, there is no doubt that a brickyard and potteries could, if thought advisable, be run as an adjunct to a colliery.

The Straits Times, 26 May 1913, Page 9. “Malayan Collieries. RAWANG COALFIELDS AND THEIR PROSPECTS.

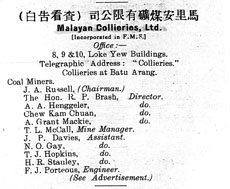

A Two Million -Dollar Company. To the present established industries of this fecund Peninsula is shortly to be added another, and an important one, by the opening up and development of the Rawang coalfields. The existence of coal in the Ulu and Kuala Selangor districts was proved by the Government of the F.M.S. a number of years ago, and the results of prospecting carried out over a considerable period by the Rawang (F.M.S.) Coal Syndicate Ltd. of London, have established beyond doubt that the deposits are extensive and accessible. Their development is to be undertaken by a concern named Malayan Collieries, Ltd. with headquarters in Kuala Lumpur. The capital is to be £2,000,000, of which it is proposed to issue three fourths at present. The shares are of the $10 denomination. The vendors who are represented by Mr. J. A. Russell, get one million dollars- $610,000 in shares and the remainder in cash – which leaves on the primary issue a sum of $500,000 for working capital, therefore, 89,000 shares are being offered to the public, but the prospectus states that applications have already been received for 60,000, upon which the directors will proceed to allotment.” Results of Prospecting. Prospecting operations have been conducted for the past two years by Messrs. Osborne and Chappell on the concession for which the Syndicate had acquired a prospecting licence. As a result of these operations an application for a lease of 1,200 acres of the richest land has been made by the Syndicate, and they are at liberty to select and apply for other areas up to a limit of 18,000 acres before the end of July. On the area already applied for the prospectors have located a main seam extending over 345 acres with an average coal thickness of 30 feet. After making allowances for slack and small coal, they estimate a visible supply of over nine million tons of marketable fuel. Nor do the resources of the field end there. According to the report, other seams have been discovered, but these have not been thoroughly prospected, the Syndicate wisely pursuing the policy of delineating the one main measure which, in itself, have proved rich enough to justify their faith. The coal is of a lignite or woody, character, such as is successfully mined in many countries. Compared with coals of a similar nature mined in South Africa, India, Australia and Siberia, the evaporative power of Rawang is a low one, but a good impression of its practical value may be gathered from the statement of Mr. Benedict Kitto, the eminent analyst of St. Swithin's Lane, London, who tested a number of samples, that its heating power is equal to about three-quarters of that of good Welsh steam coal. Very exhaustive practical tests, in fact, have been carried out both locally and in England, in the latter country under the direct supervision of Professor W. A. Bone, D.Sc. F.R.S., professor of chemical technology (fuel) at the Imperial College of Science and Technology, London. Commenting on a test with Rawang coal on a Bettington boiler, Professor Bone writing on March 13 last said that “ having regard to the lignite character of the coal, these results may be considered as eminently satisfactory, and there is no doubt but that the coal can be used economically for steam raising in this type of boiler”. Gratifying reports are also made of tests carried out on the F.M.S. Government railways, at the Batu Caves Portland Cement works, and elsewhere. The Market for Coal. These facts are extracted from the mass of evidence contained in the prospectus and are sufficient to show that Rawang coal may compete on favourable terms with other steam raising fuels in the market at present. As to establishing itself in competition with existing supplies, the promoters are sanguine of success. It is estimated by Messrs. Osborne and Chappell that the company will be able to produce coal at a cost nearer $2 per ton than $3. To arrive at a selling price for the product, they took into careful consideration the value of Rawang coal compared with firewood and other brands of coal actually in use in Malaya and came to the conclusion that it could compete favourably with existing fuels at a selling price of $5.25 per ton at the pit-head. As a matter of fact, one of the tests, carried out on a 12 N.H.P. portable boiler at Ampang- a type of boiler very largely used in the F.M.S.- seems to show that in order to compete with firewood the coal can command $10.75 at the pit head, but Messrs. Osborne and Chappell have adopted for the purposes of calculation their own conservative figure of $5.25. All things considered, there would appear to be little doubt that Rawang coal will find a ready market among the tin-mines, rubber plantations, railways, local steamships and other coal-consuming industries. The Government of the F.M.S. regards the enterprise with a favourable eye, in token whereof provision has already been made for laying of a branch line of the railway to the pit-head; while to guard its interests, the Government will nominate one of its own officers to sit on the Board of Directors. Messrs. Osborne and Chappell in their general remarks say: “We are of the opinion that the commercial potentialities of the concession have been proved to be of great value. All estimates have been made on a conservative basis. The opening out of this coal field- resulting in cheap fuel being put on the local market- should act as a stimulus to the tin-mining industry, which is faced at the present time with the serious menace of increasing coal costs.” Every colliery venture looks to make a considerable enhancement of profits from its by products. Rawang coal is stated to be very rich in easily recoverable tar, a commodity for which there is a good local demand, and ammonium sulphate is another product for which a ready market should be found in an agricultural country like this. A thick layer of oil-bearing shales exists in the field and, although the yield of oil from them, on testing, is lower than is usually looked for from workable shales, the proximity of the bed to the surface and its thickness lead to the hope that it may prove to be well worth exploiting. These are factors, however, which may be shelved for later consideration when the actual mining has been put on a proper footing, and in their outlook the promoters do not lay much stress on their existence.

The Malay Mail, Wednesday 28th May 1913, page 5.